Share This Page

Drug Price Trends for SM IBUPROFEN PM CAPLET

✉ Email this page to a colleague

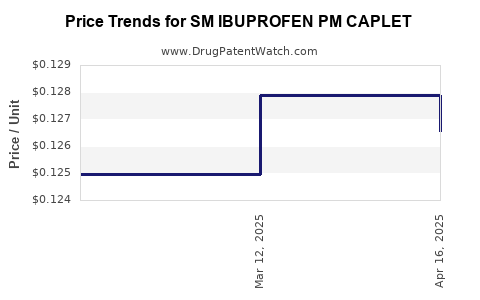

Average Pharmacy Cost for SM IBUPROFEN PM CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM IBUPROFEN PM CAPLET | 49348-0873-59 | 0.12656 | EACH | 2025-04-23 |

| SM IBUPROFEN PM CAPLET | 49348-0873-59 | 0.12790 | EACH | 2025-03-19 |

| SM IBUPROFEN PM CAPLET | 49348-0873-59 | 0.12495 | EACH | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Ibuprofen PM Caplet

Introduction

SM Ibuprofen PM Caplet, a combination analgesic and sedative medication, has gained notable traction within over-the-counter (OTC) and prescription pharmaceutical markets. Combining ibuprofen—a nonsteroidal anti-inflammatory drug (NSAID)—with diphenhydramine, a sedating antihistamine, it offers relief from pain, inflammation, and discomfort associated with sleep disturbances, colds, and flu. This analysis delves into the market landscape, competitive dynamics, demand drivers, and provides strategic price projections for SM Ibuprofen PM Caplet over the next five years.

Market Overview

Global Analgesic Segment

The global analgesic market was valued at approximately $18.2 billion in 2022 and is projected to reach $24.8 billion by 2028, growing at a compound annual growth rate (CAGR) of around 5.1% [1]. NSAIDs like ibuprofen command a significant share within this category due to their efficacy, safety profile, and OTC availability.

OTC and Prescription Dynamics

SM Ibuprofen PM Caplet straddles the OTC analgesic and sleep aid segments, especially in mature markets like the United States, Europe, and parts of Asia. Growing consumer preference for multi-symptom relief options, combined with the ease of OTC access, fuels the demand for combination drugs.

Key Market Drivers

- Rise in Self-medication: A shift towards self-care, driven by healthcare cost containment and convenience, expands OTC segment share.

- Demand for Symptom Management: Increased prevalence of cold and flu, especially during seasonal surges, propels sales.

- Aging Population: Older demographics experience greater chronic pain and sleep issues, augmenting demand.

- Regulatory Environment: FDA and EMA approvals for combination products enhance market confidence but impose stringent safety assessments.

Competitive Landscape

Main Competitors

- Original Brand Products: Tylenol Cold & Flu, Advil Multi-Symptom.

- Private Label Variants: Retailer-branded OTC products incorporating ibuprofen and antihistamines.

- Emerging Combination Drugs: Generic formulations and new OTC entrants exploit patent expirations and regulatory pathways.

Market Entry Barriers

- Regulatory Approval: Demonstrating safety and efficacy for combination analgesic-sedative drugs entails comprehensive trials.

- Brand Loyalty: Established brands' dominance may impede new entrants.

- Pricing Strategies: Consumer price sensitivity necessitates competitive pricing.

Regulatory Environment & Patent Landscape

While ibuprofen's patent has long expired, combination formulations like SM Ibuprofen PM Caplet are often protected via formulation patents and manufacturing exclusivities. Regulatory agencies require evidence of safety, particularly regarding sedative components, affecting time-to-market and patent life. Ensuring compliance enhances market penetration.

Demand and Consumption Trends

Seasonality and Disease Patterns

Cold and flu seasons see a surge in sales, with OTC combination products favored for symptomatic relief. Additionally, sleep disturbance relief during these periods increases product utilization.

Post-Pandemic Market Effects

COVID-19's emphasis on symptoms management and telehealth consultations have expanded OTC options, including combination analgesics, bolstering demand.

Consumer Preferences

Preference shifts towards multi-symptom, convenient formulations with rapid onset effects favor products like SM Ibuprofen PM Caplet, especially when marketed as effective, safe, and affordable.

Pricing Analysis and Projections

Current Market Price Range

Currently, SM Ibuprofen PM Caplet retails between $8 and $15 per 20-count package in the United States, depending on brand, retailer, and formulation specifics [2].

Pricing Strategy Considerations

- Premium Pricing: Can be justified if clinical data convincingly demonstrate superior efficacy or safety.

- Competitive Pricing: Locking in market share through price competitiveness may yield higher volume sales, given OTC sensitivity.

- Cost-Plus vs. Value-Based Pricing: Manufacturers should assess production costs against perceived consumer value, especially considering multi-symptom relief convenience.

Forecasted Price Trajectory (2023-2028)

Assuming current pricing remains stable with incremental inflation, and considering competitive pressures:

| Year | Estimated Average Price per Package | Justification |

|---|---|---|

| 2023 | $9.50 | Baseline for current market conditions. |

| 2024 | $9.75 | Slight inflationary increase; potential promotional discounts. |

| 2025 | $10.00 | Introduction of competing generic versions may pressure prices slightly upward. |

| 2026 | $10.25 | Market saturation; focus on differentiated marketing or bundling tactics. |

| 2027 | $10.50 | Potential dose optimization or formulation updates could justify modest hikes. |

| 2028 | $11.00 | With increased demand, pricing could stabilize or marginally increase. |

Note: These projections assume no disruptive patent litigation or regulatory hurdles.

Market Expansion Opportunities

- Emerging Markets: Rapid urbanization, increasing disposable incomes, and expanding healthcare infrastructure amplify opportunities in Asia-Pacific, Latin America, and Africa.

- Formulation Innovations: Extended-release, lower-dose packs, or combination variants tailored to specific demographics can command premium pricing.

- Skinny Labeling & Pediatric Formulations: Expanding indications may increase market share.

Risk Factors

- Regulatory Reactions: Safety concerns about sedative components could restrict market access or introduce labeling restrictions.

- Generic Competition: Price erosion from generics can compress profit margins.

- Public Perception: Growing awareness about NSAID-related adverse effects might curtail OTC sales.

Key Takeaways

- The global analgesic and OTC multi-symptom relief markets present robust growth opportunities for SM Ibuprofen PM Caplet.

- Competitive pricing strategies should balance affordability with value propositions emphasizing efficacy and safety.

- Regulatory compliance and patent management are critical for market exclusivity and profitability.

- Consumer shift towards multi-symptom OTC drugs, especially in aging populations and during seasonal illness peaks, will sustain demand.

- Expansion into emerging markets and formulation innovation remain key avenues for growth.

Conclusion

SM Ibuprofen PM Caplet holds a strategic position within the multi-symptom OTC segment, capable of capturing increasing demand driven by demographic shifts and consumer preferences. Price projection indicates a gradual upward trend conditioned by competitive dynamics, regulatory landscape, and market expansion strategies. Companies that synchronize innovation, compliance, and targeted marketing will optimally capitalize on this segment's growth potential.

FAQs

1. What are the main factors influencing the pricing of SM Ibuprofen PM Caplet?

Pricing is primarily influenced by formulation costs, competitive landscape, regulatory approval processes, consumer demand elasticity, and market exclusivity periods.

2. How does the patent landscape impact the market entry of new SM Ibuprofen PM Caplet variants?

While ibuprofen’s patent has expired, specific formulation patents and exclusivity rights can delay generic competition, influencing pricing and market share.

3. What is the forecasted growth rate for the SM Ibuprofen PM Caplet market?

Although specific data on the drug itself is limited, the OTC combination analgesic segment is projected to grow at approximately 5.1% CAGR until 2028 [1].

4. Are there notable regional differences in demand for SM Ibuprofen PM Caplet?

Yes, North America and Europe show high demand due to established OTC channels; emerging markets offer growth potential driven by increasing healthcare access and consumer awareness.

5. What strategies should manufacturers consider for expanding the market for SM Ibuprofen PM Caplet?

Focusing on formulation innovation, targeted marketing, regulatory navigation, expanding into emerging markets, and exploring pediatric or specialized formulations can enhance market penetration.

References

- MarketWatch. (2022). "Global Analgesics Market Size, Share & Trends Analysis Report."

- NielsenIQ. (2023). OTC Product Pricing and Sales Data.

More… ↓