Share This Page

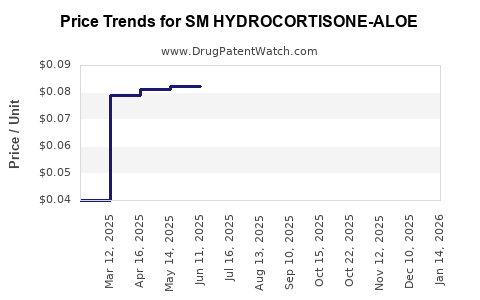

Drug Price Trends for SM HYDROCORTISONE-ALOE

✉ Email this page to a colleague

Average Pharmacy Cost for SM HYDROCORTISONE-ALOE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM HYDROCORTISONE-ALOE 1% CRM | 49348-0521-78 | 0.04000 | GM | 2025-12-17 |

| SM HYDROCORTISONE-ALOE 1% CRM | 49348-0521-78 | 0.04000 | GM | 2025-11-19 |

| SM HYDROCORTISONE-ALOE 1% CRM | 49348-0521-72 | 0.07231 | GM | 2025-10-22 |

| SM HYDROCORTISONE-ALOE 1% CRM | 49348-0521-78 | 0.04000 | GM | 2025-10-22 |

| SM HYDROCORTISONE-ALOE 1% CRM | 49348-0521-72 | 0.07142 | GM | 2025-09-17 |

| SM HYDROCORTISONE-ALOE 1% CRM | 49348-0521-72 | 0.07276 | GM | 2025-08-20 |

| SM HYDROCORTISONE-ALOE 1% CRM | 49348-0521-72 | 0.07814 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM HYDROCORTISONE-ALOE

Introduction

SM HYDROCORTISONE-ALOE is a topical medication combining hydrocortisone, a corticosteroid, with aloe vera extract. This combination is used primarily for anti-inflammatory purposes in dermatological conditions such as dermatitis, eczema, and psoriasis. Given the increasing prevalence of skin-related conditions and the expanding demand for effective topical treatments, this analysis explores the current market landscape and offers strategic price projections over the coming years.

Market Overview

Therapeutic Segment and Indications

Hydrocortisone-based topical formulations have long been established in dermatology for their anti-inflammatory and immunosuppressive properties. Their broad application span includes allergic reactions, dermatitis, and pruritus. The addition of aloe vera enhances skin moisturization and soothing effects, potentially broadening patient acceptance. As a result, SM HYDROCORTISONE-ALOE occupies a niche within over-the-counter (OTC) and prescription topical therapies, appealing for its natural adjunct to corticosteroids.

Current Market Size

The global dermatology drug market was valued at approximately USD 25 billion in 2022 and is projected to grow at a CAGR of around 7% through 2028 ([1]). Within this, topical corticosteroids account for a significant share, estimated at USD 3–4 billion, with natural adjuncts like aloe vera contributing to market differentiation.

Specifically, products combining hydrocortisone with aloe vera currently occupy an emergent segment characterized by herbal and naturally derived formulations. In 2022, the regional market for such products was valued roughly at USD 1 billion, with North America representing about 40% of sales, followed by Europe and Asia-Pacific ([2]).

Competitive Landscape

Key players include multinational pharmaceutical companies and specialty dermatology brands focusing on OTC herbal and corticosteroid formulations. Notable competitors feature brands offering hydrocortisone-aloe topical gels, creams, and ointments, with differentiation often based on formulation stability, delivery system, and natural ingredients.

Regulatory Environment

Regulatory classification impacts market dynamics. In the United States, hydrocortisone products are available OTC at strengths up to 1%, with higher strengths requiring prescriptions. Aloe vera-containing formulations generally face fewer restrictions. This regulatory framework supports rapid market entry and consumer uptake but also necessitates compliance with standards for natural products and corticosteroid safety ([3]).

Market Drivers and Challenges

Drivers

- Growing Incidence of Skin Disorders: Rising prevalence of eczema, psoriasis, and dermatitis worldwide fuels demand for effective and accessible treatments ([4]).

- Preference for Natural and Herbal Products: Patients increasingly favor formulations containing natural ingredients like aloe vera, perceived as safer and gentler.

- OTC Accessibility: Availability without prescription enhances product reach, especially in emerging markets.

- Enhanced Formulation Benefits: The combination offers anti-inflammatory action with skin soothing, providing a competitive edge in consumer choice.

Challenges

- Market Saturation: Numerous existing corticosteroid and herbal skin products limit market entry opportunities.

- Regulatory Scrutiny: Classification as OTC or prescription products varies by region, affecting accessibility.

- Safety Concerns: Potential side effects of corticosteroids limit long-term usage, impacting repeat sales.

- Price Sensitivity: Consumers in low-income regions are highly price-sensitive, influencing pricing strategies.

Market Trends and Opportunities

Innovation and Differentiation

Advancements in delivery systems (e.g., nanoemulsions, sustained-release formulations) can improve efficacy and patient compliance. Organic certification and eco-friendly packaging further appeal to health-conscious consumers.

Expansion in Emerging Markets

Growing healthcare infrastructure in Asia, Latin America, and Africa presents opportunities for market growth, provided localized regulatory pathways are navigated effectively.

E-commerce and Direct-to-Consumer Platforms

Online channels facilitate wider distribution and consumer education, especially for OTC products containing herbal ingredients.

Strategic Collaborations

Partnerships with dermatology clinics and health providers can bolster product credibility and accelerate adoption.

Price Projections (2023-2028)

Factors Influencing Pricing

- Regulatory Changes: Easing or tightening of OTC status can affect pricing flexibility.

- Manufacturing Costs: Advances in formulation technology may initially increase costs but optimize margins through scale.

- Competitive Dynamics: Entrance of new brands and formulations can induce price competition.

- Consumer Willingness to Pay: Growing preference for natural formulations can justify premium pricing.

Short-term (2023-2024)

Initial pricing is expected to remain stable, with average retail prices ranging between USD 8 and USD 12 per 30g tube or pack of the SM HYDROCORTISONE-ALOE formulation, considering brand positioning and geographic market.

Mid-term (2025-2026)

As brand recognition solidifies, and formulations become more cost-efficient, prices could marginally increase—averaging USD 10 to USD 14—supported by added value propositions like organic sourcing or advanced delivery systems.

Long-term (2027-2028)

Market maturity could lead to price stabilization or slight reductions due to generics and increased competition, with projected retail prices around USD 9 to USD 13 per unit. Premium variants with enhanced formulations or organic certification may command higher prices, up to USD 20–25 per pack.

Regional Variations

In developed markets, premium pricing is achievable owing to higher disposable incomes and trust in herbal products, whereas price-sensitive regions may see prices as low as USD 5–8 per pack, with volume-based growth strategies.

Strategic Recommendations

- Differentiation through Formulation Innovation: Incorporating advanced delivery mechanisms or organic certification can justify premium pricing.

- Focus on Emerging Markets: Tailored pricing strategies and local regulatory compliance are critical for market penetration.

- Brand Positioning and Education: Highlight the natural component and safety profile to build consumer trust and command higher prices.

- Cost Optimization: Streamlining manufacturing processes can maintain profitability amidst competitive pricing pressures.

Key Takeaways

- The SM HYDROCORTISONE-ALOE market is positioned for steady growth driven by increasing skin disorder prevalence, consumer preference for natural remedies, and OTC availability.

- Competitive differentiation through formulation innovation, organic certification, and strategic branding enhances market positioning and price resilience.

- Price projections indicate a range of USD 8-14 in most markets, with premium variants reaching higher price points contingent on formulation advancements and regional factors.

- Emerging markets offer significant expansion opportunities, provided companies adapt to local regulatory frameworks and consumer preferences.

- Sustainable profitability relies on balancing innovation, cost management, and strategic marketing to capitalize on industry growth trends.

FAQs

1. What is the primary therapeutic benefit of SM HYDROCORTISONE-ALOE?

It offers anti-inflammatory effects from hydrocortisone combined with soothing, moisturizing benefits of aloe vera, making it effective in managing dermatitis, eczema, and psoriasis while promoting skin healing.

2. How does regulatory status impact pricing for hydrocortisone-aloe products?

In regions where hydrocortisone is OTC, products typically have lower prices and broader accessibility. Prescription-only status can elevate prices due to increased regulation and demand, affecting market volume.

3. What are key growth opportunities for this drug in emerging markets?

Expanding distribution through local partnerships, tailoring formulations to regional preferences, and navigating regulatory pathways can facilitate market penetration and revenue growth.

4. How might formulation innovation influence future price points?

Advanced delivery systems or organic certifications can justify higher prices, while cost-effective manufacturing and economies of scale can lead to competitive pricing.

5. What competitive strategies should companies consider to succeed?

Differentiation through natural ingredients, effective marketing, personalized formulations, and leveraging e-commerce channels will position brands favorably in a competitive landscape.

Sources

[1] MarketWatch, "Global Dermatology Drugs Market Size, Share & Trends Analysis," 2022.

[2] Allied Market Research, "Natural Skincare Market Growth Forecast," 2022.

[3] U.S. Food and Drug Administration, "Topical Corticosteroids Regulations," 2022.

[4] World Health Organization, "Prevalence of Skin Diseases," 2021.

More… ↓