Share This Page

Drug Price Trends for SM HEMORRHOIDAL OINTMENT

✉ Email this page to a colleague

Average Pharmacy Cost for SM HEMORRHOIDAL OINTMENT

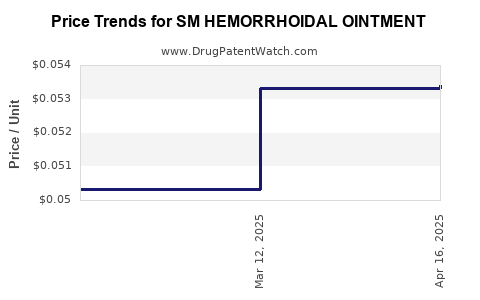

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM HEMORRHOIDAL OINTMENT | 49348-0198-78 | 0.05340 | GM | 2025-04-23 |

| SM HEMORRHOIDAL OINTMENT | 49348-0198-78 | 0.05333 | GM | 2025-03-19 |

| SM HEMORRHOIDAL OINTMENT | 49348-0198-78 | 0.05033 | GM | 2025-02-19 |

| SM HEMORRHOIDAL OINTMENT | 49348-0198-78 | 0.05026 | GM | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for SM Hemorrhoidal Ointment

Introduction

SM Hemorrhoidal Ointment is a topical medication used primarily for the treatment of hemorrhoids, a common condition affecting approximately 75% of adults at some point in their lives. As a prevalent over-the-counter (OTC) product, the ointment's market dynamics are influenced by factors such as disease prevalence, consumer awareness, competitive landscape, regulatory environment, and pricing strategies. This analysis provides an in-depth overview of the current market landscape and projects future pricing trends based on recent data and industry insights.

Market Overview

Global Prevalence and Market Demand

Hemorrhoids are associated with factors such as aging, sedentary lifestyle, obesity, and chronic constipation. The global market for hemorrhoidal treatment, valued at approximately USD 1.2 billion in 2022, is expected to grow at a compounded annual growth rate (CAGR) of 4.5% through 2028[1]. The increasing incidence among aging populations in North America and Europe, coupled with rising awareness and accessibility of OTC remedies, fuels market expansion.

Key Regional Markets

- North America: Dominates due to high healthcare awareness, OTC product availability, and aging demographics.

- Europe: Significant due to healthcare infrastructure and consumer demand.

- Asia-Pacific: Exhibits rapid growth driven by improving healthcare infrastructure and urbanization despite lower per-capita spending.

Product Segmentation

SM Hemorrhoidal Ointment competes within a broad category of topical hemorrhoid treatments, including creams, suppositories, and ointments. Its market share is influenced by efficacy perception, brand recognition, availability, and pricing.

Competitive Landscape

Major Players

- Proprietary branded products: Anusol, Preparation H, Tronolane.

- Private-label brands: Retailers’ own formulations.

- Generic options: Many local and international manufacturers producing similar OTC ointments.

Market Differentiators

- Efficacy & formulation: Ingredients such as hydrocortisone, phenylephrine, or witch hazel.

- Formulation attributes: Ease of application, tolerability, and ingredient safety profile.

- Pricing: Widely variable, with generics generally offering lower prices.

Regulatory Environment

OTC status in developed markets simplifies access but imposes standards on quality, safety, and efficacy. Regulatory rigor varies by country, influencing market entry strategies and price points.

Price Analysis

Current Pricing Landscape

- Brand-name OTC products: USD 8–15 per tube (30–50g).

- Generic and private-label products: USD 3–8 per tube.

- Regional pricing variation: Higher in North America and Europe, lower in Asia-Pacific and Latin America.

Factors Influencing Price

- Formulation complexity: Combination drugs with multiple active ingredients tend to be priced higher.

- Brand recognition: Established brands command premium prices.

- Distribution channels: Pharmacy sales generally demand higher margins than supermarket or online sales.

- Regulatory approvals: Stringent registration processes may elevate costs, impacting end-user prices.

Price Trends

Recent years have seen slight declines in average OTC hemorrhoid treatment prices due to the surge in generic options and retailer private labels that increase market competition. Additionally, the rise of e-commerce platforms has facilitated access to lower-priced alternatives.

Future Price Projections (2023-2028)

Key Market Drivers

- Increasing consumer awareness and at-home treatment preferences.

- Continued proliferation of generic and private-label products.

- Potential regulatory reforms promoting affordability and safety.

Projected Pricing Strategies

- Stagnation of premium brands: Expect minimal discounting due to brand loyalty and perceived efficacy.

- Growth in generics and private labels: Prices may decline further with increased price competition, potentially reaching USD 2.50–4.00 per tube in emerging markets.

- Impact of online sales: Prices could decrease by an additional 10–15% as online渠道 enhance price transparency.

Forecasted Price Range (per 30–50g tube)

- North America & Europe: USD 9–13 (2023), gradually declining to USD 8–11 by 2028.

- Asia-Pacific & Latin America: USD 3–5 (2023), potentially decreasing to USD 2.50–4.50 by 2028, driven by market entry of low-cost generics.

Implications for Stakeholders

Pharmaceutical Companies & Manufacturers

- Investing in formulations that optimize efficacy and reduce costs can allow profit margins while offering competitive pricing.

- Expansion into emerging markets through affordable private-label products offers growth opportunities.

- Strategic partnerships with online platforms can enhance distribution and market penetration.

Retailers & Distributors

- Competitive pricing strategies are critical; investing in private labels can improve margins.

- Educating consumers about efficacy and safety enhances brand loyalty and justifies premium pricing where applicable.

Regulators & Policymakers

- Supporting policies that promote transparency and affordability can benefit public health and market competitiveness.

Key Takeaways

- The global hemorrhoidal treatment market, including SM Hemorrhoidal Ointment, is experiencing steady growth, driven by increased prevalence and consumer shift towards OTC remedies.

- Price points vary widely across regions, with generics and private labels compelling downward pressure on premiums.

- The current average price for OTC hemorrhoidal ointments ranges from USD 3 in emerging markets to USD 15 in developed regions, with a projected gradual decline over the next five years.

- Market expansion in Asia-Pacific and Latin America, alongside online sales growth, will further influence price dynamics, primarily leading to cost reductions.

- Strategic product formulation and distribution channel optimization are essential for stakeholders aiming to sustain profitability amid competitive pressures.

FAQs

1. What are the main active ingredients in SM Hemorrhoidal Ointment?

Most formulations include hydrocortisone for inflammation, local anesthetics for pain relief, and astringents like witch hazel. Ingredient specifics depend on the product’s formulation and regulatory approvals[2].

2. How does the price of SM Hemorrhoidal Ointment compare to competitors?

Prices typically range from USD 3–15 per tube, with generics and private-label brands offering more affordable options, often under USD 5, while established brands tend to command higher prices due to brand reputation and formulation complexity.

3. What factors are likely to influence the price trend of hemorrhoidal ointments?

Market competition, regulatory changes, ingredient costs, and consumer demand for affordability primarily influence future pricing. The rise of online sales channels also exerts downward pressure.

4. Are there any regulatory hurdles that could impact pricing or market access?

Yes. Regulatory approval processes vary globally, with more rigorous standards potentially increasing costs. Conversely, deregulation or simplified registration can facilitate pricing flexibility and market entry.

5. What strategies can companies adopt to remain competitive in this market?

Offering cost-effective formulations, leveraging online retail channels, expanding into emerging markets, and investing in product efficacy improvements are vital strategies for competitive advantage[3].

References

[1] Market Research Future. “Hemorrhoidal Treatment Market.” 2022.

[2] U.S. FDA. “Hemorrhoid Product Labeling & Composition.”

[3] GlobalData. “OTC Hemorrhoid Treatment Outlook,” 2022.

More… ↓