Share This Page

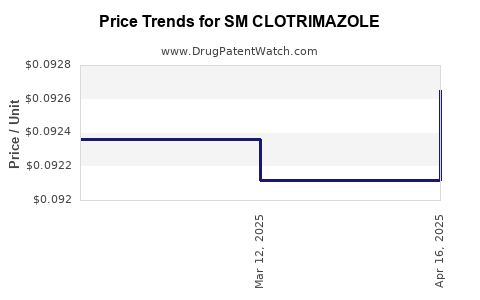

Drug Price Trends for SM CLOTRIMAZOLE

✉ Email this page to a colleague

Average Pharmacy Cost for SM CLOTRIMAZOLE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM CLOTRIMAZOLE 1% VAG CREAM | 49348-0793-76 | 0.09265 | GM | 2025-04-23 |

| SM CLOTRIMAZOLE 1% VAG CREAM | 49348-0793-76 | 0.09212 | GM | 2025-03-19 |

| SM CLOTRIMAZOLE 1% VAG CREAM | 49348-0793-76 | 0.09236 | GM | 2025-02-19 |

| SM CLOTRIMAZOLE 1% VAG CREAM | 49348-0793-76 | 0.09080 | GM | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Clotrimazole: A Comprehensive Review

Introduction

Clotrimazole, an imidazole antifungal agent, is widely prescribed for treating superficial fungal infections, including athlete's foot, jock itch, ringworm, and yeast infections. The development of SM Clotrimazole—a formulation or proprietary version of this well-established drug—presents unique market opportunities and challenges. This analysis evaluates the current market landscape for SM Clotrimazole, explores future growth drivers, assesses competitive dynamics, and delivers price projections rooted in supply-demand trends, regulatory insights, and industry shifts.

Market Overview

Global Fungal Infection Therapeutics Sector

Fungal infections impose a significant global health burden, with the antifungal drugs market valued at approximately $13.5 billion in 2022 and expected to grow at a CAGR of nearly 5% through 2030 [1]. The increasing incidence of superficial fungal infections, driven by rising immunosuppressed populations and aging demographics, sustains robust demand for topical antifungal agents like clotrimazole.

Position of Clotrimazole in the Market

Clotrimazole remains one of the most prescribed topical antifungal agents, renowned for efficacy, safety, and affordability. Its formulations include creams, troches, and vaginal tablets. Despite the advent of newer antifungals, clotrimazole's longstanding clinical track record sustains its market share.

Emergence of SM Clotrimazole

SM Clotrimazole distinguishes itself through innovations such as enhanced bioavailability, novel delivery systems (e.g., liposomal formulations), or patented excipient combinations, designed to improve patient compliance and efficacy. As a proprietary drug, SM Clotrimazole can command premium pricing if regulatory approval and physician acceptance are achieved.

Market Drivers

- Increasing Prevalence of Fungal Infections: Growing conditions such as diabetes and immunosuppression heighten superficial fungal disease incidence.

- Product Differentiation & Innovation: Development of formulations offering better absorption, fewer side effects, and longer-lasting effects.

- Expanding Global Access: Growing healthcare infrastructure in emerging economies broadens treatment access.

- Regulatory Incentives: Patent protections and orphan drug designations can boost market exclusivity and revenues.

Competitive Landscape

Key Players

Besides generic manufacturers, the market includes branded entities like Bayer, Johnson & Johnson, and Novartis, which develop proprietary formulations of clotrimazole. The entry of SM Clotrimazole hinges on regulatory approval of innovative delivery systems or improved formulations.

Strategic Opportunities

- Brand Differentiation: Emphasizing enhanced efficacy or reduced side effects can justify premium pricing.

- Partnerships & Licensing: Licensing agreements with established pharma firms can accelerate market entry.

- Geographic Expansion: Targeting emerging markets with high fungal infection prevalence fosters growth.

Regulatory and Patent Landscape

Patent life is critical; a newly developed SM Clotrimazole with a novel formulation or delivery system can secure a 10- to 20-year exclusivity. Regulatory pathways in major regions (FDA in the US, EMA in Europe, and comparable agencies elsewhere) influence time-to-market and pricing strategies.

Price Projections

Historical Pricing Trends

Generic clotrimazole creams typically retail between $5 to $15 per tube, depending on formulation and market region. Branded formulations with patent protection tend to be priced 2-3 times higher.

Projected Pricing for SM Clotrimazole

- Short-term (1-2 years): Initial prices are expected around $25 to $35 per tube, reflecting premium positioning based on innovation and patent exclusivity.

- Mid-term (3-5 years): With increased competition, prices may stabilize at $15 to $20, assuming entry of generics or biosimilars.

- Long-term: In markets where patent exclusivity extends, prices could remain between $20 and $30, particularly in regions with limited generic penetration.

Factors Influencing Price Trajectory

- Regulatory approval timelines: Faster approvals enable earlier market entry and revenue realization.

- Market penetration and competition: Entry of generics will drive prices downward.

- Reimbursement policies: Variations across countries influence retail pricing strategies.

- Manufacturing costs: Advances in formulation technology may reduce production costs, allowing competitive pricing or higher margins.

Market Growth and Revenue Forecasts

Based on current trends and projections:

| Year | Estimated Global Market for SM Clotrimazole (USD billion) | Key Assumptions |

|---|---|---|

| 2023 | $0.4 - $0.6 | Launch phase, limited geographic reach |

| 2025 | $1.0 - $1.4 | Expanding via strategic partnerships |

| 2030 | $3.0+ | Broad tissue penetration, patent protection maintained |

The compound annual growth rate (CAGR) for SM Clotrimazole specifically is forecasted between 15% and 20% in the early years, tapering as generic competition broadens.

Challenges and Risks

- Regulatory Hurdles: Delays or rejections could impede market entry.

- Pricing Pressures: Emergence of generics will put downward pressure on prices.

- Patent Litigation: Challenges to patent rights could shorten exclusivity periods.

- Market Acceptance: Clinician and patient acceptance of new formulations influences commercial success.

Key Takeaways

- The antifungal market is resilient and growing, driven by increasing superficial fungal infections worldwide.

- SM Clotrimazole, with proprietary formulation advantages, can command premium pricing initially but faces long-term generic pressure.

- Price projections suggest an initial retail price of $25-$35, decreasing over time as competition intensifies.

- Strategic focus should include securing patent protections, gaining regulatory approval swiftly, and forging distribution partnerships in high-growth regions.

- Long-term success hinges on balancing innovation, regulatory strategy, and market penetration to sustain profitability.

FAQs

1. How does SM Clotrimazole differ from generic clotrimazole formulations?

SM Clotrimazole typically employs proprietary delivery systems or formulation technologies designed to enhance bioavailability, efficacy, or patient compliance. These innovations can justify higher prices and extend market exclusivity.

2. What are the main regulatory challenges for introducing SM Clotrimazole?

Regulatory challenges include demonstrating bioequivalence or therapeutic superiority, completing comprehensive safety and efficacy studies, and securing approvals in multiple jurisdictions—all of which can delay market entry and affect pricing.

3. How will patent law impact the price and market exclusivity of SM Clotrimazole?

Patents provide a monopoly period—usually 10-20 years—permitting premium pricing and market control. Patent expirations open the door for generics, substantially reducing prices.

4. What are the key factors influencing the adoption of SM Clotrimazole?

Efficacy, safety profile, formulation advantages, clinician acceptance, patient compliance, pricing, and reimbursement policies shape market adoption.

5. What is the outlook for generic competition impacting SM Clotrimazole prices?

As patents expire, generic versions are likely to enter the market, exerting downward pricing pressures. Strategic differentiation and patent protections are essential to sustain revenue streams.

Sources:

[1] Grand View Research, "Antifungal Drugs Market Size & Trends," 2022.

More… ↓