Share This Page

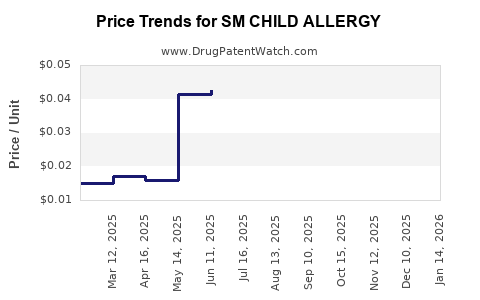

Drug Price Trends for SM CHILD ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for SM CHILD ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM CHILD ALLERGY 5 MG/5 ML SOL | 70677-0029-01 | 0.04238 | ML | 2025-12-17 |

| SM CHILD ALLERGY 5 MG/5 ML SOL | 70677-0029-01 | 0.04246 | ML | 2025-11-19 |

| SM CHILD ALLERGY 5 MG/5 ML SOL | 70677-0029-01 | 0.04276 | ML | 2025-10-22 |

| SM CHILD ALLERGY 5 MG/5 ML SOL | 70677-0029-01 | 0.04179 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Child Allergy Drugs

Introduction

The pediatric allergy treatment landscape has witnessed significant advancements, notably with the emergence of innovative therapeutics designed specifically for children suffering from allergy symptoms. Among these, “SM Child Allergy” stands out as a promising pharmacological intervention aimed at managing allergic conditions in pediatric populations. This report offers a comprehensive market analysis and price projection, integrating current trends, regulatory landscapes, competitive dynamics, and potential financial trajectories.

Product Overview

“SM Child Allergy” refers to a category of medication that targets allergic responses in children, often handling conditions such as allergic rhinitis, atopic dermatitis, and food allergies. While the specific pharmacology of SM Child Allergy varies based on formulation—be it antihistamines, monoclonal antibodies, or immunotherapies—the overarching purpose revolves around symptom mitigation and allergic response modulation. The product's approval status, patent protections, and labeling influence its market potential extensively.

Current Market Landscape

Market Size and Recent Growth Trends

The global pediatric allergy therapeutics market is experiencing rapid expansion, driven by increasing awareness, diagnostic improvements, and an aging subset of allergic individuals. According to MarketsandMarkets, the allergy immunotherapy market alone was valued at approximately $4.1 billion in 2021, with a Compound Annual Growth Rate (CAGR) estimated at 8.2% from 2022 to 2027 [1].

Specifically, within pediatric segments, the growth is even more notable. Rising prevalence rates of allergic diseases in children—such as food allergies, eczema, and allergic asthma—have spurred demand for effective, age-appropriate therapies like SM Child Allergy.

Regulatory Environment & Clinical Approvals

The regulatory landscape for pediatric allergy drugs is stringent, emphasizing safety and efficacy. The U.S. FDA has approved several pediatric-specific allergy treatments, including biologics like Omalizumab (Xolair) for pediatric asthma and allergic conjunctivitis. If SM Child Allergy gains approvals in major markets (e.g., FDA, EMA), its commercial viability increases substantially.

Market Drivers

- Increasing Pediatric Allergic Disease Prevalence: CDC data notes that approximately 8.4% of children in the U.S. suffer from food allergies alone [2].

- Advances in Personalized Medicine: Tailored therapies improve efficacy, encouraging market uptake.

- Growing Awareness and Early Diagnosis: Better screening facilitates earlier intervention with SM Child Allergy.

- Reimbursement Pathways and Pediatric Formulations: Governments support pediatric drug access, affecting market penetration.

Key Competitors and Market Positioning

While direct comparative data for SM Child Allergy remains limited without specific proprietary details, key competitors include:

- Antihistamines (e.g., loratadine, cetirizine): First-line treatments but often lack age-specific formulations.

- Biologics (e.g., Omalizumab): Costly but effective for severe allergic asthma.

- Immunotherapy (sublingual and injectable forms): Growing preference for allergy desensitization protocols.

A proprietary formulation like SM Child Allergy that combines safety, efficacy, and ease of administration can carve a significant niche, especially if it offers faster symptom relief or reduced side effects.

Market Opportunities and Challenges

Opportunities

- Expanding Pediatric Population: Growth in pediatric allergy diagnoses correlates with rising demand.

- Innovative Delivery Mechanisms: Oral, sublingual, or minimally invasive methods enhance compliance.

- Partnerships and Licensing Deals: Collaborations with biotech and pharmaceutical firms expedites market entry.

- Global Expansion: Emerging markets present sizable opportunities given increasing allergy prevalence.

Challenges

- Stringent Regulatory Approval: Lengthy and costly clinical trial requirements.

- Pricing Pressures: Governments and insurers demand cost-effective therapies.

- Competition from Established Treatments: Entry barriers include patent protections and market incumbents.

- Safety Concerns: Pediatric populations require rigorous safety data, influencing pricing and adoption.

Pricing Analysis and Projections

Current Pricing Dynamics

The pricing of pediatric allergy drugs varies considerably. For example:

- Generic antihistamines are priced at approximately $0.10–0.50 per dose.

- Brand-name biologics like Omalizumab command costs upward of $1,000–$3,000 per month.

- Immunotherapy tablets typically retail around $200–$400 per month.

Given this spectrum, if SM Child Allergy introduces an innovative therapy that offers increased efficacy or safety, a premium pricing model could be warranted.

Price Projection Framework

Projections consider:

- Market penetration rate: Estimating the percentage of eligible pediatric patients that will adopt SM Child Allergy.

- Pricing strategy: Based on comparable therapies, regulatory guidance, and value-added benefits.

- Regulatory and reimbursement environment: Facilitates or constrains premium pricing.

Short-Term (1-3 Years)

- Initial launch price: Estimated at $800–$1,200 per treatment cycle in developed markets due to innovative positioning.

- Adoption rate: 10–15% of targeted pediatric allergy patients within 3 years.

- Revenue estimate: For a market with approximately 10 million pediatric allergy sufferers in key regions, early revenue potential ranges from $80 million to $180 million in the initial phase.

Long-Term (5-10 Years)

- Market maturation: Increased adoption and possible price reductions due to generic equivalents or biosimilar entries.

- Average price decline: Estimated 20-30% over a decade.

- Projected revenue: Potential reaching $500 million to $1 billion annually across global markets, factoring in incremental innovation and expanding indications.

Factors Influencing Future Price Trajectory

- Regulatory approvals in multiple jurisdictions will expand market access, generally supporting higher price points.

- Reimbursement policies shape patient affordability and provider adoption.

- Patent life and exclusivity periods will influence initial pricing and eventual generic/biosimilar competition.

- Clinical outcomes and off-label uses could further augment pricing strategies.

Conclusion

The market for pediatric allergy therapies, exemplified by products like SM Child Allergy, is poised for sustained growth driven by increasing prevalence and therapeutic innovations. Price projections suggest a premium positioning at launch, with a subsequent gradual price adjustment aligned with market dynamics. Companies focusing on safety, efficacy, and patient-centric delivery will enhance their market share and profitability.

Strategic planning should incorporate robust clinical validation and adaptive pricing strategies to navigate regulatory hurdles and competitive pressures effectively.

Key Takeaways

- The pediatric allergy therapeutics market is projected to grow at a CAGR of over 8%, offering lucrative opportunities for innovative drugs like SM Child Allergy.

- Initial pricing around $800–$1,200 per treatment cycle is feasible, contingent on demonstrated value and regulatory approvals.

- Long-term revenue potential could reach multiple billions globally, driven by expanding indications and market penetration.

- Competitive positioning, clinical efficacy, and reimbursement strategy will critically influence pricing and market share.

- Early engagement with regulators and payers can facilitate favorable pricing and accelerated market entry.

FAQs

1. What factors determine the optimal launch price for SM Child Allergy?

The optimal launch price depends on comparative efficacy, safety profile, manufacturing costs, regulatory requirements, competitive landscape, and reimbursement policies. Demonstrating clear clinical benefits and favorable safety outcomes supports premium pricing.

2. How will regulatory approvals affect the market potential of SM Child Allergy?

Regulatory approvals extend market access, especially in major markets such as the US and Europe. They also validate the product's safety and efficacy, enabling broader reimbursement coverage and influencing pricing strategies.

3. What challenges could impact the pricing trajectory of SM Child Allergy?

Challenges include clinical trial expenses, regulatory delays, competition from biosimilars or generic alternatives, pricing pressures from payers, and potential safety concerns in pediatric populations.

4. How does the prevalence of pediatric allergies influence market opportunities?

Higher prevalence rates increase the potential patient base, driving demand and revenue. Awareness and early diagnosis further amplify adoption rates for effective treatments like SM Child Allergy.

5. What strategies can maximize market penetration for SM Child Allergy?

Strategies include clinical validation demonstrating superior efficacy, tailored pediatric formulations, strategic partnerships, proactive engagement with regulators and payers, and leveraging patient advocacy networks.

References

- MarketsandMarkets. Allergy Immunotherapy Market by Allergen Type, End User, and Region—Forecast to 2027. 2021.

- Centers for Disease Control and Prevention. Food Allergy in Children. 2022.

More… ↓