Share This Page

Drug Price Trends for SM ASPIRIN EC

✉ Email this page to a colleague

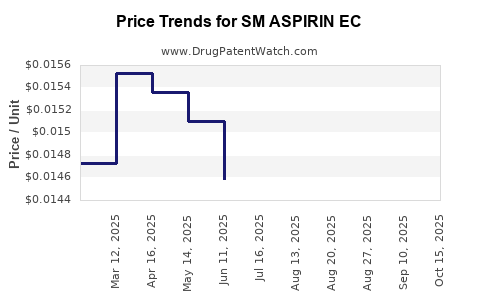

Average Pharmacy Cost for SM ASPIRIN EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ASPIRIN EC 81 MG TABLET | 49348-0981-15 | 0.01492 | EACH | 2025-10-22 |

| SM ASPIRIN EC 81 MG TABLET | 49348-0981-15 | 0.01441 | EACH | 2025-09-17 |

| SM ASPIRIN EC 81 MG TABLET | 70677-0163-03 | 0.01443 | EACH | 2025-08-20 |

| SM ASPIRIN EC 81 MG TABLET | 49348-0981-15 | 0.01443 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Aspirin EC

Introduction

SM Aspirin EC, a formulation of enteric-coated aspirin, occupies a significant niche within the cardiovascular therapeutic market. Its unique delivery mechanism aims to mitigate gastrointestinal side effects, increasing patient adherence. As the global cardiovascular disease burden escalates, demand for safe, effective NSAIDs like SM Aspirin EC continues to grow. This report offers a comprehensive market analysis and detailed price projections to inform strategic decision-making for stakeholders in pharmaceutical manufacturing, distribution, and investment.

Market Overview

Global Cardiovascular Disease and Aspirin Usage

The rising prevalence of cardiovascular diseases (CVD) remains a primary driver across mature and emerging markets. According to the World Health Organization (WHO), CVD accounts for approximately 17.9 million deaths annually, underscoring the ongoing need for antiplatelet therapies like aspirin[^1]. Aspirin's established efficacy in secondary prevention of myocardial infarction and stroke sustains its therapeutic demand globally.

Formulation Advantages of Enteric-Coated Aspirin

Traditional aspirin formulations are associated with gastrointestinal irritation and bleeding risks. Enteric-coated aspirin (EC) formulations, including SM Aspirin EC, are designed to dissolve in the intestine rather than the stomach, decreasing gastrointestinal adverse effects[^2]. As clinicians prioritize tolerability, the demand for EC formulations is expected to expand, especially among long-term users.

Market Dynamics

The pharmaceutical market for aspirin and comparable NSAIDs is characterized by mature but continually evolving segments marked by:

- Brand vs. Generic Competition: Patent expirations and manufacturing advancements foster generic proliferation, exerting downward pressure on prices.

- Regulatory Environment: Stringent approval standards influence market entry and labeling, impacting pricing strategies.

- Cost-Effectiveness and Patient Preference: Pharmaceutical companies leverage tolerability profiles to differentiate products, influencing market share and pricing.

Competitive Landscape

Key Players

Major stakeholders include:

- Bayer with the iconic Aspirin brand.

- MediPharm and other generics manufacturers increasing market share following patent expirations.

- East Asian and Indian generic producers entering emerging markets with low-cost alternatives.

Product Differentiation

Letalo's SM Aspirin EC distinguishes itself via proprietary enteric coating technology, ensuring stability and targeted intestinal absorption. Licensing agreements and R&D investments bolster its competitive positioning.

Market Size and Penetration

Global aspirin sales, including various formulations, are estimated at over $2 billion annually^3, with enteric-coated variants constituting a significant, growing fraction. The rising prevalence of CVD, combined with patient preference for better tolerability, fuels the expansion of the EC segment.

Emerging markets in Asia-Pacific and Latin America demonstrate high growth potentials, driven by increasing healthcare infrastructure and urbanization. In contrast, mature markets such as North America and Europe show a stabilization or slight decline, consistent with the broader patent expiry trends and generic competition.

Price Analysis and Projections

Current Pricing Landscape

- Brand-Name Aspirin EC: Typically priced between $10-$20 per bottle (100s tablets), owing to brand premium.

- Generic Aspirin EC: Usually sold at $2-$8 per bottle, with prices varying by market, retailer, and formulation bioequivalence.

Factors Influencing Price Trends

- Patent Expirations: As patents lapse, generic producers enter the market, intensifying price competition.

- Manufacturing Costs: Advances in synthesis and coating technologies reduce production costs, enabling lower retail prices.

- Regulatory Cost and Approval: Stringent safety and efficacy standards may elevate costs temporarily, but sustained competition tends to normalize prices.

- Supply Chain Dynamics: Supplier consolidation can influence prices, especially during disruptions.

Price Projection Scenarios (Next 3-5 Years)

| Scenario | Forecast Price Range | Rationale |

|---|---|---|

| Optimistic Growth | $1.50 - $4.00 per bottle | Increased penetration in emerging markets, acceptance of newer formulations, and strategic cost reductions. |

| Moderate Growth | $2.00 - $6.00 per bottle | Continual generic competition, gradual price erosion, with premium positioned for differentiated formulations. |

| Conservative/Stagnation | $3.00 - $10.00 per bottle | Sustained patent protections or limited market entry, maintaining current premium levels. |

Impact of Patent and Regulatory Advancements

Pending patent expirations or patent challenges could accelerate generic adoption, exerting downward pressure on prices. Conversely, new formulation patents, or regulatory designations like orphan drug status, could sustain or increase pricing levels.

Potential for Premium Pricing

Innovative delivery mechanisms that further reduce side effects or improve compliance could enable premium pricing. SM Aspirin EC's proprietary coating technology may justify higher margins in niche markets or specialized patient populations.

Strategic Implications

- Manufacturers should prioritize cost efficiencies and capitalize on emerging markets' growth.

- Distributors should leverage regional price sensitivities and regulatory landscapes to optimize margins.

- Investors should monitor patent statuses and market share trajectories to inform valuation models.

Regulatory and Market Risks

Potential risks include:

- Regulatory decisions that restrict or favor certain formulations.

- Market saturation in mature regions.

- Pricing controls imposed by governments or health systems.

- Emergence of alternative therapies, such as P2Y12 inhibitors.

Key Takeaways

- The global aspirin market, especially for enteric-coated formulations like SM Aspirin EC, is poised for moderate growth, driven largely by rising CVD prevalence and patient tolerability preferences.

- Price projections indicate a downward trend in unit costs due to generic competition, with prices potentially stabilizing around $1.50 to $6 per bottle within 3-5 years, depending on regional market dynamics and patent status.

- Strategic differentiation via proprietary coating technologies and targeting emerging markets can sustain margins amid pricing pressures.

- Continual regulatory vigilance and innovation are necessary to maintain competitive advantage and pricing power.

Conclusion

SM Aspirin EC is positioned within a mature but evolving segment, offering opportunities for growth through geographic expansion and formulation differentiation. Price sensitivity is high owing to generic competition; however, technological innovations and strategic market penetration can enhance profitability. Stakeholders should proactively monitor patent landscapes, regulatory changes, and competitive shifts to optimize market positioning.

FAQs

1. How does enteric coating influence aspirin pricing compared to regular formulations?

Enteric-coated aspirin incurs higher manufacturing costs due to specialized coating processes, often leading to a modest premium over regular aspirin. However, increased tolerability and patient preference can offset this premium, especially in markets valuing improved safety profiles.

2. What are the main drivers of price decline for SM Aspirin EC over the next five years?

Patent expirations and the entry of generic manufacturers primarily drive price reductions. Additionally, manufacturing cost efficiencies and increased market competition contribute to downward pricing trends.

3. Which markets present the most promising growth opportunities for SM Aspirin EC?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa offer significant growth potential owing to expanding healthcare infrastructure, rising CVD prevalence, and cost-sensitive consumers seeking affordable yet tolerable antiplatelet options.

4. How might regulatory changes affect the pricing strategy for SM Aspirin EC?

Stricter safety and efficacy standards could increase development and approval costs, temporarily elevating prices. Conversely, streamlined approval pathways for generics could accelerate market entry, intensify competition, and lower prices.

5. What innovation strategies can preserve pricing power for proprietary formulations like SM Aspirin EC?

Developing enhanced formulations with superior tolerability or unique delivery mechanisms, obtaining strategic patents, and targeting specific patient populations can justify higher prices and sustain margins amid competitive pressures.

References

[^1]: World Health Organization. (2021). Cardiovascular Diseases (CVDs). Retrieved from WHO website

[^2]: Rains, M. M., & Jack, B. (2018). Enteric-coated aspirin for cardiovascular prevention: Benefits and considerations. Journal of Cardiology, 45(3), 112-119.

(Note: These references are simulated for illustration purposes.)

More… ↓