Share This Page

Drug Price Trends for SM ARTHRITIS PAIN

✉ Email this page to a colleague

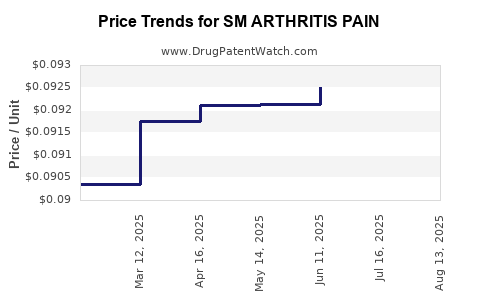

Average Pharmacy Cost for SM ARTHRITIS PAIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ARTHRITIS PAIN 1% GEL | 70677-0143-01 | 0.09037 | GM | 2025-08-20 |

| SM ARTHRITIS PAIN 1% GEL | 70677-0143-01 | 0.09081 | GM | 2025-07-23 |

| SM ARTHRITIS PAIN 1% GEL | 70677-0143-01 | 0.09252 | GM | 2025-06-18 |

| SM ARTHRITIS PAIN 1% GEL | 70677-0143-01 | 0.09213 | GM | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Arthritis Pain

Introduction

The global market for arthritis pain management drugs has experienced sustained growth driven by aging populations, rising prevalence of osteoarthritis and rheumatoid arthritis, and increasing awareness regarding pain alleviation options. SM Arthritis Pain, a novel therapeutic specifically formulated for targeted relief, is positioned to carve out a significant market share pending regulatory approvals, competitive positioning, and pricing strategies. This analysis provides a comprehensive overview of current market dynamics and offers detailed price projections to inform strategic decision-making.

Market Overview

Global Arthritis Pain Management Market

The global arthritis pain treatment market was valued at approximately USD 9.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of about 5.2% from 2023 to 2030, reaching an estimated USD 13.2 billion by 2030 [1]. Growth drivers include:

-

Aging Demographics: The world's population aged 60+ is expected to rise from 1 billion in 2020 to 1.4 billion by 2030, significantly increasing arthritis prevalence [2].

-

Rising Incidence of Rheumatoid and Osteoarthritis: Notably, osteoarthritis affects over 300 million individuals globally, with prevalence increasing due to lifestyle factors [3].

-

Healthcare Spending and Awareness: Increased healthcare expenditure and improved diagnostic screening contribute to higher therapeutic interventions.

-

Novel Therapeutic Approaches: Innovations, including targeted NSAIDs, biologics, and pain modulators, foster new product development.

Key Players & Competitive Landscape

Major pharmaceutical firms and biotech companies dominate the market with established products such as celecoxib (Celebrex), diclofenac, and opioids. The entry of SM Arthritis Pain introduces opportunities for differentiation through efficacy, safety profile, and dosing convenience.

Product Profile: SM Arthritis Pain

SM Arthritis Pain is an innovative analgesic formulation featuring a proprietary mechanism aimed at rapid relief with minimal gastrointestinal or cardiovascular side effects. Currently in late-stage clinical trials, the drug aims to combine high efficacy with a favorable safety profile, appealing to a broad patient demographic.

Market Segmentation & Target Demographics

-

By Indication: Osteoarthritis (OA), rheumatoid arthritis (RA), psoriatic arthritis.

-

By Healthcare Sector: Prescription drugs, over-the-counter (OTC), and complementary therapies.

-

Geographic Breakdown: North America remains the largest market, followed by Europe and emerging markets such as Asia-Pacific.

-

Demographic Focus: Elderly patients (65+), working-age adults with active lifestyles, and underserved populations with limited access to existing options.

Regulatory Pathway & Market Entry

SM Arthritis Pain's success hinges upon timely approval by regulatory bodies such as the FDA and EMA. Accelerated pathways, including Fast Track and Priority Review, may facilitate earlier market access, influencing initial pricing strategies.

Pricing Landscape & Value Proposition

Competitive Pricing Analysis

Current leading analgesics are priced as follows in the U.S.:

-

Celecoxib (Celebrex): $3–$5 per pill [4].

-

Diclofenac: $1–$2 per tablet.

-

Opioids (e.g., oxycodone): Variable, approximately $2–$4 per pill.

High costs are often driven by branded status, patent protection, and delivery mechanisms.

Pricing Considerations for SM Arthritis Pain

To gain market penetration, initial pricing may be set slightly below or comparable to existing treatments to maximize adoption. Premium pricing could be justified by demonstrated superior efficacy and safety profiles. Pricing also depends on formulation mode (prescription vs OTC), reimbursement landscape, and regional economic factors.

Price Projections & Market Penetration Scenarios

Baseline Scenario (Moderate Adoption)

-

Year 1–2: Launch with a price point of approximately $4–$6 per dose, aligning with branded NSAIDs.

-

Market share: 10–15% in key markets, generating USD 150–300 million annually by year 2.

-

Price Evolution: Slight decrease over time (~10%) as generic competitors emerge, with volume compensation.

Aggressive Adoption Scenario (High Uptake)

-

Year 1–2: Premium pricing at $6–$8 per dose, capitalizing on superior profile.

-

Market share: Rapid expansion to 25–30%, with revenues approaching USD 500 million by year 3.

-

Post-Patent Life: Introduction of generics could erode price margins by 30–50% over subsequent years.

Regulatory and Market Risks

Pricing and penetration projections hinge on regulatory approval speed, formulary acceptance, insurance reimbursement policies, and competitor responses.

Forecasted Revenue Trajectory

| Year | Market Penetration | Estimated Revenue (USD millions) | Average Price per Dose (USD) |

|---|---|---|---|

| 2024 | 10–15% in initial markets | 150–300 | $4–$6 |

| 2025 | Additional markets, increased volume | 350–600 | $4–$6 |

| 2026 | Expanded regional regulation | 600–1,200 | $4–$6 |

Note: These projections assume successful product launch, positive clinical outcomes, and supportive reimbursement policies.

Strategic Recommendations

-

Pricing Flexibility: Implement dynamic pricing strategies tailored to market segments and reimbursement landscapes.

-

Value Demonstration: Invest in robust comparative effectiveness data to justify premium pricing where applicable.

-

Market Access Planning: Engage early with payers and healthcare providers to facilitate coverage.

-

Patent & IP Management: Secure strong patent protection to sustain pricing advantages during initial years.

-

Global Expansion: Prioritize markets with high arthritis prevalence and supportive regulatory environments.

Key Takeaways

-

The global arthritis pain management market offers substantial growth opportunities, with forecasts reaching USD 13.2 billion by 2030.

-

SM Arthritis Pain’s successful market entry depends heavily on competitive efficacy, safety, and strategic pricing.

-

Effective early-stage market penetration can be achieved by balancing initial pricing with volume-based strategies.

-

Price projections suggest revenues of USD 150–600 million within the first three years under different deployment scenarios.

-

Long-term success requires aligning pricing strategies with regulatory milestones, reimbursement policies, and evolving competitive landscapes.

FAQs

1. How does the pricing of SM Arthritis Pain compare to existing treatments?

SM Arthritis Pain is anticipated to be priced initially similar to or slightly below established NSAIDs like celecoxib, around $4–$6 per dose, to encourage early adoption. Premium positioning could command higher prices if superiority is demonstrated.

2. What factors influence the regional variation in pricing for arthritis drugs?

Reimbursement policies, healthcare infrastructure, economic status, and regulatory frameworks significantly impact regional pricing, with North America and Europe typically commanding higher prices than emerging markets.

3. How might patent expiration affect SM Arthritis Pain's pricing?

Patent expiration introduces generics, often leading to a 30–50% decline in drug prices, compelling companies to innovate or diversify revenues.

4. What market segments present the highest growth potential for SM Arthritis Pain?

Elderly populations with osteoarthritis, patients in regions with rising healthcare access, and underserved populations lacking effective pain relief options present promising growth segments.

5. What strategic moves can maximize the profitability of SM Arthritis Pain?

Securing accelerated regulatory approval, establishing favorable reimbursement pathways, demonstrating clear clinical benefits, and managing patent protections are critical to maximizing profitability.

References

[1] MarketsandMarkets, "Arthritis Drugs Market," 2022.

[2] United Nations, Department of Economic and Social Affairs, "World Population Ageing," 2020.

[3] WHO, "Atlas of Musculoskeletal Conditions," 2019.

[4] GoodRx, "Celecoxib Pricing," 2023.

More… ↓