Share This Page

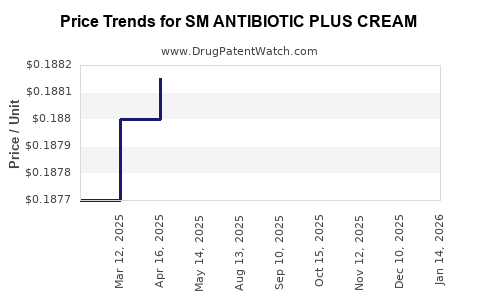

Drug Price Trends for SM ANTIBIOTIC PLUS CREAM

✉ Email this page to a colleague

Average Pharmacy Cost for SM ANTIBIOTIC PLUS CREAM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ANTIBIOTIC PLUS CREAM | 49348-0690-69 | 0.18873 | GM | 2025-12-17 |

| SM ANTIBIOTIC PLUS CREAM | 49348-0690-69 | 0.18873 | GM | 2025-11-19 |

| SM ANTIBIOTIC PLUS CREAM | 49348-0690-69 | 0.18873 | GM | 2025-10-22 |

| SM ANTIBIOTIC PLUS CREAM | 49348-0690-69 | 0.18873 | GM | 2025-09-17 |

| SM ANTIBIOTIC PLUS CREAM | 49348-0690-69 | 0.18873 | GM | 2025-08-20 |

| SM ANTIBIOTIC PLUS CREAM | 49348-0690-69 | 0.18827 | GM | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Antibiotic Plus Cream

Introduction

The pharmaceutical landscape for topical antibiotic creams has experienced steady growth driven by a rising prevalence of bacterial skin infections and increasing healthcare demands. Among these, the SM Antibiotic Plus Cream—a combination formulation addressing bacterial skin infections—aims to enter this competitive market segment. This analysis evaluates the current market dynamics, competitive landscape, regulatory considerations, and offers detailed price projections for SM Antibiotic Plus Cream over the upcoming five years.

Market Overview

Global and Regional Demand Drivers

The dermatological antibiotic market is expanding, driven by factors such as:

- Rising skin infection incidence: Increased prevalence of bacterial skin conditions stemming from urbanization, immunosuppression, and hygiene challenges (e.g., diabetic foot infections, impetigo, folliculitis).

- Growth in outpatient prescriptions: A significant portion of bacterial skin infections are treated in outpatient settings, favoring topical formulations.

- Antibiotic resistance: Growing resistance to traditional antibiotics prompts demand for combination creams with broader efficacy and reduced resistance development.

According to MarketsandMarkets, the global topical antibiotic market was valued at approximately $1.2 billion in 2021, with a projected CAGR of 4.8% through 2026 [1].

Market Segments and Competitors

The topical antibiotic landscape comprises several key players, including:

- Generic formulations: Widely available with low-cost pricing.

- Brand name products: Such as Neosporin, Bactroban, and Polysporin.

- Combination products: Enhancing efficacy through included corticosteroids or additional antimicrobial agents.

SM Antibiotic Plus Cream is expected to compete primarily within the combination segment, targeting healthcare providers seeking potent solutions for resistant or complex infections.

Regulatory and Clinical Considerations

The success of SM Antibiotic Plus Cream hinges on regulatory approval pathways, which vary regionally:

- United States: FDA approval mandates demonstrating safety, efficacy, and manufacturing quality, potentially via new drug application (NDA) pathways.

- European Union: EMA approval involves stringent clinical data assessments.

- Asia-Pacific: Regulatory timelines might be expedited for generic or biosimilar formulations, but novel combinations require comprehensive data.

Clinical trials demonstrating superior efficacy or reduced side effects could justify premium pricing and drive market penetration.

Pricing Landscape

Current Price Benchmarks

- Generic antibiotic creams: Typically priced between $0.20 to $0.50 per gram.

- Brand name combination creams: Range from $0.75 to $2 per gram depending on formulation complexity and brand positioning.

- Premium products: Can reach up to $3 per gram or higher, especially with added corticosteroids or proprietary formulations.

Pricing Strategy for SM Antibiotic Plus Cream

Given its positioning as a combination, potentially superior product:

- Low-tier pricing may target generics or cost-sensitive markets (~$0.20–$0.50 per gram).

- Mid-tier pricing could be aimed at branded markets (~$0.75–$1.50 per gram).

- Premium pricing could be reserved for differentiated formulations with clinical advantages (~$2–$3 per gram).

Market Entry and Revenue Forecasts (Next 5 Years)

Year 1–2: Launch and Adoption

- Market Penetration: Initial penetration rate estimated at 2–5%, primarily in high-income regions with established healthcare infrastructure.

- Revenue: Based on a target market size of roughly $300 million in key regions, the first-year revenue could be $5–$10 million, assuming an average price of $1 per gram and modest sales volume.

Year 3–4: Expansion and Growth

- Market penetration: Expected increase to 10–15% as physicians become familiar, with geographical expansion into emerging markets.

- Revenue projections: Growing to $30–$50 million annually, supported by expanded distribution channels and clinical endorsements.

Year 5 and Beyond: Maturation and Market Share Consolidation

- Market share stabilization: Estimated at 20–25% in targeted segments.

- Revenue ceiling: Approaching $100 million+, especially if clinical data support superior efficacy, leading to premium pricing.

Key Factors Influencing Price Projections

- Regulatory approval timelines and regional market access.

- Clinical efficacy data: Superior outcomes justify higher pricing tiers.

- Competitive response: Entry of generic competitors could pressure prices downward.

- Manufacturing costs: Economies of scale could reduce wholesale prices, potentially passing savings to consumers.

- Payor dynamics: Insurance coverage and formulary inclusion influence patient access and pricingability.

Risks and Opportunities

Risks:

- Regulatory delays impacting market entry.

- Emergence of resistance diminishing product effectiveness.

- Competitive pricing pressures from established brands and generics.

Opportunities:

- Clinical differentiation: Superior formulations can command premium prices.

- Expanding regions: Entering Emerging markets can yield higher growth.

- Combination therapy advantages: Can justify price premiums due to enhanced outcomes.

Conclusion

The SM Antibiotic Plus Cream market stands poised for growth, especially if clinical superiority can be demonstrated. Strategic pricing initially aligned with mid-tier benchmarks enables capture of diverse market segments. With ongoing clinical data, geographic expansion, and favorable regulatory pathways, revenue projections suggest a cumulative potential of $50–$100 million within five years, with scope for scaling higher based on market acceptance and global demand.

Key Takeaways

- Market prospects for SM Antibiotic Plus Cream are robust, driven by increasing bacterial skin infections and demand for effective topical therapies.

- Pricing strategy should align with market positioning, initially around $0.75–$1.50 per gram to balance demand and profitability.

- Clinical differentiation will be critical; enhanced efficacy and safety profiles justify premium pricing and accelerate market adoption.

- Geographical expansion into emerging markets offers substantial growth potential, elevating revenue prospects.

- Regulatory timelines and resistance trends are key uncertainties influencing market and price evolution.

FAQs

1. What factors influence the pricing of topical antibiotic creams like SM Antibiotic Plus?

Pricing depends on formulation complexity, clinical efficacy, brand positioning, manufacturing costs, regional regulatory approvals, and competitive dynamics.

2. How does the market for topical antibiotics compare globally?

The global market is growing at approximately 4.8% CAGR, with mature markets in North America and Europe leading, and emerging markets offering high growth potential.

3. What clinical data are necessary to support premium pricing?

Comparative efficacy studies demonstrating superior infection clearance rates, faster healing, or fewer side effects are essential for command higher prices.

4. What are the primary risks facing SM Antibiotic Plus market entry?

Regulatory delays, resistance development, aggressive generic competition, and regional pricing pressures pose significant risks.

5. How can SM Antibiotic Plus maintain market competitiveness?

Ongoing clinical research, strategic pricing, expanding indications, and geographic diversification are critical to sustaining competitive advantage.

References

[1] MarketsandMarkets. "Topical Antibiotic Market – Global Forecast to 2026." 2021.

More… ↓