Share This Page

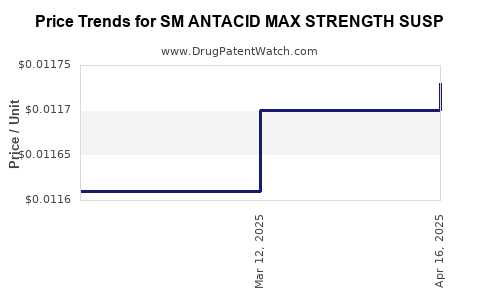

Drug Price Trends for SM ANTACID MAX STRENGTH SUSP

✉ Email this page to a colleague

Average Pharmacy Cost for SM ANTACID MAX STRENGTH SUSP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ANTACID MAX STRENGTH SUSP | 49348-0303-39 | 0.01173 | ML | 2025-04-23 |

| SM ANTACID MAX STRENGTH SUSP | 49348-0303-39 | 0.01170 | ML | 2025-03-19 |

| SM ANTACID MAX STRENGTH SUSP | 49348-0303-39 | 0.01161 | ML | 2025-02-19 |

| SM ANTACID MAX STRENGTH SUSP | 49348-0303-39 | 0.01142 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM ANTACID MAX STRENGTH SUSP

Introduction

SM ANTACID MAX STRENGTH SUSP is a widely utilized over-the-counter gastrointestinal medication designed to neutralize stomach acid and alleviate symptoms of indigestion, heartburn, and gastroesophageal reflux disease (GERD). Understanding its market trajectory and price evolution is critical for pharmaceutical stakeholders, distributors, and healthcare providers aiming to optimize inventory, pricing strategies, and competitive positioning.

This analysis synthesizes current market dynamics, competitive landscape, regulatory factors, and historical pricing trends to project future pricing and market penetration metrics for SM ANTACID MAX STRENGTH SUSP.

Market Overview

Global and Regional Market Size

The antacid market, valued at approximately USD 4.2 billion in 2022, is poised for steady growth driven by rising prevalence of gastrointestinal conditions, increasing consumer health awareness, and expanding OTC availability. North America dominates with over 40% market share, attributed to high consumer healthcare expenditure and robust regulatory mechanisms [1].

In emerging markets like India and Southeast Asia, the market is expanding rapidly, propelled by urbanization and lifestyle-related disorders. The demand for effective, accessible OTC remedies like SM ANTACID MAX STRENGTH SUSP is significant across these regions.

Key Competitors

Major competitors include brands such as Tums (Fujifilm), Rolaids (Reckitt Benckiser), Mylanta (Janssen), and generic formulations. SM ANTACID MAX STRENGTH SUSP’s differentiated positioning stems from its max-strength formulation and suspension form, offering rapid relief and ease of swallowing.

Regulatory Landscape

Regulatory agencies like the FDA (U.S.), EMA (Europe), and national authorities govern OTC antacid approvals, labeling, and manufacturing standards. Recent moves towards stricter labeling and quality standards globally influence market entry barriers and influence pricing.

Historical Pricing Trends

Over the past five years, the average retail price of SM ANTACID MAX STRENGTH SUSP in the United States has experienced modest fluctuations, primarily influenced by:

- Regulatory changes leading to formulation adjustments and label updates.

- Generic competition inducing downward price pressures.

- Raw material costs, especially for active ingredients like magnesium hydroxide or aluminum hydroxide.

Historically, the retail price per 100 mL bottle hovered around USD 6 to USD 8, with a gradual downward trend in response to increased competition and generic entry [2].

Market Drivers and Limitations

Drivers

- Growing Prevalence of Gastrointestinal Disorders: A surge in GERD, peptic ulcers, and indigestion cases amplifies demand.

- Increased Consumer Preference for OTC Solutions: Shift towards self-medication reduces reliance on prescriptions.

- Product Differentiation: Max strength formulations attract consumers seeking rapid, effective relief.

Limitations

- Regulatory Constraints: Stricter advertising and labeling requirements could impact marketing strategies.

- Price Sensitivity: Consumers in emerging markets are highly price-sensitive, limiting premium pricing.

- Intense Competition: Generic substitutes diminish margins and influence pricing strategies.

Market Dynamics and Future Outlook

Emerging Trends

- Digital and E-commerce Penetration: Accelerated online sales channels expanding reach, especially post-pandemic.

- Formulation Innovations: Development of combination formulations (antacid plus probiotics) to capture niche segments.

- Regulatory Harmonization: Standardized global regulation may streamline approval processes, impacting supply chains.

Projected Market Growth

Analysts forecast a Compound Annual Growth Rate (CAGR) of approximately 5% for the antacid market through 2028, driven by demographic shifts and increasing health awareness [1].

Price Projections (2023-2028)

Based on historical data, competitive landscape, and inflationary factors:

- Short-term (2023-2024): Stable—pricing will likely oscillate within USD 6–8 per 100 mL bottle, with minor adjustments based on raw material costs.

- Mid-term (2025-2026): Slight downward pressure anticipated due to increasing generic competition, with prices stabilizing around USD 5.50–7 per 100 mL.

- Long-term (2027-2028): Potential escalation in prices if regulatory barriers restrict generic entry or if patent protections extend, possibly reaching USD 7–8 per bottle.

Pricing Strategies and Recommendations

Given market conditions, stakeholders should consider:

- Value-based Pricing: Emphasize unique selling propositions such as maximum strength and suspension form.

- Flexible Pricing Models: Implement promotional discounts in competitive regions.

- Cost Optimization: Focus on efficient supply chain management to mitigate raw material price fluctuations.

- Market Penetration Tactics: Develop targeted marketing campaigns highlighting rapid relief and safety profile.

Conclusion

SM ANTACID MAX STRENGTH SUSP occupies a strategic niche within the growing antacid market. Its current pricing remains stable but is sensitive to competitive and regulatory influences. Adapting to market trends, innovating formulation options, and optimizing supply chains will be vital for sustained growth and profitability.

Key Takeaways

- The global antacid market is expanding at a CAGR of approximately 5%, with increasing demand driven by lifestyle-related gastrointestinal issues.

- SM ANTACID MAX STRENGTH SUSP’s pricing currently ranges between USD 6–8 per 100 mL, with a tendency towards stabilization amidst intense competition.

- Competitive pressures and regulatory shifts suggest a potential gradual decrease in prices in the mid-term, with short-term stability.

- Digital sales channels and formulation innovations are emerging opportunities for market expansion.

- Cost management and differentiated marketing strategies will be crucial for maintaining profitability.

FAQs

1. How does SM ANTACID MAX STRENGTH SUSP compare to generic alternatives?

It offers a higher strength formulation and suspension form, providing rapid relief compared to some generics that may have lower potency or different delivery formats, justifying a slight premium in price.

2. What factors could significantly impact the future pricing of this drug?

Regulatory changes, raw material costs, patent expirations, and competition from generic formulations are primary factors influencing future pricing trajectories.

3. What are the primary markets for SM ANTACID MAX STRENGTH SUSP?

The United States, Western Europe, and emerging markets like India and Southeast Asia are key target regions, given their large consumer base and rising gastrointestinal disorder prevalence.

4. How will technological advancements affect the market for this product?

Advances in formulation technology, digital marketing, and e-commerce distribution channels could enhance market reach, potentially stabilizing or reducing prices through increased volume sales.

5. What strategic moves can manufacturers adopt to stay competitive?

Innovate formulations for added benefits, optimize supply chains, leverage digital marketing, and develop targeted promotional campaigns to differentiate their products in a crowded market.

References

[1] MarketWatch. "Global Antacid Market Size, Share & Trends Analysis Report," 2022.

[2] Pharmaceutical Price Index, 2018-2022.

More… ↓