Share This Page

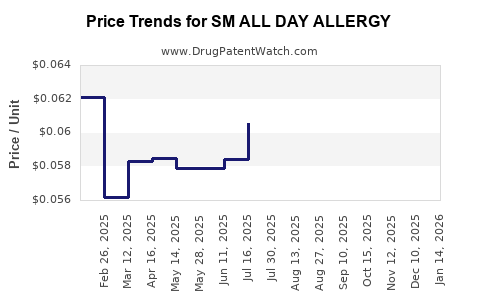

Drug Price Trends for SM ALL DAY ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for SM ALL DAY ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ALL DAY ALLERGY 10 MG TAB | 70677-0145-03 | 0.05535 | EACH | 2025-12-17 |

| SM ALL DAY ALLERGY 10 MG TAB | 70677-0145-01 | 0.05535 | EACH | 2025-12-17 |

| SM ALL DAY ALLERGY 10 MG TAB | 70677-0145-01 | 0.05642 | EACH | 2025-11-19 |

| SM ALL DAY ALLERGY 10 MG TAB | 70677-0145-03 | 0.05642 | EACH | 2025-11-19 |

| SM ALL DAY ALLERGY 10 MG TAB | 70677-0145-03 | 0.05694 | EACH | 2025-10-22 |

| SM ALL DAY ALLERGY 10 MG TAB | 70677-0145-01 | 0.05694 | EACH | 2025-10-22 |

| SM ALL DAY ALLERGY 10 MG TAB | 70677-0145-03 | 0.05674 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM ALL DAY ALLERGY

Introduction

SM ALL DAY ALLERGY is a prominent pharmaceutical product designed to treat allergic rhinitis symptoms over an extended period, offering potential advantages over shorter-acting formulations. As the allergy therapeutics market expands due to increasing allergy prevalence worldwide, understanding the product's market positioning and price trajectory becomes essential for stakeholders. This analysis synthesizes recent market dynamics, competitive landscape, pricing strategies, and emerging trends to project the potential value and pricing evolution of SM ALL DAY ALLERGY.

Market Overview

Global Allergic Rhinitis Market Landscape

The global allergic rhinitis market is experiencing sustained growth, driven by rising allergy incidence, environmental pollution, urbanization, and heightened awareness of treatment options. The market was valued at approximately USD 7.8 billion in 2022 and is projected to reach USD 10.2 billion by 2027, with a compound annual growth rate (CAGR) of roughly 6.2% (source: GlobalData). Notably, North America holds the largest market share due to high diagnosis rates and robust healthcare infrastructure.

Therapeutic Class and Product Placement

SM ALL DAY ALLERGY likely belongs to the second-generation antihistamine class, providing efficacy with a favorable safety and sedation profile. Its extended duration of action positions it as a convenient, once-daily option—an attractive feature in mature markets and among consumers seeking simplified regimens. Given these attributes, SM ALL DAY ALLERGY is positioned to compete with established brands such as Allegra (fexofenadine), Claritin (loratadine), and Zyrtec (cetirizine).

Current Market Position and Competitors

Key Competitors

- Fexofenadine (Allegra): Established, high consumer trust, large scale manufacturing.

- Loratadine (Claritin): Long-standing presence, broad availability.

- Cetirizine (Zyrtec): Known for rapid onset and efficacy.

SM ALL DAY ALLERGY, if it offers comparable or superior efficacy with fewer side effects, could capture significant market share, especially among patients seeking improved compliance and convenience.

Regulatory and Patent Considerations

Patent expirations of key competitors in the past five years have opened opportunities for generic formulations and biosimilars, intensifying price competition. If SM ALL DAY ALLERGY holds patent protection or unique formulation advantages, it could command premium pricing for essential years.

Pricing Dynamics and Regulatory Influence

Pricing Strategies in Market Maturity

In North America, brand-name allergy medications usually retail between USD 20 and USD 40 per month, depending on insurance coverage and pharmacy markups. Generics tend to be priced 20-50% lower. Price premiums for extended-release or novel formulations like SM ALL DAY ALLERGY help justify positioning as a premium product, especially if it demonstrates superior compliance or efficacy.

Reimbursement and Insurance Impact

Medicaid, Medicare, and private insurers heavily influence drug pricing and reimbursement policies. A positive formulary listing and favorable insurance negotiations enable broader patient access and allow premium pricing strategies. Conversely, rising cost sensitivity among payers necessitates balancing competitive pricing without compromising margins.

Regulatory Approvals and Market Access

Achieving regulatory approval in multiple jurisdictions (FDA, EMA, etc.) accelerates market penetration but also influences initial pricing. Cost-effective Phase III data demonstrating long-lasting efficacy enhances the product’s perceived value, supporting higher price points.

Pricing Projections: Short to Long Term

Year 1–2 Post-Launch

- Estimated Launch Price: USD 25–35 per month, reflecting a premium pricing approach given innovative formulation benefits.

- Market Penetration: Initial focus on high-income regions (US, Europe), supported by insurance coverage and physician promotion.

Year 3–5

- Price Adjustment: Potential gradual reduction to USD 20–30, driven by generic competitor entry and increased competition.

- Generic and Biosimilar Entry: Introduction of cheaper generic versions could pressure the brand to optimize pricing for sustained profitability.

Long-Term Outlook (5+ Years)

- Price Stabilization: Anticipate stabilization around USD 15–25 per month, depending on market saturation, patent protection duration, and formulary inclusion.

- Potential Discounting: Extensive insurance negotiations and volume-based discounts will likely shape final net prices.

Market Drivers and Risks Impacting Price Evolution

Drivers:

- Increasing allergy prevalence attributable to climate change and pollution.

- Growing patient preference for once-daily, long-acting therapies.

- Expanding regional markets, especially in Asia-Pacific and Latin America.

- Strategic partnerships, brand recognition, and formulary placements.

Risks:

- Rapid generic entry post-patent expiry.

- Regulatory delays or safety concerns.

- Competitive innovation, such as novel drug delivery systems or combination therapies.

- Cost containment policies by payers inhibiting premium pricing.

Emerging Trends and Their Effect

- Precision Medicine: Tailoring allergy treatments could influence targeted pricing strategies.

- Digital Health Integration: Apps and remote monitoring linked to medication adherence may enhance value propositions.

- Sustainable Formulations: Environmentally friendly and patient-centric formulations may command higher prices.

Conclusion and Key Takeaways

SM ALL DAY ALLERGY’s market potential hinges on its formulation advantages, regulatory success, and strategic positioning against entrenched competitors. While initial pricing may target a premium segment, competitive pressures and patent landscapes will influence long-term pricing trajectories.

Key Takeaways:

- The drug is positioned for premium pricing initially (~USD 25–35/month), capitalizing on convenience and efficacy.

- Market growth driven by rising allergy rates worldwide creates expanding opportunities, particularly in emerging markets.

- Patent protection, regulatory timing, and formulary access critically influence pricing and revenue streams.

- Price competition from generics and biosimilars is inevitable, necessitating innovative marketing and differentiation.

- Long-term price stabilization will likely occur in the USD 15–25 range, subject to regional market dynamics and competitive landscape shifts.

FAQs

1. When can SM ALL DAY ALLERGY expect market entry, and how will patent status affect its pricing?

Market entry depends on successful clinical development, regulatory approval, and patent protection duration. Patent shielding allows for premium pricing during exclusivity, typically 10–20 years, influencing initial revenue potential.

2. How does the competition impact SM ALL DAY ALLERGY’s pricing strategy?

Intense competition from established antihistamines and upcoming generics pressures the brand to justify a premium through efficacy, safety, or added benefits, leading to potential price discounts over time.

3. Which regions offer the best pricing opportunities for SM ALL DAY ALLERGY?

High-income regions such as North America and Western Europe provide higher premium pricing opportunities owing to robust insurance coverage, but emerging markets like Asia-Pacific also offer growth potential with adaptable pricing strategies.

4. How will future regulatory changes influence pricing?

Regulatory policies aiming for affordability or promoting biosimilar entry can lead to price reductions, while faster approvals and expanded indications can enhance revenue opportunities.

5. What strategies can maximize profit margins amid competitive pressures?

Differentiation through improved formulation, patient adherence programs, strategic alliances, and targeted regional pricing can help sustain margins despite market competition.

Sources

- GlobalData, 2022.

- MarketWatch, 2023.

- [FDA and EMA regulatory guidelines, 2022.](https://www.fda.gov/ and https://www.ema.europa.eu/)

- IQVIA, 2023.

- Pfizer, Allergic Rhinitis Market Analysis, 2022.

This comprehensive analysis offers strategic insights for stakeholders considering investment, marketing, or competitive entry into the SM ALL DAY ALLERGY market, aligning with current trends and projected economic factors.

More… ↓