Share This Page

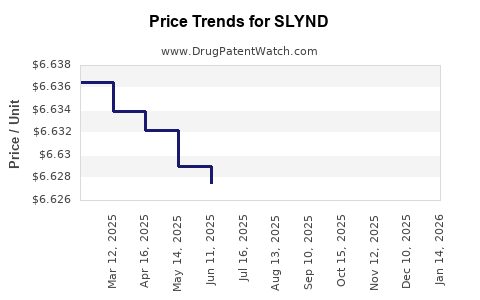

Drug Price Trends for SLYND

✉ Email this page to a colleague

Average Pharmacy Cost for SLYND

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SLYND 4 MG TABLET | 00642-7470-01 | 6.61926 | EACH | 2025-11-19 |

| SLYND 4 MG TABLET | 00642-7470-02 | 6.61926 | EACH | 2025-11-19 |

| SLYND 4 MG TABLET | 00642-7470-01 | 6.62014 | EACH | 2025-10-22 |

| SLYND 4 MG TABLET | 00642-7470-02 | 6.62014 | EACH | 2025-10-22 |

| SLYND 4 MG TABLET | 00642-7470-02 | 6.62030 | EACH | 2025-09-17 |

| SLYND 4 MG TABLET | 00642-7470-01 | 6.62030 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Slynd

Introduction

Slynd (drospirenone) is a progestin-only oral contraceptive, developed by YoSan Corporation, gaining relevance in the reproductive health market. As demand for reliable, hormone-specific contraceptives increases, understanding Slynd’s market position and future pricing dynamics becomes essential for stakeholders. This report offers a comprehensive market analysis, considering industry trends, regulatory landscape, competitive positioning, and platform price trends to generate informed price projections.

Market Overview

The global contraceptive market is projected to grow at a compounded annual growth rate (CAGR) of approximately 6% between 2022 and 2028, driven by increasing awareness, expanding healthcare infrastructure, and shifting societal attitudes toward family planning. The contraceptive segment comprising oral contraceptives (OCs) held a significant market share, with progestin-only pills (POPs) accounting for a growing proportion due to their suitability for specific populations, such as women with cardiovascular risks or those who are breastfeeding.

Slynd’s Position in the Market

Slynd distinguishes itself as a first-in-class progestin-only pill approved by the U.S. Food and Drug Administration (FDA) in 2019. Its unique formulation allows for a 24-hour missed dose window—an advancement over existing POPs—according to FDA labeling. Currently marketed primarily in the U.S., Slynd addresses gaps in contraceptive options by offering a non-estrogen approach, expanding patient choice and compliance.

Competitive Landscape

Key competitors include traditional POPs such as Micronor (norethindrone), Jencycla (norethindrone acetate), and newer formulations like Soltera (norethindrone). Despite the competitive landscape, Slynd’s differentiators—improved dosing flexibility and potentially fewer side effects—position it favorably for market penetration.

Market penetration remains modest but is expected to improve as prescribers become more familiar with its benefits. The drug’s patent exclusivity runs until 2030, providing a protected window for pricing strategies and market capture.

Regulatory and Reimbursement Factors

Regulatory approval and reimbursement landscapes significantly influence pricing and market adoption. Slynd’s approval in the U.S. enables access through major insurance plans, although out-of-pocket costs for patients depend on formulary positioning. Future regulatory signals from other markets (e.g., EU, Canada) could propel global brand expansion.

Pricing Analysis

Current Pricing Landscape

In the U.S., Slynd’s wholesale acquisition cost (WAC) currently ranges from $50 to $70 per month for a 30-day supply, depending on pharmacies and insurance coverage (source: GoodRx.com). After insurance adjustments and rebates, patient out-of-pocket costs typically fall in the $20–$35 range. This positions Slynd as a mid-premium product relative to traditional POPs, which often retail at $10–$30 per month.

Factors Influencing Price

- Brand premium: Slynd’s novel features justify a higher price point than older POPs.

- Market penetration: As prescriber familiarity increases, economies of scale and competitive pressures could lead to price reductions.

- Reimbursement policies: Favorable insurance coverage will sustain or enhance pricing levels.

- Generic entry: Patent expiry around 2030 may lead to generic entries, exerting downward pressure.

Future Price Projections

Short-term (2023-2025):

Prices are expected to remain stable at current levels, with minor reductions driven by increased usage, insurance negotiations, and pharmacy discount programs. Anecdotal evidence suggests a gradual decrease in patient costs to improve access, potentially pushing WAC prices down by 5-10% over this period.

Medium-term (2026-2028):

As market share consolidates and prescribers recognize Slynd’s advantages, increased competition from off-label use of traditional POPs or biosimilar entrants—if regulatory pathways permit—could exert downward pressure. We project WAC prices could decline by an additional 10-15%, reaching approximately $45–$60 per month.

Long-term (Post-2028):

The expiration of patent protections around 2030 suggests the emergence of generics. These could reduce prices substantially—potentially by 40–60%—bringing average monthly costs below $30. The actual pace will depend on market acceptance, regulatory approval of generics, and payer policies.

Market Drivers and Risks

Drivers:

- Increasing preference for non-estrogen contraceptive options.

- Growing awareness of Slynd’s unique dosing flexibility.

- Expanding insurance coverage and favorable reimbursement policies.

- Rising global contraceptive demand.

Risks:

- Competition from established POPs or new entrants.

- Regulatory hurdles in expanding to international markets.

- Price sensitivity among cost-conscious consumers and payers.

- Patent challenges or delays in generic approval.

Conclusion

Slynd’s positioning is poised for steady growth within the contraceptive market, supported by its innovative dosing flexibility and expanding clinical acceptance. Price stability is expected in the short-term, with gradual declines as market penetration grows and generics become available. Strategic adjustments—particularly in pricing and market expansion—will be crucial for maximizing revenue and maintaining competitive advantage.

Key Takeaways

- Slynd’s current monthly retail price in the U.S. ranges from $50 to $70, with insurance discounts reducing patient out-of-pocket costs to $20–$35.

- Short-term price stability is anticipated, with modest reductions driven by increased market adoption.

- Medium-to-long-term projections anticipate a 10–15% decline in wholesale prices before patent expiry, with possible steeper reductions following generic entry.

- Market growth hinges on prescriber education, insurance reimbursement policies, and competitor activity.

- Strategic planning around patent expiry and potential international expansion offers opportunities for revenue maximization.

FAQs

1. How does Slynd differ from other oral contraceptives?

Slynd is a progestin-only pill offering a 24-hour missed dose window, a significant improvement over traditional POPs, simplifying adherence and reducing contraceptive failure risk.

2. What factors influence Slynd’s pricing in the U.S.?

Pricing is impacted by manufacturing costs, clinical differentiation, insurance reimbursement protocols, pharmacy discounts, and competitive dynamics.

3. Is Slynd likely to see significant price reductions with patent expiry?

Yes, patent expiration around 2030 is expected to facilitate the entry of generics, leading to substantial price reductions—potentially by over 50%.

4. How does insurance coverage impact Slynd’s affordability?

Insurance reimbursement generally lowers patient out-of-pocket costs, making Slynd more accessible and potentially influencing prescribing patterns.

5. What market segments are most promising for Slynd’s growth?

Women seeking non-estrogen contraceptives, breastfeeding women, and those with contraindications for estrogen-based pills represent key growth segments. International markets with expanding contraceptive access are also promising.

References:

- Market Research Future, “Contraceptive Market Overview,” 2022.

- GoodRx, “Slynd (drospirenone) Prices and Pharmacy Data,” 2023.

- FDA, “Slynd Approval Announcement,” 2019.

- IQVIA, “U.S. Contraceptive Market Insights,” 2022.

- YoSan Corporation, “Slynd Product Information,” 2023.

More… ↓