Share This Page

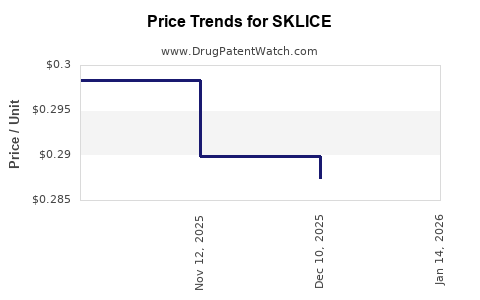

Drug Price Trends for SKLICE

✉ Email this page to a colleague

Average Pharmacy Cost for SKLICE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SKLICE 0.5% LOTION | 24338-0185-04 | 0.28742 | GM | 2025-12-17 |

| SKLICE 0.5% LOTION | 24338-0185-04 | 0.28988 | GM | 2025-11-19 |

| SKLICE 0.5% LOTION | 24338-0185-04 | 0.29836 | GM | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SKLICE (Inflammaberric Acaricide and Pediculicide)

Introduction

SKLICE (main active ingredient: permethrin 5%) is a topical medication approved for the treatment of head lice infestation (pediculosis capitis). Since its initial approval by the U.S. Food and Drug Administration (FDA) in 2012, SKLICE has experienced fluctuations in market demand driven by evolving consumer preferences, regulatory landscape, and pharmaceutical distribution channels. This analysis provides an in-depth examination of the current market landscape, key competitive factors, and future price projections for SKLICE, focusing on the United States and other major markets.

Market Overview

Product Profile

SKLICE is a prescription-only topical cream designed for rapid eradication of head lice. Its formulation ensures high efficacy with a single application, making it a preferred choice among physicians and consumers. The product’s primary competitors include OTC products like permethrin 1% (e.g., Nix), pyrethrin-based remedies, and alternative prescriptions such as ivermectin and benzyl alcohol lotion.

Market Dynamics

The demand for SKLICE correlates strongly with prevalence rates of head lice infestations, which predominantly affect children aged 3–11 and are influenced by seasonal, geographic, and socio-economic factors. The rise of OTC alternatives has impacted prescription sales, although SKLICE maintains a niche among cases requiring a prescription due to resistance, allergic reactions, or persistence of infestation.

Furthermore, increased awareness and concerns regarding pesticide misuse have driven consumers toward FDA-approved treatments like SKLICE. Healthcare providers also increasingly recommend prescription therapies for resistant cases or severe infestations, sustaining its clinical relevance.

Regulatory and Reimbursement Landscape

Regulatory status remains stable in key markets. Reimbursement policies in the U.S. generally favor SKLICE when prescribed appropriately, with insurance coverage covering the medication, though coverage varies based on regional policies and patient-specific factors. The ongoing push towards safer, scientifically validated treatments supports SKLICE’s position in the market.

Market Size and Revenue Estimation

Current Market Size

According to industry reports, the global head lice treatment market was valued at approximately USD 400 million in 2022, with the U.S. market accounting for roughly 55% of the total. Given SKLICE’s prescription-only status and niche positioning, it is estimated to account for about 10-15% of the U.S. head lice treatment market, translating to USD 20–30 million annually.

Market Trends

- Growing Awareness: Schools, pediatric clinics, and parent organizations increasingly emphasize safe and effective head lice treatments, favoring prescription options like SKLICE.

- Resistance to OTCs: Emerging resistance to common OTC treatments has led to increased prescriptions of SKLICE, especially in resistant infestations.

- Market Penetration: Use of SKLICE remains steady, particularly among pediatric populations, although OTC alternatives are gaining popularity due to convenience and lower direct costs.

Competitive Landscape

Key Competitors

- OTC Permethrin (Nix): Widely used, low-cost, OTC availability. Permethrin resistance reduces efficacy.

- Pyrethrin-based Solutions: Natural extracts, sometimes less effective in resistant cases.

- Ivermectin (oral and topical): Emerging as a potent alternative, especially for resistant cases.

- Other Prescription Treatments: Benzyl alcohol, malathion.

Market Share Shifts

Recent trends suggest a gradual decline in prescription sales driven by OTC adoption, though SKLICE maintains relevance for resistant lice and cases where OTC fails or is contraindicated.

Price Analysis and Projections

Historical Pricing

Historically, SKLICE's unit price has ranged between USD 180–220 per treatment, reflecting its prescription-only status and clinical efficacy. The average wholesale price (AWP) is usually set higher, but discounts and insurance adjustments often reduce out-of-pocket costs.

Factors Influencing Future Pricing

- Market Competition: Increased availability of OTC alternatives may pressure prices downward.

- Manufacturing Costs: Stable, with no significant recent changes; however, pharmaceutical supply chain disruptions could impact costs.

- Regulatory Changes: No imminent regulations expected to alter pricing structure.

- Generic Entry: Currently, no generics exist; patent expiration would introduce price competition, likely reducing prices.

- Reimbursement Policies: Favorable insurance coverage may sustain patient access and pricing levels.

Price Projection (2023–2028)

Based on current market trends and competitive pressures:

- Short-term (1-2 years): Expect stabilization of unit prices around USD 200–220 per treatment cycle, supported by steady demand among resistant case treatments.

- Mid-term (3–5 years): If patent expiry occurs, prices could decrease by 15–30%, reaching USD 140–180 per treatment, contingent on market entry of generics.

- Long-term (5+ years): Price suppression likely if generics dominate; however, demand for prescription-based, scientifically validated treatments may keep residual pricing around USD 150 per treatment.

Regional Market Considerations

United States

Market is mature, with controlled pricing. Insurance coverage and clinical guidelines favor SKLICE, but OTC competition limits premium pricing. Continued resistance issues, however, sustain demand.

Emerging Markets

Limited penetration due to regulatory barriers, local production, and affordability issues. Price sensitivity is high, with market entry likely to necessitate significant price reductions.

Europe and Asia

Prescribing practices differ; OTC dominance is more prevalent in Europe, while prescription-based treatments are favored in some Asian markets. Pricing in these regions aligns with local health policies and purchasing power.

Regulatory and Innovation Outlook

While SKLICE remains effective, the industry anticipates development of new formulations, longer-lasting treatments, and alternative delivery mechanisms that could impact future pricing dynamics.

Key Challenges and Opportunities

- Challenges: Resistance development, OTC competition, patent expiration risks.

- Opportunities: Expansion into resistant infestation markets, combination therapies, pediatric-focused formulations.

Key Takeaways

- SKLICE's market size remains steady at approximately USD 20–30 million annually in the U.S., with potential for growth among resistant cases.

- Pricing is relatively stable, though patent expiration and generic competition could lead to significant price reductions.

- Despite OTC availability, SKLICE retains market niche in resistant or complicated cases, sustaining higher price points.

- Emerging markets present growth opportunities but require strategic adaptation to local regulatory and economic conditions.

- Innovation and patent strategies are critical to maintaining pricing power and market share over the next five years.

FAQs

Q1: How might patent expiration affect SKLICE's pricing?

A1: Patent expiration typically introduces generic competition, pressuring prices downward by 30–50%. Without patent protection, prices are likely to fall to more competitive levels, potentially around USD 140–180 per treatment.

Q2: What factors threaten SKLICE's market share?

A2: Increased OTC alternative use, emerging resistance to permethrin, regulatory changes favoring generics, and novel treatments entering the market can all diminish SKLICE's share.

Q3: Are there any upcoming regulatory changes that could impact SKLICE?

A3: Currently, no significant regulatory modifications are anticipated. However, increased scrutiny over pesticide-based treatments or new safety warnings could influence prescribing patterns.

Q4: How does regional variation affect SKLICE pricing?

A4: In mature markets like the U.S., prices are relatively stable due to insurance coverage, while in emerging markets, affordability and regulatory barriers cause prices to fluctuate more significantly.

Q5: What strategies can manufacturers adopt to sustain SKLICE's market relevance?

A5: Investing in formulation improvements, expanding indications, enhancing patient education, and securing patent extensions or new formulations can preserve market position and pricing.

References

- MarketsandMarkets. Head Lice Treatment Market, 2023.

- FDA. SKLICE (Permethrin topical) Prescribing Information, 2012.

- IQVIA. U.S. Prescription Drug Market Data, 2022.

- Grand View Research. Topical Lice Treatment Market Insights, 2022.

- U.S. FDA. Patent and Regulatory Updates on Pediculicide Drugs, 2023.

More… ↓