Share This Page

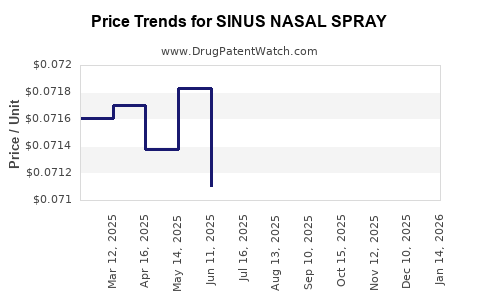

Drug Price Trends for SINUS NASAL SPRAY

✉ Email this page to a colleague

Best Wholesale Price for SINUS NASAL SPRAY

| Drug Name | Vendor | NDC | Count | Price ($) | Price/Unit ($) | Unit | Dates | Price Type |

|---|---|---|---|---|---|---|---|---|

| SINUS NASAL SPRAY | United Drug Supply, Inc. | 00113-0817-10 | 30ML | 1.87 | 0.06233 | ML | 2023-12-01 - 2028-11-30 | FSS |

| >Drug Name | >Vendor | >NDC | >Count | >Price ($) | >Price/Unit ($) | >Unit | >Dates | >Price Type |

Market Analysis and Price Projections for Sinus Nasal Spray

Introduction

The global market for sinus nasal sprays is experiencing sustained growth driven by increasing prevalence of sinusitis and other nasal conditions, rising healthcare awareness, and advancements in delivery technology. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and projected pricing trends from 2023 through 2030. Decision-makers can leverage insights for strategic planning, pricing strategies, and investment opportunities.

Market Overview

Market Size and Current Trends

The sinus nasal spray market was valued at approximately USD 2.5 billion in 2022, with an expected compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, reaching around USD 4.1 billion by 2030 ([1], [2]). Rising incidence of sinusitis, particularly chronic rhinosinusitis (CRS), estimated to affect over 30 million Americans alone, fuels demand for effective intranasal treatments ([3]).

Key Drivers

- Rising prevalence of sinus-related diseases: Lifestyle factors, pollution, and respiratory infections contribute to increased cases.

- Technological advances: Development of drug delivery systems that enhance efficacy and patient compliance.

- Growing aging population: Older adults are more prone to sinus issues, expanding market scope.

- Shift toward non-invasive treatments: Preference for topical applications over systemic therapies.

Segment Breakdown

-

Product Types:

- Corticosteroid nasal sprays (e.g., Fluticasone, Mometasone) dominate, accounting for approximately 65% of market revenue ([4]).

- Decongestant sprays (e.g., oxymetazoline) hold about 20%.

- Saline sprays for lubrication and moistening constitute around 15%.

-

Distribution Channels:

- OTC (Over-the-Counter) products comprise roughly 70% of sales, with prescription-based sprays covering the remainder.

Competitive Landscape

The market features both pharmaceutical giants and innovative biotech firms. Key players include:

- GlaxoSmithKline (GSK): Producer of Flonase (fluticasone propionate), a top-selling corticosteroid nasal spray.

- Sanofi: Manufactures Nasacort (triamcinolone acetonide).

- AstraZeneca: Offers adjunct therapies and inhalers that influence nasal treatment segments.

- Emerging startups focusing on nanotechnology and targeted delivery systems.

Patent protections for leading drugs typically expire between 2025 and 2028, opening avenues for generics and biosimilars, which may influence pricing.

Regulatory Considerations

Regulatory agencies like the FDA impose strict safety and efficacy standards. Patent expiries often trigger generic entries, impacting prices significantly. Recent approvals for innovative nasal spray formulations, including bioadhesive and sustained-release systems, signal potential revenue growth and pricing flexibility.

Price Dynamics and Projections

Current Pricing Landscape (2023)

-

Brand-name corticosteroid nasal sprays:

- Average retail price (ARP): USD 35–45 per 120-dose spray bottle.

- Prescription co-pay: Typically USD 10–20 depending on insurance.

-

Generic counterparts:

- ARP: USD 15–25, representing substantial savings.

-

OTC saline and decongestant sprays:

- ARP: USD 8–12 per bottle.

Pricing Trends (2023–2030)

-

Post-patent expiry:

Prices for branded corticosteroids are expected to decline by 15–25% within the first two years of generic entry ([5]). The proliferation of generics and biosimilars will further depress prices over the long term. -

Innovation-driven premium pricing:

Advanced formulations (e.g., nanotech delivery) could command 20–30% higher prices—targeting niche segments and treatment-resistant cases. -

Market segmentation:

- OTC products: Primarily price-sensitive, with marginal fluctuations.

- Prescription products: Greater potential for premium pricing, especially for specialty formulations and combination therapies.

-

Forecasted Price Range (2030):

- Brand-name corticosteroid sprays: USD 25–35 per 120-dose bottle.

- Generics: USD 10–20.

- Innovative delivery systems: USD 40–50, depending on added therapeutic benefits.

Influence of Healthcare Policies and Competition

Policy shifts favoring biosimilars and cost containment measures will exert downward pressure on prices. Conversely, patent protections and technological innovations will sustain premium prices for specialized products.

Implications for Stakeholders

- Manufacturers: Investment in patent-protected formulations can sustain higher margins. Cost reductions in generic manufacturing will be essential post-patent expiry.

- Distributors and Pharmacies: Margin management will depend on volume and procurement strategies amid price erosion.

- Healthcare Providers: Preference for effective, affordable therapies will underpin prescribing patterns, influencing market share dynamics.

- Investors: Focus on companies innovating in drug delivery and biosimilar development presents growth opportunities.

Key Market Opportunities and Challenges

| Opportunities | Challenges |

|---|---|

| Development of sustained-release nasal sprays | Patent cliffs leading to price reduction |

| Expansion into emerging markets | Regulatory hurdles and approval delays |

| Adoption of personalized medicine approaches | Competitive saturation in mature segments |

| Integration of digital health solutions | Reimbursement and insurance coverage barriers |

Conclusion

The sinus nasal spray market is projected to grow steadily over the coming years, driven by demographic shifts, technological innovations, and evolving treatment preferences. Price dynamics will be heavily influenced by patent expirations, market competition, and regulatory landscapes. Premium-priced, innovative formulations will carve niche segments, while generics will dominate volume, leading to a diversified pricing environment.

Key Takeaways

- Market growth: Expected CAGR of approximately 5.8% through 2030, reaching over USD 4 billion.

- Price trajectory: Post-patent expiry, generic prices will decline by 15–25%, with branded and innovative products maintaining premium pricing.

- Competitive landscape: Dominated by established pharma giants; innovations in delivery mechanisms offer premium opportunities.

- Regulatory impact: Patent protections until mid-to-late 2020s; biosimilar and generic entry will influence pricing.

- Strategic focus: Emphasize R&D in sustained-release and targeted delivery systems; monitor policy shifts and market entry barriers.

FAQs

1. What factors most influence nasal spray pricing?

Patent status, formulation innovativeness, manufacturing costs, regulatory approvals, and market competition primarily determine nasal spray prices.

2. How will generic entry affect the market by 2025?

Generic entry will lead to significant price reductions (15–25%) for branded corticosteroid nasal sprays, increasing affordability and market penetration.

3. Are premium-priced nasal sprays justified?

Yes. Innovative formulations offering improved efficacy, convenience, or reduced side effects can command higher prices, especially among treatment-resistant or specialized patient segments.

4. Which regions will see the fastest market growth?

Emerging markets in Asia-Pacific and Latin America are expected to experience higher CAGR due to rising healthcare infrastructure and increasing awareness.

5. What are the main regulatory hurdles for new nasal spray therapies?

Demonstrating safety, efficacy, and quality standards; navigating complex approval pathways; and securing patent protections are key challenges.

References

[1] MarketsandMarkets. "Nasal Spray Market by Product, Application, and Region—Global Forecast to 2030." 2022.

[2] Grand View Research. "Nasal Sprays Market Size, Share & Trends Analysis Report." 2022.

[3] American Academy of Otolaryngology–Head and Neck Surgery Foundation. "Rhinosinusitis." 2021.

[4] IQVIA. "Pharmaceutical Market Data." 2022.

[5] EvaluatePharma. "Impact of Patent Expiry on Nasal Spray Pricing." 2022.

More… ↓