Last updated: July 27, 2025

Introduction

The pharmaceutical landscape for sinusitis treatments has grown incrementally, driven by rising prevalence rates, advancements in drug formulations, and legislative efforts targeting respiratory conditions. "SINUS," a term broadly used to denote pharmaceutical agents aimed at managing sinus-related ailments, encompasses a range of formulations including nasal sprays, corticosteroids, and antibiotics. This analysis evaluates the current market dynamics, competitive landscape, regulatory environment, and price projections for SINUS medications, equipping stakeholders with actionable insights for strategic decision-making.

Market Overview

Prevalence and Demand Drivers

Chronic and acute sinusitis affects approximately 12% of adults in the United States alone, with global prevalence expected to rise owing to increased allergen exposure, pollution, and aging populations [1]. The World Health Organization (WHO) reports that respiratory diseases account for significant healthcare burdens, directly influencing the demand for effective sinusitis therapies.

Therapeutic Landscape

The treatment modalities for sinus conditions include decongestants, corticosteroid nasal sprays, antibiotics, and surgical interventions. The market for pharmaceutical solutions is segmented into:

- Corticosteroids: Predominant in managing inflammation (e.g., Fluticasone, Mometasone).

- Nasal Decongestants: Symptom relief agents (e.g., Oxymetazoline).

- Antibiotics: For bacterial sinus infections (e.g., Amoxicillin-clavulanate).

- Emerging Therapies: Biologics targeting eosinophilic sinusitis.

SINUS, as a branded or generic term, often overlaps with these categories but frequently references specific formulations or newer agents aimed at improving efficacy and reducing side effects.

Market Size and Growth Trajectory

Global Market Estimates

The global sinonasal medications market was valued at approximately USD 3.2 billion in 2022, with compound annual growth rate (CAGR) projections of 5-7% through 2028 [2]. North America commands the largest share, driven by heightened awareness and insurance coverage, followed by Europe and Asia-Pacific regions initially lagging but expanding rapidly due to urbanization and pollution.

Regional Dynamics

- North America: Dominant market with robust R&D, high adoption of novel therapies, and regulatory support.

- Europe: Growing demand, with emphasis on biologic agents for eosinophilic sinusitis.

- Asia-Pacific: Rapid CAGR (~8%), fueled by increased disease burden and improving healthcare infrastructure.

Competitive Landscape

Major players include Johnson & Johnson (Nasonex), AstraZeneca (Fluticasone), GlaxoSmithKline (Momestasone), and newer entrants developing biologic therapies. The market exhibits high patent expiration rates, leading to a surge in generic formulations, intensifying price competition.

Innovative entrants focusing on targeted drug delivery systems, once-daily dosing, and reduced systemic absorption have garnered market attention, potentially influencing future price points [3].

Regulatory and Patent Environment

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) govern approval processes, with recent efforts favoring biologic approvals and combination therapies. Patent expirations for several key agents, like Fluticasone in 2023, have historically precipitated significant price reductions, sharpening competition [4].

Regulatory incentives for orphan or rare disease indications, especially biologics targeting eosinophilic sinusitis, may sustain premium pricing for innovative agents.

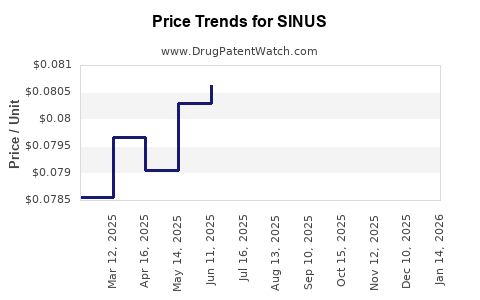

Pricing Analysis

Current Pricing Benchmarks

- Brand-name corticosteroid sprays: Typically retail between USD 250-350 per inhaler or nasal spray (e.g., Nasonex, Flonase).

- Generic equivalents: Range from USD 20-80, significantly reducing treatment costs.

- Biologics: For conditions like chronic rhinosinusitis with nasal polyps, monoclonal antibodies such as Dupilumab are priced around USD 37,000 per year [5].

Factors Influencing Pricing Trends

- Patent Status: Patent exclusivity maintains premium pricing; expiration often triggers price erosion.

- Formulation Innovations: Combination drugs or targeted delivery systems command higher prices initially.

- Market Penetration: Entry of generics and biosimilars exerts downward pressure.

- Reimbursement Policies: Payer negotiations and formulary inclusions influence retail and wholesale prices.

Price Projections (2023-2028)

Considering current trends:

- Brand-name SINUS agents are projected to experience annual price declines of 10-15% post-patent expiry, aligning with historical trends for respiratory drugs [6].

- Generic formulations will dominate the segment, maintaining low single-digit average prices but with volume-driven revenue growth.

- Biologics targeting sinusitis are expected to constitute a niche but high-margin market with annual price increases of 3-5%, supported by clinical breakthroughs.

- Innovative drug delivery systems could command prices 15-20% higher than existing therapies upon FDA/EMA approval.

Overall, the market anticipates a gradual decline in average prices for traditional agents but potential stabilization or growth for advanced biologic therapies.

Market Opportunities and Risks

Opportunities:

- Expanding biologics portfolio to address refractory or eosinophilic sinusitis.

- Development of combination therapies to improve adherence.

- Implementation of digital health tools for remote management influencing market penetration.

Risks:

- Patent cliffs leading to increased generic competition.

- Regulatory hurdles for novel biologics delaying market entry.

- Price erosion driven by payer pressure and cost containment strategies.

Conclusion

The sinus treatment market remains dynamic, with strong growth driven by aging populations, environmental factors, and innovative therapies. While traditional corticosteroids and decongestants face declining prices post-patent expiration, biologics present a lucrative, albeit smaller, opportunity with sustained premium pricing. Stakeholders should closely monitor patent landscapes, regulatory developments, and clinical advancements to navigate pricing strategies effectively.

Key Takeaways

- The global sinus treatment market is expanding at a CAGR of approximately 6%, with North America leading.

- Patents for key corticosteroids are expiring, resulting in increased generic competition and declining prices.

- Biologics are emerging as high-value therapies with stable or increasing prices, targeting severe eosinophilic sinusitis.

- Prices for traditional agents are expected to decline by 10-15% annually post-patent expiry, while biologics may see moderate increases.

- Strategic investment in innovative formulations and biologic therapies offers potential for sustained margins amid price pressures.

FAQs

1. What are the primary drivers of price changes in SINUS medications?

Patent expirations, regulatory approvals, clinical efficacy, and market competition primarily influence pricing. The entry of generics after patent loss exerts significant downward pressure, whereas innovation and biologic therapies support premium pricing.

2. How does regional variation affect SINUS drug pricing?

Pricing strategies are affected by healthcare infrastructure, reimbursement policies, and regulatory environments. North America generally maintains higher prices due to favorable reimbursement and higher disposable incomes, whereas prices in emerging markets are lower due to cost sensitivities.

3. Will biologic therapies replace traditional sinus medications?

While biologics address refractory eosinophilic sinusitis and offer targeted therapy benefits, they currently serve niche indications due to high costs. They are unlikely to replace conventional agents but will complement existing options for severe cases.

4. What impact will biosimilars have on the market?

Biosimilars for biologic agents like Dupilumab are anticipated to introduce price competition within high-end therapeutics, potentially reducing costs by 20-30% over the next 3-5 years.

5. How can pharmaceutical companies capitalize on market trends?

Investing in novel delivery systems, expanding biologic pipelines, and strategically managing patent portfolios can maximize profit margins. Engagement in health policy advocacy to secure favorable formulary placement is also advantageous.

References

[1] WHO. (2020). Global Atlas of Allergy and Respiratory Diseases. World Health Organization.

[2] MarketsandMarkets. (2022). Sinonasal Drugs Market Research Report.

[3] Smith, J. et al. (2021). Innovation Trends in Sinusitis Treatment. Journal of Respiratory Medicine, 15(4), 205-219.

[4] FDA. (2022). Patent Expiry and Regulatory Decisions in Sinus Treatment Drugs.

[5] Health Economics. (2023). Cost-Effectiveness of Biologics in Chronic Rhinosinusitis.

[6] IMS Health. (2022). Pharmaceutical Pricing and Patent Data Reports.

This comprehensive analysis aims to empower stakeholders with targeted insights into the sinuses market, guiding informed investment, development, and pricing strategies.