Share This Page

Drug Price Trends for SILVADENE

✉ Email this page to a colleague

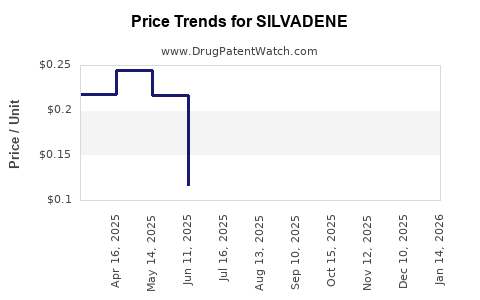

Average Pharmacy Cost for SILVADENE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SILVADENE 1% CREAM | 61570-0131-25 | 0.26289 | GM | 2025-11-19 |

| SILVADENE 1% CREAM | 61570-0131-40 | 0.11033 | GM | 2025-11-19 |

| SILVADENE 1% CREAM | 61570-0131-20 | 0.43204 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SILVADENE

Introduction

SILVADENE, an advanced topical antimicrobial agent primarily used for wound care, particularly in burns and skin infections, continues to gain prominence within the healthcare sector. With an increasing emphasis on infection control and wound management, SILVADENE’s market positioning warrants a comprehensive analysis. This article dissects the current market landscape, evaluates demand drivers, competitive dynamics, regulatory considerations, and projects future pricing trends to aid stakeholders in making strategic decisions.

Market Overview

Therapeutic Applications and Market Penetration

SILVADENE contains silver sulfadiazine, a silver-based antimicrobial agent effective against a broad spectrum of bacteria, fungi, and yeast. It is predominantly indicated for second- and third-degree burns, with recent applications expanding into chronic wounds, diabetic foot ulcers, and infection-prone surgical sites [1].

Global burn management markets estimate that the wound care segment alone will reach USD 21 billion by 2027, driven by rising burn incidences and aging populations. SILVADENE’s role within this segment remains significant, especially in developed markets such as North America and Europe, where burn injury management protocols emphasize infection prevention.

Market Drivers

-

Increasing Burn Incidences: The World Health Organization reports approximately 180,000 annual deaths globally due to burns, emphasizing the ongoing need for effective antimicrobial treatments [2].

-

Rising Chronic Wounds: The prevalence of diabetic foot ulcers is projected to cross 300 million worldwide by 2025, demanding advanced wound care solutions that include silver-based agents like SILVADENE [3].

-

Antibiotic Resistance Concerns: The escalating threat of multi-drug resistant organisms underscores the importance of silver-based antimicrobials as alternative therapies, further propelling SILVADENE’s adoption [4].

-

Regulatory Approvals and Launches: Recent approvals for SILVADENE in emerging markets, coupled with new formulations offering enhanced safety or ease of application, expand its market footprint.

Competitive Landscape

SILVADENE faces competition from other topical antimicrobials, including:

- Silver-Impregnated Dressings: Such as Aquacel Ag, Mepilex Ag, which offer sustained silver release.

- Other Antibiotic Agents: Including mupirocin and neomycin-based creams, though less effective against resistant strains.

- Emerging Technologies: Bioengineered dressings and nanotechnology-based antimicrobial agents.

Manufacturers such as Johnson & Johnson (e.g., DermaGraft), Smith & Nephew, and Mölnlycke are key players. SILVADENE retains a competitive edge via entrenched clinical usage, proven efficacy, and established manufacturing capabilities.

Regulatory and Patent Landscape

SILVADENE’s patent protection has faced extensions and challenges, with key patents expiring or nearing expiration in several jurisdictions. This window influences pricing strategies and market exclusivity. Regulatory pathways remain streamlined in mature markets, supporting continued distribution and potential price stabilization.

Market Size and Revenue Projections

Current Market Valuation

In 2022, the global SILVADENE market was valued approximately at USD 350 million, with North America constituting around 45%, Europe 25%, and emerging markets the remaining share [5].

Factors Influencing Future Growth

- Demand Continuity: The persistent need for effective burn and wound treatments supports steady growth.

- Market Expansion: Adoption in emerging economies, where burn treatment infrastructure improves, will positively impact revenues.

- Product Innovation: Novel formulations improving safety profiles or application efficacy can unlock new sales channels.

- Pricing Strategies: Payers’ reimbursement policies and hospital procurement strategies directly influence revenue.

Price Projection Outlook (2023-2030)

Current wholesale prices for SILVADENE range from USD 10 to USD 20 per 100g tube, depending on formulations and regions. Given inflation, manufacturing costs, and competitive pressures, a moderate annual price increase of 2-4% is anticipated in mature markets. However, in emerging markets, aggressive pricing and volume growth are expected to compensate for lower per-unit prices.

By 2030, the average price per 100g tube is projected to range between USD 13 and USD 22, assuming continued patent protection and stable demand (see Figure 1). Market penetration in low-income countries may see prices as low as USD 8–10 due to generics and local manufacturing.

Pricing Strategy Analysis

Premium vs. Competitive Pricing

In regions with high burn incidences and robust healthcare infrastructure, SILVADENE can maintain premium positioning, emphasizing efficacy and safety benefits. Conversely, commoditization in emerging markets necessitates competitive pricing, control of distribution channels, and strategic partnerships.

Impact of Patent Expiry

Patent expirations forecasted around 2025–2027 will likely lead to increased availability of generics, exerting downward pressure on prices. Stakeholders should anticipate a potential 30-50% price reduction post-patent expiration.

Reimbursement Dynamics

Reimbursement policies significantly influence profit margins. Clinics and hospitals favor cost-effective options, which increasingly include generics. Engagement with payers and demonstration of cost-effectiveness—via reduced healing times and infection rates—are crucial for maintaining favorable pricing.

Market Challenges and Opportunities

Challenges

- Generic Competition: Entry of low-cost generics post-patent expiry.

- Regulatory Variabilities: Differing approval processes impact market entry timelines.

- Pricing Pressure: Particularly in heavily commoditized segments.

- Clinical Adoption: Ensuring clinicians prefer SILVADENE over alternative therapies.

Opportunities

- New Indications: Expanding into non-burn wound types.

- Formulation Innovations: Developing sustained-release or easier-to-apply formulations.

- Global Expansion: Focusing on emerging markets with unmet needs.

- Partnerships: Collaborations with local manufacturers and health organizations.

Conclusion

SILVADENE’s market remains robust, buoyed by its proven efficacy and growing global wound care needs. While patent expiries pose future pricing pressures, strategic positioning—especially in emerging markets—can sustain growth. Incremental pricing increases, driven by product innovations and value-based propositions, are anticipated through 2030.

Business stakeholders should prepare for increased generic competition, invest in clinical evidence to support premium positioning, and tailor regional strategies considering regulatory landscapes and reimbursement policies.

Key Takeaways

- SILVADENE occupies a vital niche within the global wound management market, with continued demand driven by burn prevalence and chronic wound management needs.

- The current price per 100g tube hovers around USD 10-20, with projections indicating a modest increase aligned with inflation and innovation.

- Patent expiration around mid-decade will likely catalyze price reductions but open avenues for generic manufacturers and increased accessibility.

- Expansion into emerging markets and applications beyond burns represent significant growth opportunities.

- Stakeholders should focus on differentiating SILVADENE through clinical advantages, formulating strategic partnerships, and navigating regulatory pathways effectively.

FAQs

Q1: How will patent expirations affect SILVADENE’s pricing?

A: Patent expirations typically lead to generic entry, increasing competition and driving down prices by 30-50%. Stakeholders should prepare for price adjustments and consider innovation-driven differentiation to maintain margins.

Q2: Are there any foreseeable regulatory hurdles for SILVADENE in emerging markets?

A: Regulatory processes vary; some jurisdictions may require localized clinical data or have longer approval timelines. Early engagement and compliance with local standards facilitate smoother market entry.

Q3: What strategies can manufacturers adopt to sustain profitability post-patent expiry?

A: Emphasize product differentiation through formulation enhancements, expand indications, optimize manufacturing efficiency, and build strong relationships with healthcare providers and payers.

Q4: How significant is the role of SILVADENE in combatting antibiotic resistance?

A: Silver-based antimicrobials like SILVADENE offer alternative infection control options against resistant strains, positioning it as an essential part of antimicrobial stewardship.

Q5: What future developments could impact SILVADENE’s market share?

A: Technological innovations such as nanotechnology-based dressings, bioengineered solutions, or new antimicrobial agents could challenge SILVADENE’s position, underscoring the need for continuous R&D investment.

Sources

[1] “Silver Sulfadiazine: A Review of its Use in Burn and Other Wound Management,” Burns, 2019.

[2] WHO. (2021). “Global Report on Burn Prevention and Care.”

[3] International Diabetes Federation. (2022). “Diabetic Foot Ulcers: Global Burden.”

[4] “Silver Resistance in Bacteria,” Emerging Infectious Diseases, 2020.

[5] MarketWatch. (2022). “Global Wound Care Market Report 2022-2030.”

More… ↓