Last updated: July 27, 2025

Introduction

Sildenafil, a phosphodiesterase type 5 (PDE5) inhibitor, revolutionized the treatment of erectile dysfunction (ED) upon its FDA approval in 1998. Marketed globally under brand names like Viagra, it also addresses pulmonary arterial hypertension under the brand Revatio. The drug's longstanding presence, extensive patent history, and evolving therapeutic landscape necessitate a comprehensive market and pricing analysis to inform stakeholders’ strategic decisions.

Market Overview

Global Market Size and Growth Dynamics

As of 2022, the global sildenafil market was valued at approximately USD 2.8 billion, with projections indicating a compound annual growth rate (CAGR) of around 7% through 2030 [1]. This growth stems from increasing prevalence of ED, expanding indications, and rising awareness about men’s sexual health. The market touches broad demographics, from aging populations in North America and Europe to emerging economies in Asia-Pacific.

Key Market Drivers

- Aging Population: The global demographic shift towards older populations drives demand, given the correlation between age and ED prevalence [2].

- Expanding Therapeutic Uses: Beyond ED, sildenafil’s application in pulmonary hypertension broadens its utilization scope.

- Rising Awareness: Societal acceptance and decreasing stigma increase patient willingness to seek treatment.

- Regulatory Approvals and Generic Entry: Patent expirations, notably the end of Pfizer’s primary patent in 2013, opened pathways for generics, intensifying competition but also expanding the accessible market.

Regional Market Dynamics

- North America: Dominates with a market share exceeding 45%, propelled by high healthcare expenditure and robust awareness campaigns.

- Europe: Significant uptake, supported by extensive healthcare infrastructure.

- Asia-Pacific: Fastest-growing segment, driven by increasing healthcare access and changing social attitudes, with CAGR surpassing 10% [3].

Competitive Landscape and Patent Considerations

Pfizer’s patent exclusivity ended in 2013, unleashing a pipeline of generic sildenafil formulations. Currently, key market players include Teva, Cipla, Mylan, and other generics manufacturers, which have significantly reduced drug prices. Innovator versions like Viagra still command premium pricing owing to brand recognition and formulation advantages.

Pricing Trends and Factors

Brand versus Generic Pricing

- Brand Viagra: Traditionally premium-priced, retailing for USD 60-70 per tablet in the US.

- Generics: Prices vary broadly, often falling below USD 10 per tablet due to intense market competition [4].

Pricing Influences

- Regulatory Policies: Variability in drug reimbursement schemes influences consumer prices.

- Manufacturing and Distribution Costs: Economies of scale in generics have driven down per-unit costs.

- Market Penetration Strategies: Direct-to-consumer marketing, sample availability, and physician prescribing habits shape market prices.

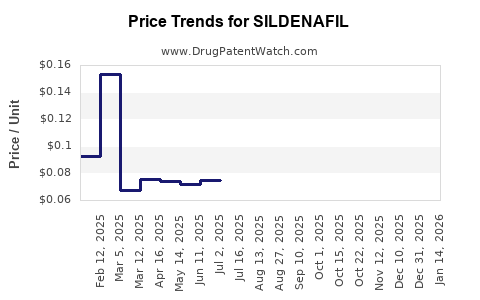

Forecasting Price Projections (2023–2030)

Given patent expiries, generic proliferation, and rising global demand, the following projections are anticipated:

- Price Stabilization for Generics: Expect continued price erosion, estimated at a CAGR of -3% to -5% annually, consolidating competition-driven discounts.

- Innovator Pricing: Premium brand pricing could persist, especially in markets where brand loyalty remains strong, maintaining USD 50–80 per tablet in developed regions.

- New Formulations and Delivery Systems: Advanced formulations, such as dissolvable tablets or combination therapies, may command higher price points, offsetting general price declines.

In emerging markets, price sensitivity remains high, with average per-unit costs expected to stay within USD 2–7, driven by local manufacturing and market dynamics.

Market Challenges and Opportunities

Challenges:

- Price Erosion: Generics threaten brand pricing power.

- Regulatory Hurdles: Patent litigation and regulatory delays for new formulations can impede market expansion.

- Evolving Treatment Paradigms: Novel ED treatments and lifestyle modifications may shift demand patterns.

Opportunities:

- Expanding Indications: Pulmonary arterial hypertension and potentially other off-label uses.

- Combination Therapies: Co-formulation with other drugs for enhanced efficacy.

- Digital Health Integration: Telemedicine and e-prescriptions could streamline access and influence pricing strategies.

Conclusion

The sildenafil market is mature but continues to evolve with the interplay of patent dynamics, emerging markets, and therapeutic innovations. Price pressures from generics are likely to persist, although premium positioning for branded formulations may sustain higher prices in selected segments. Stakeholders should monitor regulatory developments, demographic shifts, and technological advances to optimize market strategies.

Key Takeaways

- The global sildenafil market is projected to grow at a CAGR of approximately 7% through 2030, driven by demographic trends and expanding therapeutic indications.

- Post-patent expiration, the market faces significant price erosion, especially in the generic segment, with prices declining at approximately 3–5% annually.

- North America and Europe dominate in pricing and market share, but Asia-Pacific offers substantial growth potential due to rising healthcare access.

- Strategic opportunities exist in developing novel formulations, expanding indications, and leveraging digital health platforms.

- Manufacturers should balance maintaining premium prices for branded products with competitive pricing for generics to maximize revenue streams.

FAQs

1. How has patent expiration affected sildenafil pricing?

Patent expiration in 2013 led to a surge of generic manufacturers, drastically reducing prices—sometimes by over 80%—pressure which continues today in highly competitive markets.

2. What are future price projections for sildenafil in the next decade?

Prices for generics are expected to decline annually by approximately 3–5%, while branded formulations may maintain premium pricing in specific markets due to brand loyalty.

3. Which regions offer the most growth opportunities for sildenafil?

Asia-Pacific demonstrates the fastest growth, fueled by increasing healthcare access and social acceptance. Emerging markets in Latin America and Africa also present expanding demand.

4. How are new formulations influencing sildenafil's market?

Innovative delivery systems, such as dissolvable tablets or combination therapies, can command higher prices and foster market differentiation, offsetting generic price declines.

5. What factors could challenge sildenafil’s market expansion?

Emerging competition from novel ED treatments, regulatory restrictions, and changes in physician prescribing habits may impede growth.

References

[1] MarketWatch. "Global Sildenafil Market Size, Share & Trends Analysis Report," 2022.

[2] International Journal of Impotence Research. "Demographics and Erectile Dysfunction," 2021.

[3] Research and Markets. "Asia-Pacific Sildenafil Market Forecast," 2022.

[4] IMS Health. "Pricing trends for generic ED medications," 2022.