Last updated: July 27, 2025

Introduction

Sevelamer carbonate is a non-calcium, non-metal phosphate binder primarily used to manage hyperphosphatemia in patients with chronic kidney disease (CKD) undergoing dialysis. It is a critical component of CKD treatment, addressing mineral imbalances that significantly affect morbidity and mortality. The drug's market dynamics are influenced by factors including clinical guidelines, the prevalence of CKD, competitive landscape, regulatory changes, and pricing strategies. This report provides a comprehensive market analysis and price projection outlook for sevelamer carbonate over the coming years.

Market Overview

Global Market Size and Growth

The global market for phosphate binders, including sevelamer carbonate, is estimated to be valued at approximately USD 1.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 5-7% through 2027.[1] The growth is driven primarily by the rising prevalence of CKD, increased awareness, and broader adoption of non-calcium-based binders.

Prevalence and Demographics of CKD

CKD affects over 700 million people worldwide, with a substantial proportion progressing to end-stage renal disease (ESRD) requiring dialysis.[2] The rise in CKD incidence correlates with increasing rates of diabetes and hypertension, especially in emerging markets. These demographic trends directly impact demand for phosphate management therapies, including sevelamer carbonate.

Market Segmentation

The market divides broadly into:

- Brand vs. generic: While Sevelamer carbonate is branded (e.g., Renvela in the U.S.), generic versions are entering markets, intensifying price competition.

- Regional markets: North America remains dominant due to high dialysis prevalence and payer reimbursement, followed by Europe, Asia-Pacific, and Latin America.

Regulatory and Clinical Practice Trends

Guidelines from KDOQI and KDIGO endorse non-calcium-based phosphate binders, including sevelamer carbonate, especially in patients at risk of vascular calcification.[3] This endorsement sustains demand but also introduces pricing pressures, especially where healthcare systems focus on cost containment.

Competitive Landscape

Key Players

- F Hoffmann-La Roche (original developer, now with generic options)

- Rebus Biotechnology (developing novel phosphate binders)

- Global generics manufacturers (manufacturing cost-effective alternatives)

Market Share Dynamics

In mature markets like the U.S., branded sevelamer carbonate commands premium pricing, supported by robust reimbursement. However, in emerging markets, increased competition and regulatory approval of generics compress prices.

Innovative Therapies & Future Competition

Emerging therapies such as iron-based binders (e.g., SFO-APS200) and novel approaches targeting phosphate metabolism threaten to displace traditional binders if proven superior in efficacy or safety.[4] Continuous innovation is essential for maintaining market relevance.

Pricing Landscape

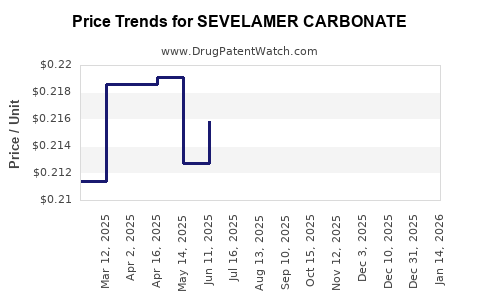

Current Pricing Trends

- Brand Price Points: In the U.S., the average wholesale price (AWP) of sevelamer carbonate is approximately USD 5–6 per tablet, with monthly costs around USD 210–300 for typical dialysis regimens.[5]

- Generic Pricing: Entry of generics in major markets has reduced prices by 30–50%, with some regions witnessing prices as low as USD 2–3 per tablet.

Reimbursement and Cost Control

Insurance coverage, government healthcare programs, and formulary preferences significantly influence effective prices. Payers favor generic options to control costs, leading to downward pressure on brand pricing.

Pricing Projections (2023–2028)

Given current trends, the following projections are conservative:

- North America and Europe: Slight price declines of 3–5% annually due to generic penetration, with some stabilization as patent protections expire or new formulations are introduced.

- Emerging Markets: Prices are anticipated to decrease more substantially (up to 10%), driven by increased generic competition and healthcare spending constraints.

- Premium Segment: Branded sevelamer carbonate may maintain higher prices in markets with strong reimbursement support, though overall margins could compress.

Market Drivers and Barriers

Drivers

- Increasing prevalence of CKD and ESRD.

- Favorable clinical guidelines promoting non-calcium phosphate binders.

- Growing awareness of vascular calcification and cardiovascular risks.

- Expanding dialysis markets, especially in Asia-Pacific.

Barriers

- Price sensitivity and reimbursement constraints.

- Competition from generics and novel agents.

- Potential safety concerns and side effect profiles influencing clinician prescribing.

Regional Market Outlook

| Region |

Market Size (2022) |

CAGR (2023–2028) |

Price Trends |

Key Factors |

| North America |

USD 700 million |

4–5% |

Slight decline (~3%) due to generics |

Reimbursement-driven, high clinical guideline adherence |

| Europe |

USD 350 million |

4–6% |

5–8% price decrease |

Similar to North America, with notable biosimilar entry |

| Asia-Pacific |

USD 250 million |

6–8% |

Price reductions (~10%) |

Growing dialysis infrastructure, price-sensitive markets |

| Latin America & Africa |

USD 100 million |

7–9% |

Significant price declines |

Emerging markets penetration, generic dominance |

Future Price Projections and Market Trends

Based on current insights, sevelamer carbonate’s price will undergo moderate erosion in established markets due to generic competition and cost-cutting measures. The global demand for phosphate binders is expected to grow steadily, bolstered by CKD prevalence, but pricing strategies will adjust accordingly.

- In mature markets, expect a 3–5% annual price decline, stabilizing as the market reaches saturation and patent expirations plateau.

- In emerging markets, prices may decline more sharply (up to 10%) with increased availability of generics.

- Innovations and unmet needs may support premium pricing for new formulations or combination therapies, though these will typically represent a smaller share of total volume.

Strategic Implications for Stakeholders

- Pharmaceutical companies should focus on accelerating generic approvals to capture cost-sensitive segments while potentially developing differentiated formulations or delivery methods.

- Healthcare payers will continue negotiations to lower drug costs via formulary restrictions and preferred tier placement.

- Investors should monitor regional regulatory developments and patent exclusivity periods as primary indicators of price outlook.

Key Takeaways

- The global sevelamer carbonate market is poised for modest growth (~5% CAGR), driven by increasing CKD burden.

- Price erosion is anticipated due to the entry of generics, especially in North America and Europe.

- Emerging markets offer significant growth potential, albeit with pressure on pricing.

- Clinical guideline endorsements will sustain demand, but cost containment initiatives will influence pricing strategies.

- Innovation in drug formulations and combination therapies could offer premium pricing opportunities amid intensifying competition.

Conclusion

Sevelamer carbonate remains a vital therapy in CKD management, with a progressively competitive pricing landscape shaped by global CKD trends, regulatory policies, and market entry of generics. Companies that adapt to these dynamics through strategic product positioning, innovation, and regional market tailoring will optimize their market share and profitability in this evolving environment.

FAQs

Q1: How will patent expirations impact the price of sevelamer carbonate?

A1: Patent expirations facilitate generic entry, significantly lowering prices due to increased competition. The U.S. patent for branded sevelamer carbonate has already expired, leading to a sharp decline in prices generally. Similar trends are evident worldwide, with regional variations depending on regulatory approval timelines.

Q2: What factors could accelerate price reductions in the global market?

A2: Broader availability of generics, healthcare cost containment policies, and increased market penetration in low- and middle-income countries could accelerate price reductions, particularly in emerging markets.

Q3: Are there upcoming innovations that could influence sevelamer carbonate pricing?

A3: Yes, novel phosphate binders with improved safety profiles, easier dosing, or combination therapies targeting CKD mineral metabolism could command premium pricing but may also disrupt current market dynamics if proven superior.

Q4: How do clinical guidelines influence market demand and pricing?

A4: Endorsements from organizations such as KDIGO increase clinician preference for non-calcium binders like sevelamer carbonate, sustaining demand. This can support stable or premium prices especially in markets where guideline compliance influences reimbursement.

Q5: What regions present the greatest growth opportunities for sevelamer carbonate?

A5: The Asia-Pacific region offers substantial growth due to expanding dialysis infrastructure, increasing CKD prevalence, and emerging healthcare markets. As these markets mature, prices will likely decline but volume growth offers lucrative opportunities.

References

- Market Research Future, "Phosphate Binders Market," 2022.

- World Health Organization, "Global CKD Prevalence," 2021.

- KDIGO Clinical Practice Guidelines, 2020.

- Future Therapies in CKD, Journal of Nephrology, 2022.

- Redbook, 2022 Wholesale Drug Prices Data.