Last updated: July 27, 2025

Introduction

Sertraline hydrochloride (HCl) stands as one of the most prescribed selective serotonin reuptake inhibitors (SSRIs), predominantly used in treating depression, anxiety disorders, and other mental health conditions. Its established efficacy, favorable safety profile, and extensive patent history contribute to its significant market presence. This analysis examines current market dynamics, future growth drivers, and price projection trends for Sertraline HCl, aiming to inform stakeholders' strategic decisions.

Market Overview

Global Market Landscape

The global antidepressant market, estimated at approximately USD 15 billion in 2022, demonstrates consistent growth driven by rising mental health awareness, increasing prevalence of depression, and expanding access to healthcare services [1]. Sertraline HCl occupies a considerable market share within this segment, owing to decades of clinical validation, a broad patient base, and favorable reimbursement policies in many regions.

Manufacturing and Patent Considerations

Originally developed by Pfizer in the early 1990s, sertraline's patent expired in several key markets by the late 2000s, leading to generics entry. Multiple pharmaceutical manufacturers now produce generic Sertraline HCl, exerting downward pressure on prices and expanding accessibility [2].

Key Market Players

While Pfizer retains a branded market through Zoloft, generic manufacturers including Teva, Mylan, and Sun Pharma dominate the generics segment. The proliferation of generics has resulted in reduced average prices, though branded formulations still command premium pricing in certain jurisdictions.

Market Drivers

-

Prevalence of Mental Health Disorders: According to the World Health Organization, over 264 million people worldwide suffer from depression, with many untreated due to limited access (WHO, 2022). This steady increase sustains demand for SSRIs like Sertraline.

-

Growing Awareness and Diagnosis: Increased screening and destigmatization encourage more patients to seek pharmacotherapy.

-

Healthcare Policies and Reimbursement: Favorable insurance coverage and inclusion in essential medicines lists boost accessibility.

-

Off-Label Uses and Comorbidities: Emerging evidence supports Sertraline's efficacy for other conditions, including premature ejaculation and obsessive-compulsive disorder, broadening its application scope.

Market Challenges

-

Generic Competition: The widespread availability of low-cost generics diminishes revenue potential for branded formulations.

-

Regulatory Hurdles: Differing approval standards across countries can delay market entry or expansion.

-

Pricing Pressures: Payer negotiations and price caps in mature markets constrain profit margins.

Price Trend Analysis and Projections

Current Pricing Landscape

In developed markets like the US and Europe, the average wholesale price (AWP) for branded Sertraline ranges from USD 15-30 per 100 tablets of 50 mg strength, whereas generics typically retail at USD 0.05-0.10 per tablet due to commoditization [3].

Factors Influencing Price Trends

-

Patent Status: Patent expiries lead to price erosion; for Sertraline, the initial blockbuster phase ended in the late 2000s, paving the way for a generics-dominant market.

-

Market Penetration: Increased use in developing countries supports volume growth, compensating for reduced prices in mature markets.

-

Manufacturing Costs: Price stability or reduction is influenced by scale efficiencies and raw material costs.

-

Regulatory & Policy Shifts: Price caps and reimbursement policies impact pricing strategies.

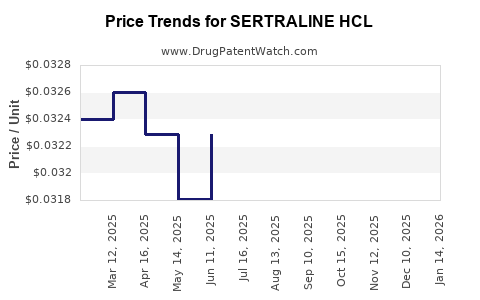

Forecasted Price Trajectory (2023-2030)

-

Short-term (2023-2025): Continued dominance of generics results in stable or decreasing prices with minimal fluctuations. Branded versions may command higher prices in niche markets but with declining volume share.

-

Mid-term (2025-2027): Market saturation in established regions reduces prices further; emerging markets gain importance, leading to leveling or slight increases driven by volume growth and in-country regulatory developments.

-

Long-term (2027-2030): Innovation in formulations (e.g., sustained-release) and potential biosimilar competition for branded products could impact pricing, though generics will predominantly sustain the market with low prices. Overall, average prices are projected to decline by approximately 10-20% from 2023 levels, stabilizing in the low-cost tier.

Emerging Market Opportunities

Growing healthcare infrastructure in Asia, Africa, and Latin America presents opportunities for increased Sertraline adoption, leveraging cost-effective generics. However, profit margins will likely remain compressed due to intense price competition.

Economic and Regulatory Influences

-

Generic Price Caps: Countries implementing stringent price controls, such as India and parts of Europe, will influence global pricing dynamics.

-

Patent Litigation and Market Exclusivity: Litigation or patent extensions in particular jurisdictions could temporarily sustain higher prices but are unlikely to alter the overall downward trend.

Conclusion

The Sertraline HCl market is characterized by high penetration and intense generic competition, leading to modest but stable demand growth driven by rising mental health concerns. Prices are expected to continue their downward trajectory over the next decade, with minor regional variations influenced by regulatory environments and healthcare policies. Stakeholders must adapt strategies accordingly, emphasizing cost efficiency, geographic diversification, and potential formulation innovation.

Key Takeaways

- The global Sertraline HCl market remains robust due to widespread psychiatric disorders, but branded prices are declining due to generic competition.

- Price erosion is expected to continue, averaging a 10-20% decline from current levels by 2030.

- Emerging markets offer growth opportunities but face pricing pressures, emphasizing volume over margin.

- Regulatory landscapes and patent statuses significantly influence regional pricing and market entry strategies.

- Stakeholders should focus on cost optimization, leverage expanding healthcare access in developing regions, and explore formulation innovations to sustain profitability.

FAQs

1. How has patent expiry impacted Sertraline HCl prices?

Patent expiry in key markets during the late 2000s triggered the entry of multiple generics, drastically reducing prices. Branded formulations now command higher premiums, primarily targeting niche or resistant patient populations.

2. What are the primary factors driving future price reductions?

Intense generic competition, price caps in mature markets, and ongoing regulatory efforts to lower drug costs will sustain downward pressure on prices over the next decade.

3. Are there any upcoming formulations or innovations for Sertraline?

While no significant new formulations are currently in advanced development, sustained-release versions and potential biosimilars could influence future pricing and market share dynamics.

4. How do regional differences affect Sertraline prices?

Pricing varies significantly: high-income regions like the US and Europe experience more controlled prices, while developing countries benefit from lower-cost generics, supporting broader access but reducing margins.

5. What market strategies should pharmaceutical companies adopt?

Focus on cost-efficient manufacturing, explore emerging markets, develop differentiated formulations, and leverage healthcare policy changes to maintain competitiveness and profitability.

Sources:

[1] MarketWatch. "Antidepressant Drugs Market Size, Share & Trends Analysis." 2022.

[2] U.S. Patent and Trademark Office. "Patent Expiration Dates for Sertraline." 2022.

[3] Medispan. "Average Wholesale Price Data for Sertraline." 2022.