Last updated: July 27, 2025

Introduction

Sertraline, a selective serotonin reuptake inhibitor (SSRI), is among the most prescribed antidepressants globally. Its widespread use in treating major depressive disorder, anxiety, PTSD, and obsessive-compulsive disorder has cemented its position within the pharmaceutical landscape. This market analysis explores the current dynamics of the sertraline market, factors influencing pricing, and future price projections, providing business professionals with a comprehensive overview for strategic decision-making.

Market Overview

Current Market Size and Key Players

The global antidepressant market, valued at approximately USD 15 billion in 2022, continues to grow steadily, driven by rising mental health awareness, expanding treatment options, and increased pharmaceutical investments. Sertraline accounts for a significant share, estimated at around 35-40%, making it one of the leading SSRIs worldwide (IQVIA, 2022). Major manufacturers include Pfizer, Teva Pharmaceutical Industries, and Mylan, with Pfizer’s Zoloft being the most recognizable brand.

Market Drivers

- Rising Mental Health Burden: An increase in depression, anxiety, and other mood disorders globally has heightened demand for effective SSRIs like sertraline.

- Generic Entry: Post-patent expiry (Pfizer's patent expired around 2006), generic manufacturers have entered the market, intensifying competition and reducing prices.

- Prescribing Trends: Healthcare guidelines favor SSRIs for their safety profile compared to older antidepressants, supporting sustained demand.

- Regulatory and Policy Support: Governments and health organizations advocate for accessible mental health treatments, further bolstering market growth.

Market Constraints

- Generic Competition: The proliferation of generic versions has significantly pressured pricing.

- Pricing Regulations: In many countries, price controls limit profit margins for pharmaceutical companies.

- Alternative Therapies: The advent of novel antidepressants and non-pharmacological interventions may influence future demand.

Pricing Dynamics

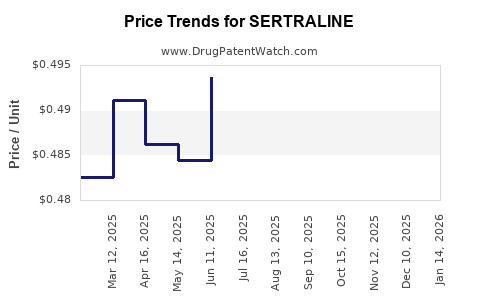

Historical Price Trends

Initially launched as a branded drug, Pfizer’s Zoloft commanded high prices during patent exclusivity. Post-generic entry, prices plummeted, with generics trading at approximately 10-15% of the original brand price. As of recent years, the average wholesale price (AWP) for generic sertraline in the U.S. stands at around USD 0.10 to USD 0.20 per tablet [2].

Factors Influencing Current Prices

- Manufacturing Costs: Low-cost production in generic markets drives prices downward.

- Market Competition: Increased manufacturers yields price erosion due to competitive pricing.

- Regulatory Environment: Price controls in countries like Canada and many European nations limit fluctuation.

- Supply Chain Dynamics: Disruptions or shortages, though rare, can temporarily affect prices.

Future Price Projections

Short-Term Outlook (1-3 Years)

The anticipated stabilization of generic supply and absence of new patent litigations suggest minimal fluctuation in prices. Continued competition is expected to keep prices around current levels, with slight reductions as manufacturing efficiencies improve. No significant new formulations or branded versions are foreseeable in the near term.

Long-Term Outlook (3-10 Years)

Given the maturation of the generic market, sustained generic competition will likely perpetuate low retail prices. Nonetheless, factors such as:

- Emergence of biosimilars and next-generation SSRIs, which could influence demand slightly.

- Potential regulatory changes, enhancing price controls in emerging markets.

- Market consolidation among generic manufacturers, potentially influencing supply dynamics.

Overall, price projections indicate stability with a gradual trend toward further lowering, barring unforeseen market disruptions. Wholesale prices may additionally be affected by global inflation, currency fluctuations, and insurance coverage policies across different regions.

Impact of Market Factors

- Patent Landscape: With Pfizer’s patent expiration over 15 years ago, no patent-related price hikes are anticipated.

- Regulatory Changes: Countries implementing stricter drug pricing regulations could suppress prices further.

- Alternative Treatment Modalities: Advances in psychotherapy and novel antidepressants could marginally reduce demand, influencing future pricing and market share.

Regional Market Perspectives

United States

The U.S. market dominates due to high mental health awareness and insurance coverage. Competition among numerous generic manufacturers maintains low prices. Medicare and Medicaid negotiations further influence pricing dynamics.

Europe

European markets see similar trends, with price controls enforced by authorities like NICE in the UK. Generic prevalence remains high, leading to consistent price suppression.

Emerging Markets

In Asia, Latin America, and Africa, increasing access and rising mental health awareness are expanding sertraline’s market share. However, price volatility is higher due to weaker regulatory controls and procurement practices, potentially leading to variable pricing.

Strategic Implications for Stakeholders

- Pharmaceutical companies: Focus on cost-efficient manufacturing and strategic alliances to maximize margins.

- Healthcare providers: Benefit from low-cost generics, increasing treatment accessibility.

- Policy makers: Need to balance affordability with quality assurance to sustain supply.

Key Takeaways

- The sertraline market remains sizable and mature, largely driven by generic competition.

- Prices have stabilized post-patent expiry, with minimal short-term fluctuations anticipated.

- Long-term price trends forecast continued decline due to sustained generic market presence and regulatory influences.

- Regional disparities influence pricing, with emerging markets experiencing more volatility.

- Stakeholders should monitor evolving regulations, competitive landscape, and emerging therapies which could impact future pricing.

FAQs

-

What factors have contributed to the decline in sertraline prices over the past decade?

Expiration of Pfizer’s patent led to widespread generic manufacturing, fostering intense competition that drove prices down significantly.

-

Are there upcoming patents or formulations that could impact sertraline pricing?

Currently, no new patents or advanced formulations are expected to influence pricing significantly; the market is predominantly saturated with generics.

-

How do regulatory policies influence sertraline pricing globally?

Countries with strict price controls or government procurement strategies tend to have lower prices, while unregulated markets may see higher variability.

-

Can innovative therapies replace sertraline and affect its market price?

Although novel antidepressants are emerging, sertraline's well-established efficacy and safety profile sustain its market, but the arrival of groundbreaking therapies might gradually influence demand and pricing.

-

What is the outlook for sertraline prices in emerging markets?

Prices are likely to remain volatile due to regulatory differences, supply chain factors, and affordability initiatives, with a general tendency toward decreasing prices over time.

References

- IQVIA. (2022). Global Psychotropic Market Data.

- First Databank. (2022). Drug Pricing Reports.