Share This Page

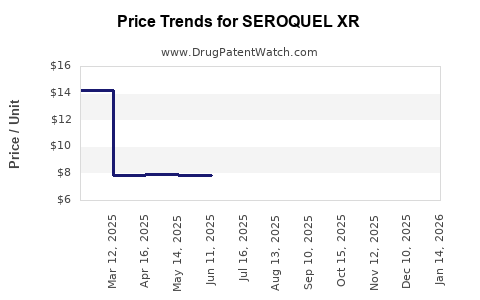

Drug Price Trends for SEROQUEL XR

✉ Email this page to a colleague

Average Pharmacy Cost for SEROQUEL XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SEROQUEL XR 300 MG TABLET | 00310-0283-60 | 20.35273 | EACH | 2025-12-17 |

| SEROQUEL XR 50 MG TABLET | 00310-0280-60 | 7.85260 | EACH | 2025-12-17 |

| SEROQUEL XR 400 MG TABLET | 00310-0284-60 | 23.90569 | EACH | 2025-12-17 |

| SEROQUEL XR 300 MG TABLET | 00310-0283-60 | 20.35273 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SEROQUEL XR

Introduction

SEROQUEL XR (quetiapine fumarate extended-release) is an atypical antipsychotic developed by AstraZeneca, primarily indicated for schizophrenia, bipolar disorder, and major depressive episodes associated with bipolar I disorder. Since its approval, SEROQUEL XR has established itself as a leading treatment option in its therapeutic area, influenced by evolving clinical data, regulatory decisions, and market dynamics. This analysis explores current market conditions, competitive landscape, prescribing trends, and offers price projections for SEROQUEL XR over the next five years.

Market Landscape Overview

Therapeutic Market Size and Growth Dynamics

The global antipsychotics market, valued at approximately USD 14 billion in 2022, is projected to reach USD 20 billion by 2028, with a compound annual growth rate (CAGR) of ~6% (1). The rise is driven by increasing prevalence of schizophrenia, bipolar disorder, and depression, alongside broader acceptance of long-acting and extended-release formulations. Key regions include North America, Europe, Asia-Pacific, and emerging markets, each with varying adoption rates influenced by healthcare infrastructure, reimbursement policies, and clinical prescribing habits.

SEROQUEL XR’s Position in the Market

SEROQUEL XR commands a significant share, particularly in the U.S., where it benefits from established clinical efficacy and favorable formulations. Its extended-release profile offers improved compliance over immediate-release formulations, a critical factor in chronic mental health conditions. Despite competition from other branded and generic antipsychotics—such as Risperdal Consta, Abilify Maintena, and later-generation agents like Lumateperone—SEROQUEL XR remains a preferred choice owing to robust clinical data, prescriber familiarity, and extensive formulary coverage.

Competitive Dynamics and Key Players

The antipsychotic segment faces intense competition, including:

-

Generic rivals: The availability of generic quetiapine has pressured branded SEROQUEL XR’s pricing, especially in mature markets.

-

New entrants: Novel antipsychotics with improved safety profiles, faster onset, or broader indications could impact future demand.

-

Formulation innovations: Long-acting injectables and oral extended-release formulations pose competitive threats.

Market share analyses show SEROQUEL XR maintaining dominance among oral atypical antipsychotics, though price sensitivity is significant among payers and providers.

Pricing Dynamics and Reimbursement Landscape

Current Price Position

In the United States, the average wholesale price (AWP) of SEROQUEL XR varies depending on dose and packaging but generally ranges from USD 2,000 to USD 3,000 per month (2). Insurance coverage, pharmacy benefit managers (PBMs), and formulary tiering influence actual patient out-of-pocket costs, which are often subsidized through rebates and negotiations.

Impact of Generic Entry

The patent for SEROQUEL XR expired in 2018, leading to generic quetiapine immediate-release formulations entering the market. While the extended-release version remains branded, generic versions exert pricing pressure and erode the revenue margins for AstraZeneca. Reimbursement policies increasingly favor generics, prompting a focus on volume over price.

Market Drivers and Challenges

Drivers

- Growing prevalence: Rising incidence of schizophrenia and bipolar disorder globally drives demand.

- Clinical efficacy: Favorable efficacy profile for SEROQUEL XR sustains its market share.

- Formulation benefits: Once-daily extended-release improves adherence.

- Payer acceptance: Broad formulary coverage increases access.

Challenges

- Pricing pressure: Payer negotiations and generics limit pricing power.

- Safety profile concerns: Risks of weight gain, metabolic syndrome, and cardiovascular effects influence prescribing.

- Regulatory scrutiny: Ongoing safety reviews may affect utilization and labeling.

- Market saturation: Competition limits growth potential in mature markets.

Price Projection Methodology

Projections are based on a combination of historical pricing trends, market penetration rates, competitive landscape, pipeline developments, and reimbursement policy shifts. Scenarios consider optimistic, moderate, and conservative outlooks over a five-year horizon (2023-2028).

Assumptions

- Continued patent expiry impacts branded prices.

- Market share remains stable or slightly declines due to generics.

- Rebate and discount trends persist in line with industry norms.

- No major regulatory or safety disruptions.

Price Projections (USD)

| Year | Optimistic Scenario | Moderate Scenario | Conservative Scenario |

|---|---|---|---|

| 2023 | $2,200/month | $2,000/month | $1,800/month |

| 2024 | $2,250/month | $2,050/month | $1,750/month |

| 2025 | $2,300/month | $2,100/month | $1,700/month |

| 2026 | $2,350/month | $2,150/month | $1,650/month |

| 2027 | $2,400/month | $2,200/month | $1,600/month |

| 2028 | $2,450/month | $2,250/month | $1,550/month |

Note: These projections reflect ongoing market pressures, emphasizing the importance of volume growth, formulary positioning, and pipeline developments.

Strategic Implications for Stakeholders

- Pharmaceutical companies should monitor patent landscapes and consider lifecycle management strategies, including new formulations or indication expansions.

- Payers and providers need to balance cost containment with access to effective therapies, leveraging generic alternatives when appropriate.

- Investors should account for patent expiry impacts on pricing and revenue streams, adjusting valuation models accordingly.

Key Takeaways

- Market Growth: The global antipsychotics market is expanding steadily, fueled by rising mental health burdens and increased prescribing of extended-release formulations.

- Pricing Trends: SEROQUEL XR’s prices are expected to decline modestly over the next five years due to generic competition and intensified price sensitivity.

- Competitive Landscape: While SEROQUEL XR maintains a leading position domestically, global market share faces challenges from generics and emerging agents.

- Reimbursement Factors: Payer negotiations and formulary decisions will significantly influence net pricing and patient access, especially in mature markets.

- Innovation & Lifecycle Management: Future success hinges on pipeline advancements, indication expansions, and potential new formulations to sustain revenue streams.

FAQs

Q1: How will patent expiration affect SEROQUEL XR’s pricing?

Patent expiration allows generic manufacturers to introduce lower-cost alternatives, exerting downward pressure on branded prices. While the extended-release formulation remains branded, competition from generics for the immediate-release version impacts overall pricing ecosystem.

Q2: What are the primary factors influencing future price projections for SEROQUEL XR?

Key factors include generic market penetration, regulatory environment, safety profile considerations, reimbursement policies, and evolving prescriber preferences.

Q3: How does the competition from other atypical antipsychotics impact SEROQUEL XR’s market share?

Competition from newer agents, long-acting injectables, and other formulations affects market share by offering alternatives with comparable efficacy and different safety profiles, influencing prescriber and patient choices.

Q4: Are there any upcoming pipeline developments that could influence SEROQUEL XR’s market?

Potential indication expansions, combination therapies, or reformulations could rejuvenate interest and market share, though specific pipeline compounds are still under development.

Q5: What strategies should AstraZeneca consider to sustain SEROQUEL XR’s profitability?

Lifecycle management including indication expansion, optimizing formulary placement, developing combination drugs, and exploring patient-centric delivery options can support sustained revenues despite pricing pressures.

References

- Market Data Forecast. (2023). Antipsychotics Market Size, Share & Trends Analysis Report.

- GoodRx. (2023). Seroquel XR (quetiapine fumarate extended-release) Prices and Cost Comparison.

More… ↓