Share This Page

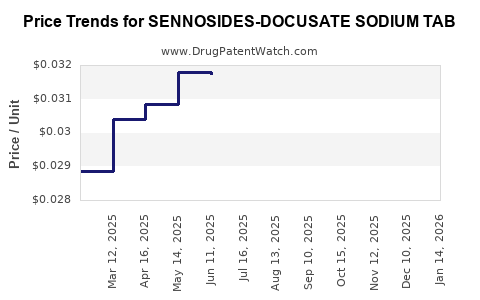

Drug Price Trends for SENNOSIDES-DOCUSATE SODIUM TAB

✉ Email this page to a colleague

Average Pharmacy Cost for SENNOSIDES-DOCUSATE SODIUM TAB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SENNOSIDES-DOCUSATE SODIUM TAB | 60687-0622-01 | 0.03270 | EACH | 2025-12-17 |

| SENNOSIDES-DOCUSATE SODIUM TAB | 63739-0432-02 | 0.03270 | EACH | 2025-12-17 |

| SENNOSIDES-DOCUSATE SODIUM TAB | 60687-0622-11 | 0.03270 | EACH | 2025-12-17 |

| SENNOSIDES-DOCUSATE SODIUM TAB | 00904-7440-61 | 0.03270 | EACH | 2025-12-17 |

| SENNOSIDES-DOCUSATE SODIUM TAB | 60687-0622-01 | 0.03270 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sennosides-Docusate Sodium Tablets

Introduction

Sennosides-Docusate Sodium Tablets combine a stimulant laxative (sennosides) with a stool softener (docusate sodium), primarily used to treat constipation. As a niche combination product, its market dynamics are influenced by the broader laxative and gastrointestinal therapeutic sectors. Analyzing current market conditions, competitive landscape, regulatory environment, and healthcare trends yields essential insights for stakeholders aiming to navigate pricing strategies and market entry.

Market Overview

Therapeutic Demand and Patient Population

The global gastrointestinal (GI) therapeutics market, valued at approximately USD 15 billion in 2022, is projected to grow at a CAGR of 4% through 2030 [1]. Constipation remains a prevalent GI disorder affecting approximately 14% of adults worldwide, with increased incidence among the elderly and those with chronic illnesses. The aging demographic, along with lifestyle factors such as diet and sedentary behaviors, sustains high demand for laxatives including combination formulations like Sennosides-Docusate Sodium Tablets.

Product Positioning and Usage Trends

Combination laxatives address multifactorial constipation, often preferred for their convenience and efficacy. Sennosides, a plant-derived stimulant, is widely used due to rapid onset, while docusate sodium, a surfactant, minimizes straining and softens stool. Manufacturers emphasize safety profiles, especially for chronic use, which sustains demand among both outpatient and institutional settings (hospitals, elderly care homes).

Market Dynamics

Competitive Landscape

The competitive environment is characterized by:

-

Generic Dominance: Multiple generics offering similar formulations have entered markets across the US, Europe, and Asia. Price competition is fierce, especially in mature markets where brand differentiation is limited.

-

Branded Variants: Major pharmaceutical companies (Johnson & Johnson, GlaxoSmithKline) own branded equivalents often marketed for their perceived quality and safety, but price premiums are declining as generics dominate.

-

Over-the-Counter (OTC) Accessibility: OTC availability boosts sales volume but compresses margins. Evolving regulations and consumer preference influence sales channels.

Regulatory Environment

Regulations differ by region:

-

FDA Approval: In the US, OTC status for laxatives facilitates broad availability but necessitates compliance with labeling and safety standards.

-

EMA and Other Agencies: Similar frameworks in Europe influence formulation approvals and marketing claims.

Market entry requires submissions aligned with pharmacovigilance and quality standards, impacting manufacturer costs and final pricing.

Pricing Trends

Price points for Sennosides-Docusate Sodium Tablets are influenced by:

-

Generic Price Erosion: Continued entry of generic versions leads to downward pressure.

-

Brand Premiums: Branded formulations can command 20-50% higher prices, though typically declining.

-

Distribution Model: OTC sales through pharmacies, supermarkets, and online platforms impact retail prices and margins.

Market Size and Price Projection

Current Market Size and Revenue

In 2022, the global OTC laxative market, including various formulations, was valued at approximately USD 4 billion [2]. Sennosides-Docusate Sodium Tablets, as a specialized combination product, likely account for a minor segment, estimated around USD 100–200 million globally.

Price Projections (2023–2030)

-

2023 Baseline: Average retail price per unit (30-tablet pack) ranges from USD 5 to USD 10, depending on regional and brand factors.

-

Short-Term Outlook (2023–2025): Prices are expected to decline by 10–15% driven by increasing generic competition and OTC channel saturation.

-

Mid to Long-Term Outlook (2026–2030): Prices are projected to plateau or decrease slightly further, with an annual compound decline of 3–5%. Factors influencing stabilization include regulatory pressures promoting cost-effective generics and shifts toward internet-based purchasing reducing distribution costs.

Influence of Emerging Factors

-

Market Penetration of Private Labels: Increasing adoption of store brands could further erode pricing power.

-

Innovative Formulations: Introduction of longer-acting or combination products with improved safety profiles may command premium pricing, but resistance from established generics could keep overall prices stable or declining.

-

Regulatory and Policy Changes: Policies encouraging generic substitution and OTC access expansion in emerging markets will further influence prices downward.

Key Industry Trends Impacting Pricing

-

Shift toward value-based care: Focus on therapeutic safety may influence premium pricing of branded formulations.

-

Digital health and direct-to-consumer channels: E-commerce facilitates price competition, impacting traditional retail margins.

-

Global supply chain factors: Raw material costs, especially for plant-derived sennosides, could affect manufacturing costs, influencing retail prices.

Strategic Considerations for Stakeholders

-

Market Entry: Emphasize competitive pricing, OTC accessibility, and safety data to secure market share.

-

Brand Differentiation: Leverage safety profiles and efficacy studies to justify premium pricing in branded segments.

-

Distribution Focus: Strengthen pharmacy relationships and online sales channels to combat price erosion.

-

Regulatory Navigation: Stay ahead of approval pathways for innovative formulations that could command higher prices.

Conclusion

Sennosides-Docusate Sodium Tablets operate within a highly competitive, price-sensitive global market. Current retail prices are under downward pressure, with projections indicating modest declines through 2030. Companies that balance cost-effective manufacturing, strategic branding, and distribution expansion will thrive amid ongoing market consolidation and regulatory evolution.

Key Takeaways

-

The global OTC laxatives market, especially combination products like Sennosides-Docusate Sodium Tablets, remains robust due to high prevalence of constipation, particularly among aging populations.

-

Price erosion is primarily driven by increasing generic competition, OTC channel proliferation, and private label expansion.

-

Despite pressure, branded formulations with proven safety profiles can sustain premium pricing through differentiated marketing.

-

Market potential exists in emerging markets with expanding healthcare access, but regulatory hurdles and supply chain factors influence pricing strategies.

-

Stakeholders should focus on innovation, strategic partnerships, and digital channels to maintain profitability in a declining price environment.

FAQs

-

What is the primary therapeutic advantage of Sennosides-Docusate Sodium Tablets?

They combine stimulant laxative action with stool softening, offering relief from constipation with fewer straining effects, particularly beneficial for patients with chronic or postoperative constipation. -

How does the availability of generics impact the pricing of Sennosides-Docusate Sodium Tablets?

Generics exert significant price pressure, leading to sustained declines in retail prices. Market entry of high-quality generics often results in savings for consumers but decreases profit margins for brand manufacturers. -

Which factors are most likely to influence the market growth of this combination drug?

Factors include aging populations, increasing prevalence of constipation, regulatory policies favoring OTC medications, and the expansion of distribution channels, especially online. -

Are there notable safety concerns with long-term use of stimulant and stool softener combinations?

Long-term use of stimulant laxatives may be associated with electrolyte imbalances or dependence, but combinations like Sennosides-Docusate are generally considered safe for short to moderate use when monitored appropriately. -

What strategies can manufacturers adopt to maintain profitability amid declining prices?

Strategies include developing differentiated formulations, investing in safety and efficacy research to support premium branding, expanding in emerging markets, and leveraging digital marketing and e-commerce distribution channels.

References

[1] Grand View Research. (2022). Gastrointestinal Therapeutics Market Size, Share & Trends Analysis Report.

[2] Research and Markets. (2022). OTC Laxatives Market Forecast & Trends.

More… ↓