Share This Page

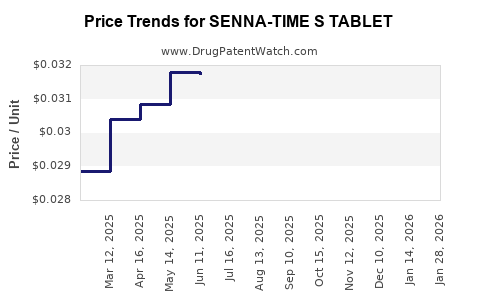

Drug Price Trends for SENNA-TIME S TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for SENNA-TIME S TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SENNA-TIME S TABLET | 49483-0081-01 | 0.03270 | EACH | 2025-12-17 |

| SENNA-TIME S TABLET | 49483-0081-10 | 0.03270 | EACH | 2025-12-17 |

| SENNA-TIME S TABLET | 49483-0081-01 | 0.03270 | EACH | 2025-11-19 |

| SENNA-TIME S TABLET | 49483-0081-10 | 0.03270 | EACH | 2025-11-19 |

| SENNA-TIME S TABLET | 49483-0081-01 | 0.03217 | EACH | 2025-10-22 |

| SENNA-TIME S TABLET | 49483-0081-10 | 0.03217 | EACH | 2025-10-22 |

| SENNA-TIME S TABLET | 49483-0081-01 | 0.03099 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SENNA-TIME S TABLET

Introduction

SENNA-TIME S TABLET is a combination pharmaceutical formulation primarily used to address constipation and related gastrointestinal disorders. Its composition typically includes senna, a natural laxative, combined with additional active ingredients aimed at enhancing bowel movement efficacy and patient compliance. As the demand for over-the-counter (OTC) laxatives grows globally, understanding the market landscape and projecting future pricing trends for SENNA-TIME S TABLET becomes essential for stakeholders, including manufacturers, investors, healthcare providers, and policymakers.

This report delivers a comprehensive market analysis and forecasts pricing trajectories based on current trends, competitive landscape, regulatory environment, and consumer behavior.

Market Overview

Global Gastrointestinal Drugs Market

The global gastrointestinal (GI) drugs market was valued at approximately USD 20 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of around 4.5% over the next five years[^1]. The growth is driven by increasing prevalence of gastrointestinal disorders, aging populations, lifestyle factors, and rising awareness of OTC remedies.

Segmental Analysis

The laxatives segment, within GI drugs, accounts for a significant share, propelled by the high demand for bowel regulation products. Senna-based laxatives, recognized for their herbal and natural origin, hold an appreciable market share in OTC laxatives, especially in regions with a preference for natural remedies.

Regional Market Dynamics

- North America: Dominates the market owing to high health awareness, accessible healthcare infrastructure, and a significant segment of OTC drug consumers.

- Europe: Exhibits steady growth, with a robust demand for herbal and natural laxatives. Stringent regulatory standards influence product formulation and pricing.

- Asia-Pacific: Demonstrates the fastest growth, driven by increasing urbanization, expanding healthcare markets, and a shift towards OTC drug utilization. Emerging markets like India and China show the highest adoption rates of senna-based products[^2].

Key Drivers and Restraints

Drivers:

- Growing geriatric population prone to constipation.

- Rising awareness about herbal and natural laxatives.

- Increased availability of OTC formulations facilitating ease of access.

- Development of combination therapies aimed at reducing side effects and improving compliance.

Restraints:

- Stringent regulatory approvals and safety concerns regarding chronic laxative use.

- Competition from alternative GI therapeutic agents.

- Price sensitivity in emerging markets.

- Potential side effects associated with long-term senna use, such as electrolyte imbalance and dependency.

Competitive Landscape

Major manufacturers operating in the senna-based bowel relief segment include:

- Bayer AG: Offers herbal laxative products with a strong presence globally.

- GlaxoSmithKline: Provides OTC laxatives, including senna formulations.

- Macleods Pharmaceuticals: Focuses on generic equivalents with competitive pricing.

- Local and regional manufacturers in Asia-Pacific capitalize on cost advantages and local consumer preferences.

Private-label brands and regional players further fragment the market, creating varied price points and product qualities.

Market Penetration Strategies

Key strategies to grow market share include:

- Formulation innovation: Combining senna with other active ingredients for enhanced efficacy.

- Packaging innovations: Easy-to-use dosage forms like chewables or sachets.

- Digital marketing: Utilizing online platforms to reach healthcare-conscious consumers.

- Strategic collaborations: Partnering with healthcare providers to endorse OTC use.

Pricing Analysis and Projections

Current Pricing Landscape

The average retail price of SENNA-TIME S TABLET varies by region:

- North America: USD 3-5 per pack of 20 tablets.

- Europe: EUR 2.50-4 per pack.

- Asia-Pacific: USD 1.50-3, reflecting regional price sensitivity and local manufacturing.

In the OTC segment, pricing tends to be influenced by brand positioning, formulation complexity, and regulatory factors.

Factors Influencing Price Trends

- Raw material costs: Fluctuations in plant-based senna supply impact the manufacturing cost.

- Regulatory landscape: Stringent safety standards may raise compliance costs.

- Market competition: Entry of generics and private-label brands exerts downward pressure.

- Consumer willingness to pay: Growing preference for natural remedies supports premium pricing in certain regions.

Price Projection (2023-2028)

Based on current market indicators, the following projections can be made:

- North America and Europe are expected to maintain stable or marginally increasing prices, around 2-5% annually, due to regulatory compliance costs and brand differentiation.

- Asia-Pacific will likely see a moderate price decline of 1-3% annualized, stemming from increased manufacturing volume, local competition, and price-sensitive consumers.

- Emerging markets might experience price stabilization or modest increases as quality standards improve and consumer awareness expands.

Future Pricing Outlook

- Premium Segment: With innovation and branding, some formulations may command higher prices, projected to reach USD 6-8 per pack by 2028.

- Economical Options: Price-conscious consumers will benefit from generics, with prices expected to stabilize around USD 1.50-2.50 per pack.

- Impact of Digital OTC Sales: E-commerce platforms could further drive price competition, with discounts and bundle deals becoming prevalent.

Regulatory and Market Entry Considerations

Entering the SENNA-TIME S TABLET market necessitates compliance with regional pharmaceutical regulations, including:

- FDA (USA): Requires evidence of safety, efficacy, and manufacturing quality.

- EMA (Europe): Adherence to EMA directives and Good Manufacturing Practice (GMP).

- National agencies (Asia): Varied, but increasingly strict standards are observed.

Moreover, market entry strategies must consider intellectual property rights, local consumer preferences, and distribution channel development.

Conclusion

The SENNA-TIME S TABLET market is positioned for steady growth in the coming years, driven by aging populations, preference for natural remedies, and increasing OTC consumption. Price stability and modest growth are expected in developed regions, while emerging markets will witness dynamic shifts influenced by competition and manufacturing scale.

Manufacturers should focus on formulation innovation, regulatory compliance, and targeted regional strategies to optimize profitability and market share. From a pricing standpoint, maintaining a balanced approach between affordability and value addition will be crucial, especially amid competitive pressures and regulatory requirements.

Key Takeaways

- The global market for senna-based laxatives, including SENNA-TIME S TABLET, is trending upward with a CAGR of approximately 4.5%, driven by demographic and consumer preference factors.

- In mature markets, prices are relatively stable, with slight increases attributable to regulatory costs.

- Emerging markets present opportunities for volume-driven growth and price competition, with potential for price reductions.

- Innovation in formulation and packaging, coupled with digital marketing, can significantly influence market penetration and pricing strategies.

- Compliance with regional regulations and understanding local consumer behavior are critical for successful market entry and expansion.

FAQs

1. What factors influence the pricing of SENNA-TIME S TABLET globally?

Pricing is influenced by raw material costs, manufacturing expenses, regulatory compliance, competitive dynamics, regional economic conditions, and consumer preferences.

2. How is the demand for natural laxatives affecting the SENNA-TIME S TABLET market?

Increased consumer preference for herbal and natural remedies boosts demand, enabling premium pricing in regions favoring traditional and herbal products.

3. What regulatory challenges could impact the market outlook for SENNA-TIME S TABLET?

Regulations concerning safety evaluation, permissible dosage, and labeling standards may increase manufacturing costs and influence market entry timelines.

4. Which regions present the most growth opportunities for SENNA-TIME S TABLET?

Asia-Pacific, especially China and India, offers significant growth potential due to expanding healthcare markets and increasing OTC drug consumption.

5. How can manufacturers maintain competitive pricing in a fragmented market?

By optimizing manufacturing processes, leveraging local sourcing, innovating formulations, and adopting direct-to-consumer online sales channels, manufacturers can sustain competitive pricing.

Sources:

[^1]: MarketDataForecast, "Global Gastrointestinal Drugs Market," 2022.

[^2]: Grand View Research, "Herbal Medicine Market Analysis," 2022.

More… ↓