Share This Page

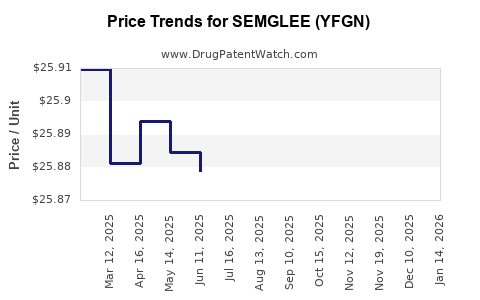

Drug Price Trends for SEMGLEE (YFGN)

✉ Email this page to a colleague

Average Pharmacy Cost for SEMGLEE (YFGN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SEMGLEE (YFGN) 100 UNIT/ML PEN | 83257-0012-33 | 25.83891 | ML | 2025-12-17 |

| SEMGLEE (YFGN) 100 UNIT/ML VL | 83257-0011-11 | 25.88744 | ML | 2025-12-17 |

| SEMGLEE (YFGN) 100 UNIT/ML PEN | 83257-0012-33 | 25.84748 | ML | 2025-11-19 |

| SEMGLEE (YFGN) 100 UNIT/ML VL | 49502-0250-80 | 25.89058 | ML | 2025-11-19 |

| SEMGLEE (YFGN) 100 UNIT/ML VL | 83257-0011-11 | 25.89058 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SEMGLEE (YFGN)

Introduction

SEMGLEE (YFGN), a biosimilar insulin glargine product developed by Genentech and marketed by Biocon, represents a significant entrant in the highly competitive diabetes management market. This biosimilar aims to provide a cost-effective alternative to the patent-protected Lantus (insulin glargine), enabling broader access for patients worldwide. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and future price projections for SEMGLEE (YFGN), offering insights pivotal for stakeholders' strategic planning.

Market Overview

Global Diabetes and Insulin Market Size

The global diabetes care market was valued at approximately USD 50 billion in 2022 and is projected to grow at a CAGR of 7% through 2030, driven by increasing prevalence, aging populations, and escalating demand for injectable therapies. Insulin sales constitute a major portion, with estimates suggesting the market for basal insulins alone nears USD 20 billion annually (source: Grand View Research[1]).

Market Segmentation of Insulin Products

Insulin products are categorized into:

- Originator (Brand) Insulins: e.g., Lantus (Sanofi), Tresiba (Novo Nordisk)

- Biosimilar Insulins: e.g., SEMGLEE (YFGN), Basaglar (Eli Lilly/Biogen), and others

Biosimilars are increasingly penetrating markets due to lower price points and comparable efficacy/safety profiles, particularly in price-sensitive regions such as Asia and Latin America.

Competitive Landscape

Key Players

- Lantus (Sanofi): The original insulin glargine product, dominant for over a decade.

- Basaglar (Eli Lilly/Biogen): First biosimilar insulin glargine approved in the US (2015), gaining steady market share.

- Semglee (YFGN): Approved by the FDA as a biosimilar in 2021; benefits from multi-source access and patent expirations.

- Other biosimilars: e.g., Amjevita (AbbVie), Insulin glargine biosimilars in emerging markets.

Market Penetration and Adoption Drivers

- Price Competitiveness: Biosimilars are typically priced 20-40% below originator brands.

- Regulatory Exclusivities: Patent litigations and regulatory pathways influence market access timelines.

- Healthcare System Dynamics: Reimbursement policies and formulary preferences heavily impact biosimilar uptake.

Patent Landscape and Market Entry Barriers

Sanofi’s patent exclusivity for Lantus has substantially expired, facilitating biosimilar entry. The US and EU markets have seen increasing biosimilar adoption, but barriers such as prescriber inertia and interchangeability concerns remain.

Regulatory Environment

Global Approval Status for SEMGLEE

- United States: Approved by the FDA as a biosimilar for insulin glargine (2021).

- European Union: Approved as a biosimilar; currently marketed in select European countries.

- Emerging Markets: Regulatory approvals vary; India and Latin America are key growth regions.

Interchangeability and Prescribing Policies

In the US, FDA designates biosimilars as interchangeable if they can be substituted without prescriber intervention, which influences market penetration. As of now, SEMGLEE is not designated as interchangeable but is prescribed under standard approval pathways.

Pricing Analysis

Historical Pricing Trends

- Biosimilar insulin glargine prices in the US range from USD 120 to USD 150 per vial, contrasted with the originator’s USD 300+.

- In emerging markets, prices can be as low as USD 30-50 per vial due to local pricing regulations and market competition.

Current Price Position of SEMGLEE

- US Retail Price (list): Approximately USD 130-150 per vial.

- European and emerging markets: Significantly lower, often USD 50-70 per vial, with discounts and insurance negotiations reducing net prices further.

Factors Influencing Future Pricing

- Market Competition: As additional biosimilars enter, price competition may drive prices downward.

- Volume Sales: Larger patient coverage facilitates economies of scale, enabling further price reductions.

- Reimbursement Policies: Governments negotiate prices; coverage expansions likely to favor biosimilar adoption.

Price Projection Outlook (2023-2030)

Short-term (2023-2025)

- Predicted Price Stability or Slight Decline: Driven by limited biosimilar competition in the US due to regulatory and prescriber hesitations.

- Emerging Markets: Significant discounts expected, with prices potentially decreasing by 10-15% annually due to increasing competition.

Medium to Long-term (2025-2030)

- Increased Biosimilar Competition: Additional biosimilars entering global markets may reduce prices by 20-30% from current levels.

- Market Penetration Growth: Expanded insurance coverage and clinician acceptance will further pressure prices downward.

- Potential Price Floor: In competitive markets, biosimilar insulin glargine may stabilize at USD 50-70 per vial, with some regions achieving lower net prices through negotiations.

Key Factors Impacting Price Trends

- Regulatory approvals: Faster approvals in emerging markets and potential for interchangeability in the US will dictate adoption pace.

- Healthcare policies: Government-driven cost-saving initiatives will promote biosimilar switching.

- Patent and litigation landscapes: Delays or extensions influence timing of additional biosimilar entries.

- Innovation and formulations: Introduction of new delivery mechanisms or combination therapies could alter pricing dynamics.

Strategic Implications for Stakeholders

- Manufacturers: Need to optimize scale and cost-efficiency to sustain profitability amidst declining prices.

- Healthcare providers: Emphasize education on biosimilar efficacy to accelerate adoption.

- Policymakers: Implement policies fostering biosimilar acceptance to maximize healthcare savings.

- Investors: Recognize that pricing declines will compress margins but also expand market access and volumes.

Key Takeaways

- The global market for insulin glargine biosimilars, including SEMGLEE, is poised for steady growth driven by patent expirations and cost-conscious healthcare systems.

- Current pricing for SEMGLEE in mature markets ranges around USD 130-150 per vial, with more significant discounts in emerging economies.

- Over the next decade, prices are projected to decline further by 20-30%, with stabilization around USD 50-70 in highly competitive regions.

- Adoption hurdles remain in some markets due to regulatory and prescriber hesitations, but increased acceptance will accelerate volume growth and justify further price reductions.

- Strategic players should focus on market penetration through differentiated delivery models, pricing strategies, and educational initiatives to maximize competitiveness.

FAQs

1. How does SEMGLEE compare to its originator, Lantus, in terms of efficacy?

SEMGLEE has demonstrated biosimilarity to Lantus in clinical trials, showing comparable safety, efficacy, and pharmacokinetic/pharmacodynamic profiles, consistent with FDA biosimilar standards.

2. What pricing strategies are leading biosimilar manufacturers adopting?

Most biosimilar producers adopt aggressive pricing, offering discounts of 20-40% off the originator to gain market share, supplemented by volume incentives and rebates in managed care settings.

3. What is the impact of regulatory changes on SEMGLEE’s market prospects?

Regulatory pathways that recognize interchangeability and facilitate automatic substitution significantly enhance biosimilar uptake, potentially accelerating price reductions and market penetration.

4. Which regions are most likely to see the fastest adoption of SEMGLEE?

Emerging markets like India, Latin America, and Southeast Asia, where cost sensitivity is high and regulatory approvals are evolving, are poised for rapid adoption, thereby influencing overall pricing trends.

5. How will increased biosimilar competition influence the long-term pricing of SEMGLEE?

As more biosimilars enter the market, price competition will intensify, leading to continued downward pressure on prices, stabilizing around the marginal cost of production in the long term.

References

- Grand View Research. “Insulin Market Size, Share & Trends Analysis Report.” 2022.

More… ↓