Share This Page

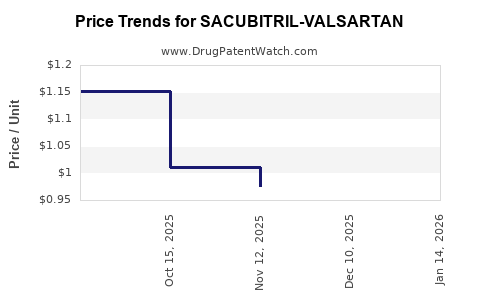

Drug Price Trends for SACUBITRIL-VALSARTAN

✉ Email this page to a colleague

Average Pharmacy Cost for SACUBITRIL-VALSARTAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SACUBITRIL-VALSARTAN 24-26 MG | 13668-0634-60 | 0.88590 | EACH | 2025-12-17 |

| SACUBITRIL-VALSARTAN 24-26 MG | 31722-0673-18 | 0.88590 | EACH | 2025-12-17 |

| SACUBITRIL-VALSARTAN 24-26 MG | 33342-0570-57 | 0.88590 | EACH | 2025-12-17 |

| SACUBITRIL-VALSARTAN 24-26 MG | 13668-0634-33 | 0.88590 | EACH | 2025-12-17 |

| SACUBITRIL-VALSARTAN 24-26 MG | 33342-0570-09 | 0.88590 | EACH | 2025-12-17 |

| SACUBITRIL-VALSARTAN 24-26 MG | 31722-0673-60 | 0.88590 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SACUBITRIL-VALSARTAN

Introduction

SACUBITRIL-VALSARTAN, commercially known as Entresto, is a groundbreaking drug designed to treat heart failure with reduced ejection fraction (HFrEF). Developed through a collaboration between Novartis and other stakeholders, it combines an angiotensin receptor blocker (valsartan) with a neprilysin inhibitor (sacubitril). Since its FDA approval in 2015, it has revolutionized the therapeutic landscape for heart failure management, positioning itself as a preferred alternative to traditional ACE inhibitors and ARBs.

This analysis examines the current market landscape, recent trends, key drivers, competitive dynamics, and provides future price projections based on existing data, patent expirations, regulatory developments, and market penetration patterns.

Market Overview

Global Heart Failure Therapeutics Market Context

The global heart failure (HF) drugs market was valued at approximately $8.7 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of 7-8% through 2030, driven by rising prevalence, aging populations, and innovations in therapeutics.[1] Heart failure affects over 26 million individuals worldwide and is associated with high morbidity, mortality, and healthcare costs.

SACUBITRIL-VALSARTAN’s Market Position

Since its launch, SACUBITRIL-VALSARTAN's market share has steadily increased, especially in developed markets such as North America, Europe, and Japan. Its clinical advantages, including significant reductions in mortality and hospitalization rates compared to enalapril, have led to its recommendation as first-line therapy for HFrEF.[2]

Regulatory Acceptance & Reimbursement

Regulatory approval spans numerous markets, with key approvals in the U.S., EU, Japan, and emerging markets. Reimbursement policies are generally favorable in developed regions, bolstering market accessibility and adoption.

Market Drivers

- Clinical Efficacy & Guideline Endorsements: Major cardiology guidelines (e.g., ACC/AHA) now endorse SACUBITRIL-VALSARTAN as a preferred treatment for HFrEF.[3]

- Rising Prevalence of Heart Failure: Increasing aging populations globally prop up demand.

- Expanding Indications & Off-label Use: Ongoing studies and real-world evidence are exploring potential benefits beyond HFrEF, possibly broadening its market.

- Brand Recognition & Physician Preference: Established efficacy reinforces clinician preference, cementing its dominant market position.

Market Challenges

- High Cost & Pricing Strategies: Despite clinical benefits, high drug prices limit access in some regions.

- Patent Expirations & Biosimilar Competition: Patent expiry negotiations could introduce generics or biosimilars, impacting prices and market share.

- Generic Entry & Pricing Pressure: Although patent protection protects initial exclusivity, impending patent cliffs can erode prices over time.[4]

- Healthcare Policy & Reimbursement Fluctuations: Variability in coverage can hamper adoption rates in certain markets.

Pricing Landscape

Current Pricing Trends

In the U.S., the listed wholesale price of Entresto has ranged from $470 to $640 per month depending on dosage and pharmacy. Actual prices paid after rebates are often lower. In the EU, prices are negotiated locally, generally lower than U.S. levels due to pricing regulations.

Cost-effectiveness and Reimbursement Impact

The drug’s high costs are justified by its reduction in hospitalizations and mortality, making it cost-effective under common health economic models in many regions.[5] Governments and insurers generally support reimbursement for eligible patients.

Competitive Landscape

Direct Competitors

- ACE inhibitors (e.g., enalapril, lisinopril): Traditional first-line therapy, with lower cost but less efficacy shown in some studies.

- ARBs (e.g., valsartan): Slightly more expensive but similar efficacy, used prior to SACUBITRIL-VALSARTAN.

- Other novel agents under development or early approval stages focusing on neurohormonal modulation.

Emerging Competitors & Pipeline Products

Several pharmaceutical entities are researching alternative mechanisms to treat HF, including SGLT2 inhibitors (e.g., dapagliflozin, empagliflozin), which are now recommended adjuncts to SACUBITRIL-VALSARTAN.[6] The expanding therapeutic options could influence its market share over time.

Price Projections (2023-2030)

Short-term (2023-2025)

- The market price will largely stabilize with minor reductions driven by rebate negotiations, especially in the U.S. and Europe.

- Patent protections, including patents on specific formulations and combination patents, are expected to last until approximately 2027-2029, shielding against generics.

- Reimbursement policies and value-based pricing agreements will influence net pricing, potentially leading to modest price decreases (~10-15%).

Mid to Long-term (2026-2030)

- Patent expirations around 2027-2029 may precipitate entry of biosimilars or generics, trending toward a 25-40% price reduction.

- The evolution of insurance coverage policies and competitive drugs will influence pricing strategies.

- The incorporation of biosimilars could lower prices, making the drug more accessible, especially in emerging markets.

- Innovations or new combination therapies emerging could pressure the existing pricing structure.

Assumptions Underpinning Projections

- No major regulatory hurdles or patent litigations extend exclusivity.

- Biosimilar competition enters the market as expected.

- Clinical data continues to support the drug’s efficacy and cost-effectiveness.

- Market penetration reaches 70-80% in indicated populations in developed economies by 2028.

Market Growth Outlook & Revenue Potential

- Forecasted global revenue for SACUBITRIL-VALSARTAN could approach $12-15 billion by 2030, driven by expanding indications and increased uptake.

- Developing markets will see increased adoption facilitated by price reductions and local manufacturing.

- Innovation-driven price premiums in high-income markets could sustain higher prices longer.

Regulatory & Policy Impact

- Regulatory agencies are increasingly adopting value-based pricing models, linking reimbursement to clinical outcomes.

- Governments incentivize innovations that reduce hospitalization costs, bolstering market prospects.

- Potential future approvals for chronic heart failure with preserved ejection fraction (HFpEF) or other cardiovascular indications could expand market size and influence prices.

Key Takeaways

- SACUBITRIL-VALSARTAN remains a dominant force in HFrEF management, with a favorable clinical profile backing its market position.

- Its pricing remains high but justified by clinical benefits; however, patent expirations forecast significant price reductions.

- The impending entry of biosimilars post-patent expiry could halve or more its current prices, especially in price-sensitive markets.

- Competition from SGLT2 inhibitors and other emerging agents will influence future market share and pricing strategies.

- Market growth hinges on expanding indications, regulatory support, and integration into broader cardiovascular treatment protocols.

FAQs

1. When will biosimilars or generics for SACUBITRIL-VALSARTAN enter the market?

Patent protections are expected to last until approximately 2027-2029, after which biosimilars and generics are likely to become available, leading to substantial price reductions.

2. How does the pricing of SACUBITRIL-VALSARTAN compare globally?

Prices vary significantly, influenced by local regulatory frameworks, reimbursement policies, and negotiations. The U.S. generally has higher list prices, whereas Europe and Asia tend to have lower prices due to government negotiations.

3. What factors could prevent significant price declines post-patent expiry?

Factors include brand loyalty, patent litigation, slow biosimilar adoption, and regulatory hurdles that might delay market entry or limit competition.

4. Are there upcoming indications that could expand SACUBITRIL-VALSARTAN’s market?

Yes, research into its efficacy for HFpEF, hypertension, or other cardiovascular conditions could broaden its use, increasing market size.

5. How do reimbursement policies influence SACUBITRIL-VALSARTAN’s pricing?

Reimbursement levels directly impact net prices; favorable policies enable broader access and support premium pricing based on cost-effectiveness analyses.

Sources

- Grand View Research. Heart Failure Drugs Market Size, Share & Trends Analysis Report, 2022-2030.

- McMurray, J.J., et al. (2014). "Angiotensin–Neprilysin Inhibition versus Enalapril in Heart Failure." The New England Journal of Medicine.

- American College of Cardiology. Heart Failure Guidelines, 2022.

- Novartis Annual Report, 2022.

- Drummond, M. F., et al. (2017). "Methods for the Economic Evaluation of Health Care Programmes." Oxford University Press.

- Packer, M., et al. (2020). "Cardiovascular Outcomes with SGLT2 Inhibitors in Heart Failure." The New England Journal of Medicine.

More… ↓