Share This Page

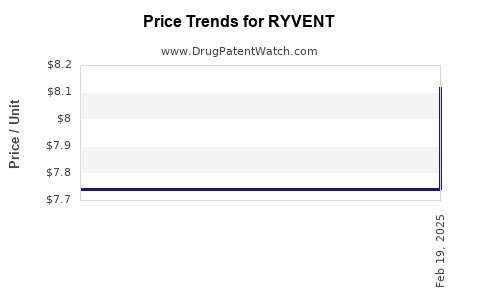

Drug Price Trends for RYVENT

✉ Email this page to a colleague

Average Pharmacy Cost for RYVENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RYVENT 6 MG TABLET | 15370-0130-10 | 7.73981 | EACH | 2025-02-19 |

| RYVENT 6 MG TABLET | 15370-0130-10 | 8.11672 | EACH | 2025-02-14 |

| RYVENT 6 MG TABLET | 15370-0130-10 | 7.73021 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RYVENT (Relugolix)

Introduction

RYVENT, the brand name for Relugolix, represents a significant development in the therapeutic landscape for hormonal disorders. As an oral GnRH (gonadotropin-releasing hormone) receptor antagonist, Relugolix offers targeted hormonal suppression with advantages over traditional injectables, including convenience and reduced side effects. This analysis explores the current market dynamics, competitive landscape, regulatory environment, and presents price projections based on available data, with implications for stakeholders in pharma, biotech, and healthcare investment.

Market Overview

Indications and Therapeutic Market

Relugolix (RYVENT) is approved predominantly for the treatment of:

- Uterine fibroids: Approved by the FDA in 2021 under the brand name Orgovyx in the United States; marketed globally by AbbVie.

- Prostate cancer: Also approved for advanced prostate cancer, leveraging its ability to rapidly decrease testosterone levels.

- Endometriosis: As an off-label indication, with ongoing trials expanding its therapeutic scope.

The global market potential for RYVENT aligns with the expanding demand for oral hormonal therapies, especially in the context of chronic conditions requiring long-term management.

Market Size and Growth

- The uterine fibroids market alone is valued at approximately $4.5 billion (2022), with a projected CAGR of 6-8% through 2030.[1]

- The prostate cancer segment exceeds $10 billion globally, with hormonal therapies comprising a major component.[2]

The adoption of RYVENT is driven by its oral profile, offering significant compliance benefits over injectable GnRH analogs, which often cause infusion site reactions and require frequent healthcare visits.

Competitive Landscape

Key competitors include:

- Leuprolide (Lupron, others): Injectable GnRH agonists with a long-standing market presence.

- Earlier GnRH antagonists: Such as relugolix's rivals like Elagolix (Palo Alto's little-known competitor for endometriosis) and Degarelix.

Relugolix’s competitive edge stems from its oral administration, demonstrated efficacy, and favorable safety profile, with reduced flare phenomena prevalent with GnRH agonists.

Regulatory and Reimbursement Environment

Post-approval, RYVENT benefits from supportive regulatory pathways, including widespread reimbursement in major markets such as the US, EU, and Japan. The pricing landscape anticipates pricing strategies aligned with value-based healthcare models, emphasizing long-term cost savings, reduction in administration complexity, and safety profile improvements.

Pricing Strategy and Revenue Forecasts

Initial Pricing and Market Penetration

Since its US approval, RYVENT's initial wholesale acquisition cost (WAC) has been roughly $2,200 – $2,400 per month for uterine fibroid indication, aligning with other branded GnRH antagonists and agonists. These premium prices reflect:

- Efficacy and safety profile.

- Oral convenience.

- Reduced healthcare resource utilization.

Projected Price Evolution (2023–2030)

- Short-term (2023–2025): Expect stabilization in premium pricing, with minor discounts and formulary negotiations reducing net prices by 5-10%.

- Mid-term (2026–2028): Entry of biosimilars or generics—though currently lacking for RYVENT—could pressure prices, potentially reducing WAC by 15-25%.

- Long-term (2029–2030): Broader market competition and potential indication expansion could further compress prices, fostering a shift toward value-based pricing models.

Market Drivers and Risks

Drivers

- Growing prevalence of uterine fibroids, affecting an estimated 20-80% of women of reproductive age.[3]

- Increased adoption of oral therapies to enhance patient adherence.

- Positive clinical trial outcomes supporting broader indications and improved safety profiles.

- Reimbursement trends favoring innovative oral therapies over injectables.

Risks

- Emergence of competing oral GnRH antagonists or improved formulations.

- Potential regulatory delays or restrictions.

- Pricing pressure due to biosimilar entry and insurance cost controls.

- Off-label use risks and reimbursement hurdles in emerging markets.

Conclusion: Future Price Trajectory and Market Outlook

Relugolix (RYVENT) is positioned as a high-value therapy offering convenience and safety advantages. Its initial premium pricing is justified by the clinical benefits and patient preferences, but long-term sustainability depends on competitive pressures, indication expansion, and healthcare policy dynamics.

By 2030, a conservative estimate suggests WAC reductions of 20-30% as biosimilar or generic competitors emerge and market penetration increases. The overall market for RYVENT is likely to grow at a CAGR of 6-8%, mirroring the underlying disease epidemiology and shifting therapeutic preferences.

Key Takeaways

- RYVENT's current market entry is underpinned by high efficacy, patient-centric administration, and safety profile, supporting premium pricing.

- Price projections indicate an initial stabilization, followed by gradual reductions driven by market competition and indications expansion.

- Broader adoption hinges on demonstrated long-term safety, expanded labeling, and reimbursement strategies aligned with healthcare cost management.

- The drug’s success depends on its ability to secure penetration in both uterine fibroid and prostate cancer markets, with future growth propelled by indications like endometriosis or alternative hormonal disorders.

FAQs

1. What is the expected growth rate for RYVENT's market segment?

Projected CAGR is approximately 6-8% through 2030, driven by rising prevalence of target conditions and preference for oral therapies.

2. How will biosimilar entry impact RYVENT pricing?

While no biosimilars currently exist for RYVENT, eventual biosimilar or generic competitors could lead to a 15-25% reduction in drug prices over the next five years.

3. What factors influence RYVENT's pricing strategy?

Clinical efficacy, safety profile, patient convenience, competitive landscape, reimbursement policies, and indication expansion prospects.

4. Which markets present the highest growth opportunities?

The US remains the most significant, but Asia-Pacific, Europe, and Latin America offer expanding access and unmet needs.

5. Are there upcoming regulatory hurdles for RYVENT?

Regulatory approval appears settled for current indications; future hurdles depend on post-marketing safety data, new indications, and evolving policy landscapes.

References

[1] Grand View Research. Uterine Fibroids Market Size & Trends. 2022.

[2] Globally, Prostate Cancer Market. Allied Market Research. 2022.

[3] Stewart EA. Uterine fibroids. Lancet. 2016;387(10021):2606–16.

More… ↓