Last updated: July 31, 2025

Introduction

Roxicodone, generically known as oxycodone hydrochloride, is a potent opioid analgesic primarily used for managing moderate to severe pain. As a Schedule II controlled substance in the United States, its market dynamics are heavily influenced by regulatory oversight, societal concerns over opioid dependency, and evolving prescribing guidelines. This analysis explores current market conditions, competitive landscape, regulatory influences, and forecasts future pricing trends.

Current Market Landscape

Global and U.S. Market Size

The global opioid analgesics market, valued at approximately USD 9 billion in 2022, is projected to grow at a CAGR of about 3% through 2030, driven by increasing pain management needs and surgical procedures. Within the United States, oxycodone products like Roxicodone hold a significant share owing to their potent analgesic efficacy and widespread prescription history, despite ongoing restrictions and scrutiny.

Key Players and Production

The primary manufacturer of Roxicodone is Purdue Pharma, which faced substantial legal and financial challenges related to its role in the opioid epidemic. Generic manufacturing rights are held by multiple pharmaceutical companies post patent expiration, increasing market competition and impacting pricing. The generic version of oxycodone is widely available, contributing to a downward pressure on prices.

Distribution Channels

Distribution occurs through pharmacies, hospital supplies, and direct-to-consumer channels, with prescriptions predominantly issued by healthcare providers for pain management, palliative care, and post-operative treatment. The role of online pharmacies has expanded but remains tightly regulated, particularly given the drug’s abuse potential.

Regulatory and Legal Environment

Regulatory Restrictions

The U.S. Food and Drug Administration (FDA) and Drug Enforcement Administration (DEA) maintain strict control over oxycodone distribution. New prescribing guidelines aim to curtail over-prescription, impacting volume sales and consequently affecting revenue streams and pricing.

Legal Liabilities

Legal settlements and ongoing litigation have increased manufacturing liabilities, raising production costs for brand-name manufacturers. These liabilities influence pricing strategies, especially as companies balance profitability against legal risk mitigation.

Opioid Reform Policies

Recent public health policies favor alternative pain management strategies, possibly reducing existing demand for Roxicodone. Nonetheless, the underground and illicit markets for diverted pharmaceuticals, including oxycodone, remain significant, complicating market projections.

Price Trends and Forecasts

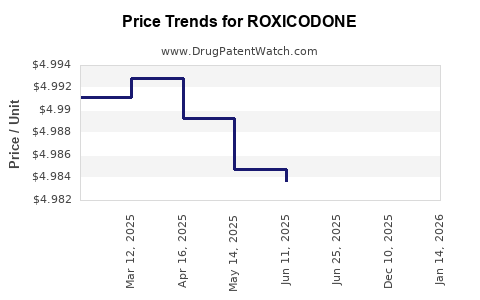

Historical Pricing Analysis

Prior to the opioid crisis, brand-name Roxicodone was priced at approximately USD 7-10 per tablet. Post-2000s, aggressive marketing, and market expansion maintained higher prices. However, from 2010 onwards, increased generic competition and legal settlements precipitated a decline, with recent prices stabilizing around USD 0.50–2 per tablet (generic versions).

Factors Influencing Price Dynamics

- Generic Competition: The expiration of Purdue’s patent in 2013 opened a flood of generics, leading to severe price erosion.

- Regulatory Restrictions: Prescribing limits and opioid stewardship programs further reduce volume sales, impacting economies of scale.

- Production Costs: Stricter manufacturing and compliance costs marginally elevate baseline costs but are offset by declining prices due to competition.

- Illicit Market Influence: Diversion and illegal sales support artificially inflated street prices; however, these do not directly impact legal retail prices but influence overall market perceptions and regulation.

Future Price Projection (Next 5–10 Years)

- Price Decline: As generic manufacturers dominate, retail prices are expected to decline further, stabilizing around USD 0.30–0.80 per tablet.

- Premium Pricing for Controlled or Extended-Release Forms: Specialized formulations such as extended-release oxycodone (e.g., OxyContin) may retain higher prices due to patented formulations, but Roxicodone as a immediate-release product will likely see minimal premium margins.

- Impact of Regulatory Measures: Stricter prescription controls, coupled with alternative pain management policies, will rigorously suppress volume sales, lowering the total revenue generated from Roxicodone.

Market Opportunities and Challenges

Opportunities

- Development of abuse-deterrent formulations to meet regulatory and prescriber demands could preserve pricing margins.

- Expansion into pain management markets in emerging economies with rising healthcare infrastructure.

- Strategic partnerships with compounding pharmacies for specialty formulations.

Challenges

- Tightened regulatory controls and reduced prescribing rates curtail revenue.

- Heightened legal and liability risks escalate costs and influence pricing strategies.

- Competition from alternative therapies, including non-opioid analgesics and non-pharmacological interventions.

Strategic Outlook and Recommendations

Pharmaceutical companies should anticipate continued downward pricing pressure for Roxicodone due to sustained generic competition and regulatory constraints. Emphasis should be on innovation—particularly abuse-deterrent formulations—and diversification into alternative pain management solutions.

Legal liabilities and reputation risks necessitate robust compliance frameworks. Investment in research for non-addictive analgesics could offset declining revenues from traditional opioids. Strategic collaborations with healthcare providers and policymakers are critical for navigating evolving market conditions.

Key Takeaways

- Roxicodone's market has transitioned from a branded product to predominantly generic formulations, resulting in significant price suppression.

- Regulatory oversight and societal efforts to curb opioid misuse remain primary drivers of declining volumes and prices.

- Future pricing will stabilize at lower levels, with premium prices retained only by specialized formulations and abuse-deterrent variants.

- Manufacturers must innovate in formulation and diversify their portfolios to mitigate declining revenues.

- The illicit opioid market continues to influence market perceptions but does not significantly impact legal retail prices.

FAQs

1. What factors have contributed to the declining price of Roxicodone?

The expiration of patents, the proliferation of generic manufacturers, stricter prescribing regulations, and legal liabilities have collectively driven down retail prices.

2. How might recent regulatory changes impact Roxicodone's market in the future?

Enhanced prescribing restrictions and increased focus on alternative pain therapies will likely reduce demand and sales volume, further suppressing prices.

3. Are there any emerging formulations of Roxicodone that could command higher prices?

Yes, abuse-deterrent and extended-release formulations may retain premium pricing, but these are limited to specialized segments with higher regulatory approval hurdles.

4. What opportunities exist for pharmaceutical companies in this market?

Innovating non-addictive pain therapies, developing abuse-deterrent formulations, and expanding into emerging markets present growth opportunities.

5. How does the illicit market affect the legal market for Roxicodone?

Illicit diversion can inflate street prices and influence public perception but has minimal direct impact on regulated retail pricing.

Sources:

[1] MarketWatch, "Opioid Market Size & Trends," 2022.

[2] U.S. Food and Drug Administration, "Pain Management and Opioid Prescribing Guidelines," 2021.

[3] Statista, "Global Opioid Market Revenue Forecast," 2022.

[4] Congressional Research Service, "The Opioid Crisis and Pharmaceutical Industry," 2021.

[5] IQVIA, "Pharmaceutical Market Trends & Insights," 2022.