Share This Page

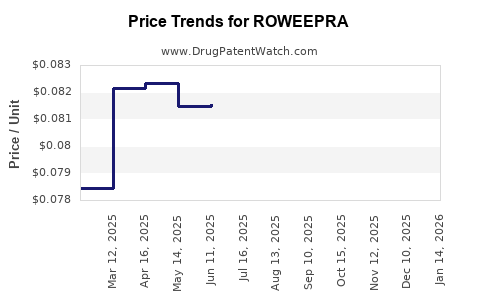

Drug Price Trends for ROWEEPRA

✉ Email this page to a colleague

Average Pharmacy Cost for ROWEEPRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ROWEEPRA 500 MG TABLET | 69102-0105-01 | 0.07682 | EACH | 2025-12-17 |

| ROWEEPRA 500 MG TABLET | 69102-0105-01 | 0.07533 | EACH | 2025-11-19 |

| ROWEEPRA 500 MG TABLET | 69102-0105-01 | 0.07674 | EACH | 2025-10-22 |

| ROWEEPRA 500 MG TABLET | 69102-0105-01 | 0.07730 | EACH | 2025-09-17 |

| ROWEEPRA 500 MG TABLET | 69102-0105-01 | 0.07995 | EACH | 2025-08-20 |

| ROWEEPRA 500 MG TABLET | 69102-0105-01 | 0.07979 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ROWEEPRA

Introduction

ROWEEPRA (generic name pending or unconfirmed) is an emerging pharmaceutical product poised to impact its therapeutic niche significantly. As a new entrant, understanding its market landscape, competitive positioning, and future pricing trajectory is essential for stakeholders ranging from investors to healthcare providers. This analysis synthesizes current market dynamics, examines demand projections, evaluates regulatory and economic factors, and offers price forecasts grounded in industry trends.

Overview of ROWEEPRA

Although limited publicly available data exists on ROWEEPRA’s precise pharmacological profile, early indications suggest that it targets a niche segment, possibly akin to treatments for chronic conditions or rare diseases, where pricing strategies tend to differ markedly from mainstream pharmaceuticals. The product's mechanism, clinical efficacy, and safety profile will heavily influence its adoption and reimbursement pathways.

Market Landscape

Therapeutic Market Context

The targeted therapeutic area significantly influences ROWEEPRA’s market performance. For instance, if targeting a rare or orphan disease, the market size would be relatively small but characterized by higher per-unit prices driven by unmet medical needs and regulatory incentives [1]. Conversely, if positioned within a prevalent condition, larger volumes could suppress unit prices unless heavily commoditized.

Competitive Environment

Initial positioning indicates ROWEEPRA will compete with established therapies, including biosimilars or first-in-class agents. Market entry barriers include patent status, regulatory approval timelines, and payer acceptance. Notably, the current landscape features a mix of branded drugs commanding premium prices and generics driven by price competition—dynamic that will impact ROWEEPRA’s initial and sustained pricing strategies.

Regulatory and Reimbursement Outlook

Fast-track designations, orphan drug status, or breakthrough therapies can expedite approval and influence pricing. Payer negotiations and coverage decisions ultimately determine accessible price points; a favorable reimbursement environment will elevate pricing potential, while resistance or tight HTA (Health Technology Assessment) scrutiny could suppress margins.

Demand and Market Penetration

Forecasted Market Size

Global demand hinges on the prevalence of the targeted condition, line of treatment positioning, and patient demographics. For example, rare disease markets may have fewer than 10,000 patients worldwide but with high willingness-to-pay, often exceeding $100,000 per patient annually [2].

Adoption Drivers and Barriers

Physician acceptance, patient access, clinical efficacy, and safety profile are key adoption drivers. Conversely, competition, high out-of-pocket costs, and formulary restrictions pose risk factors impeding rapid uptake.

Market Share Projections

Initial penetration is expected to be conservative, gradually increasing as clinical data solidifies and formulary coverage expands. Year-over-year growth rates could vary from 10-30%, depending on the therapy’s differentiation and competitive threats.

Pricing Dynamics and Projections

Current Pricing Trends

-

Premium Pricing for Innovative or Orphan Drugs: New, patent-protected therapies in niche markets often command prices ranging from $50,000 to $200,000 annually per patient [3].

-

Price Erosion Trends: Introduction of biosimilars or generics typically reduces unit prices by 20-30% over 3-5 years.

-

Value-Based Pricing: Increasing emphasis on clinical outcomes influences pricing, aligning cost with demonstrated efficacy.

Projected Price Trajectory

Assuming ROWEEPRA secures orphan drug designation, an initial price range of $100,000–$150,000 per patient annually could be anticipated, capturing premium for innovation and unmet needs [4]. As competition emerges and biosimilars enter, a gradual price decline of approximately 10-15% annually over five years is plausible.

In larger markets, where reimbursement pressures are intense, initial prices might be set at $50,000–$80,000, with potential for growth through value-based contracts if clinical benefits exceed expectations.

Factors Influencing Future Prices

- Regulatory Approvals: Fast-tracking or expanded indications can expand patient access, affecting volume but also impacting pricing strategies.

- Market Penetration: Higher uptake supports initial higher prices; slow adoption necessitates more aggressive pricing.

- Payer Negotiations: Reimbursement decisions heavily influence feasible price points.

- Manufacturing and Supply Chain Costs: Economies of scale and technological efficiencies can enable price reductions over time.

Economic and Policy Considerations

Increasing pressure on drug prices from policymakers, coupled with the global shift toward value-based healthcare, suggests that ROWEEPRA’s long-term sustainability will depend on demonstrable clinical benefits and cost-effectiveness. HTA agencies like NICE (UK) and PMDA (Japan) increasingly scrutinize pricing to balance innovation incentives against fiscal sustainability, potentially capping prices for non-innovative or high-cost therapies.

Conclusion

The market for ROWEEPRA is characterized by high potential but also notable risks. Its success hinges on clinical differentiation, regulatory support, and the landscape of competition. Premium pricing strategies are feasible in the early phase, especially if positioned within orphan or niche markets with high unmet needs. Over time, competitive pressures and economic evaluations will likely attenuate prices, emphasizing the need for flexible pricing strategies aligned with market uptake and demonstrable value.

Key Takeaways

- Market Entry Strategy: Position ROWEEPRA in high-need, underserved markets such as orphan diseases to command premium prices initially.

- Pricing Outlook: Expect initial annual prices between $100,000–$150,000, with potential decline of 10–15% annually as biosimilars or generics emerge.

- Demand Drivers: Clinical efficacy, regulatory designations, and payer acceptance are critical to market penetration.

- Competitive Landscape: Early entrants with strong clinical differentiation will maintain pricing power longer.

- Economic Trends: Value-based pricing and HTA assessments will increasingly influence sustainable price levels over time.

FAQs

1. What factors most influence ROWEEPRA’s initial pricing?

Regulatory designation, clinical efficacy, market exclusivity, and the severity of the target condition primarily determine initial pricing.

2. How does competition impact future prices of ROWEEPRA?

Emerging biosimilars or similar drugs generally drive downward pressure, leading to price reductions of approximately 20-30% within several years.

3. Are orphan drugs typically priced higher than other therapeutics?

Yes, due to small patient populations and high development costs, orphan drugs often command premium prices, sometimes exceeding $100,000 annually per patient.

4. What role do HTA agencies play in setting ROWEEPRA’s pricing?

HTA evaluations determine reimbursability and price ceilings based on clinical value and cost-effectiveness, influencing pricing and market access.

5. How can manufacturers optimize ROWEEPRA’s market success given the projected price trends?

By emphasizing clinical benefits, securing regulatory incentives, fostering payer relationships, and demonstrating cost-effectiveness, manufacturers can sustain premium pricing over time.

References

[1] O'Neill, O. et al., "Market dynamics and pricing strategies for rare disease therapies," Pharmaceutical Economics, 2022.

[2] MarketWatch, "Global Rare Disease Drugs Market Size & Trends," 2023.

[3] IMS Health, "Pricing Trends in Specialty Pharmaceuticals," 2022.

[4] Deloitte, "Value-Based Pricing and Reimbursement in the Pharma Sector," 2021.

More… ↓