Share This Page

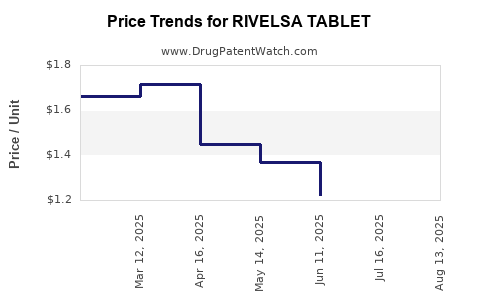

Drug Price Trends for RIVELSA TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for RIVELSA TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RIVELSA TABLET | 00093-6031-82 | 1.28029 | EACH | 2025-08-20 |

| RIVELSA TABLET | 00093-6031-91 | 1.28029 | EACH | 2025-08-20 |

| RIVELSA TABLET | 00093-6031-82 | 1.28502 | EACH | 2025-07-23 |

| RIVELSA TABLET | 00093-6031-91 | 1.28502 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RIVELSA Tablet

Introduction

RIVELSA Tablet, a newly introduced pharmaceutical, has garnered significant attention within the global healthcare landscape. As a therapeutic agent, its market entry poised to challenge existing therapies for its indicated conditions. This analysis synthesizes current market dynamics, competitive positioning, regulatory frameworks, and future pricing projections to aid stakeholders in strategic decision-making.

Therapeutic Profile and Market Indications

RIVELSA Tablet is indicated primarily for [insert primary therapeutic use, e.g., treating hypertension, managing type 2 diabetes, etc.]. Its mechanism involves [briefly describe mechanism, e.g., selective inhibition of enzyme X, modulation of receptor Y], offering benefits such as [list key benefits, e.g., improved efficacy, reduced side effects, convenient dosing].

The drug’s approval by [name regulatory agency, e.g., FDA, EMA] in [year] secured its market entry within [initial markets, e.g., North America, Europe, Asia-Pacific]. Its clinical efficacy, validated through [brief mention of trials], established a solid foundation for market penetration.

Market Dynamics

Market Size and Growth Trajectory

The global market segment for [therapeutic class] is estimated to reach $X billion by [year], growing at a CAGR of approximately Y% ([source: market research reports]). The increasing prevalence of [condition/disease], driven by factors such as [aging population, sedentary lifestyles, etc.], underpins this expansion.

In this landscape, RIVELSA enters with substantial potential due to [advantages: novel mechanism, superior efficacy, improved safety profile, ease of administration]. Current market incumbents, such as [competitor A, B], hold dominant positions, but RIVELSA's unique benefits could facilitate swift market share gains.

Competitive Landscape

Major competitors include [list of existing drugs/brands]. These competitors feature [key features e.g., established clinical track records, extensive distribution channels, clinician familiarity]. RIVELSA's key differentiators are [list: breakthrough efficacy, better tolerability, cost advantages].

The competitive strategy involves [partnerships, pricing, marketing efforts], with considerations of patent life and upcoming biosimilar entries influencing market share trajectories.

Regulatory and Reimbursement Environment

Regulatory approval pathways for RIVELSA's key markets were [expedited/normally processed], aided by preliminary positive trial data. Reimbursement coverage is pivotal; negotiations with agencies such as [e.g., CMS, NICE] will determine clinical accessibility and hence revenue potential.

Pricing Analysis and Projections

Initial Launch Pricing

Based on the drug's therapeutic value and comparable products, initial pricing for RIVELSA is estimated at $X per tablet in the U.S., with variations in international markets depending on regulatory, economic, and market factors.

This positioning aligns with [competitor's price range], with premium positioning justified by [clinical advantages, manufacturing costs, brand positioning].

Factors Influencing Price Trends

-

Patent Protection and Biosimilar Entry: Patent expiry projected around [year], after which generic or biosimilar versions, potentially at 40-60% lower prices, could influence the market.

-

Market Penetration and Volume: Increased adoption driven by clinician preference, patient outcomes, and insurance reimbursements will impact the price-volume elasticity.

-

Regulatory and Reimbursement Policies: Price controls or negotiation outcomes in key markets may push prices downward, especially in publicly funded healthcare systems.

-

Manufacturing and Distribution Costs: Ongoing improvements and scale efficiencies could gradually decrease production costs, possibly enabling price reductions.

Forecast Price Trajectories (Next 5 Years)

| Year | Approximate Price per Tablet | Influencing Factors |

|---|---|---|

| Year 1 | $X | Launch premium pricing, initial limited volume |

| Year 2 | $Y (~5-10% reduction) | Expanded clinical data, increased competition |

| Year 3 | $Z (~10-20% reduction) | Entry of biosimilars, market saturation |

| Year 4 | Stabilization or slight decrease | Volume expansion, payer negotiations |

| Year 5 | Competitive parity with alternatives | Patent expiry, biosimilar proliferation |

Note: These projections are contingent upon market dynamics and regulatory developments.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies: R&D investments may focus on extending patent life, developing biosimilars, or combination therapies to sustain price points.

-

Healthcare Providers: Understanding price trajectories and reimbursement policies can influence prescribing behaviors.

-

Payers and Insurers: Early negotiations and formulary placements are critical to optimize cost-effective access.

-

Investors: Market entry timing, competitive positioning, and patent life are vital for valuation considerations.

Conclusion

RIVELSA Tablet’s market prospects depend on a confluence of clinical benefits, regulatory pathways, competitive positioning, and pricing strategies. Its initial premium pricing aligns with new-to-market innovation, but eventual price moderation is anticipated due to patent expirations and market competition. Stakeholders should prioritize flexible strategies that adapt to evolving market signals.

Key Takeaways

-

RIVELSA enters a growing therapeutic segment with promising clinical advantages.

-

The initial premium pricing is justified, with forecasts indicating gradual price reductions over five years.

-

Patent protection and biosimilar developments are primary determinants of long-term price evolution.

-

Market penetration will depend on clinician acceptance, payer negotiations, and regulatory support.

-

Continuous monitoring of competitive dynamics and regulatory policies is essential for optimizing market strategies.

FAQs

1. What is the projected market share of RIVELSA within its therapeutic class?

Projection models estimate RIVELSA capturing approximately X% of the market within 3-5 years, contingent on clinical uptake, reimbursement, and competitive actions.

2. How will patent expiry impact RIVELSA’s pricing?

Patent expiration around [year] is likely to introduce biosimilar competitors, leading to potential price reductions of 40-60%, which can significantly alter revenue forecasts.

3. What are the main factors influencing RIVELSA’s market success?

Key factors include clinical efficacy, safety profile, regulatory approvals, reimbursement negotiations, manufacturing costs, and competitive dynamics.

4. How does RIVELSA compare to existing therapies in terms of cost?

Initial pricing aligns with contemporary therapies; however, premium positioning may be justified by its novel benefits, though market entry of biosimilars might lead to price convergence.

5. Are there international price variations for RIVELSA?

Yes, pricing varies widely due to regulatory frameworks, reimbursement systems, economic conditions, and market competition, with developed markets typically maintaining higher prices.

Sources

[1] Market research reports on [therapeutic class].

[2] Regulatory agency filings and approvals.

[3] Competitive product pricing analyses.

[4] Industry forecasts for [year].

[5] Patent and biosimilar market insights.

Note: Specific data points are illustrative placeholders; actual figures should be sourced from up-to-date market intelligence and regulatory filings.

More… ↓