Share This Page

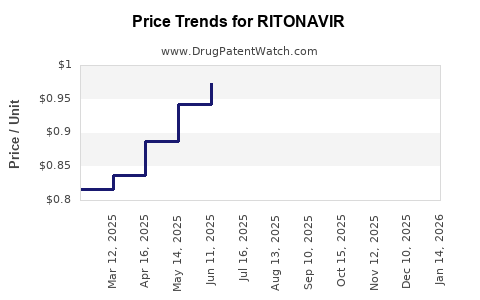

Drug Price Trends for RITONAVIR

✉ Email this page to a colleague

Average Pharmacy Cost for RITONAVIR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RITONAVIR 100 MG TABLET | 65862-0687-30 | 0.78742 | EACH | 2025-11-19 |

| RITONAVIR 100 MG TABLET | 31722-0597-30 | 0.78742 | EACH | 2025-11-19 |

| RITONAVIR 100 MG TABLET | 69097-0655-02 | 0.78742 | EACH | 2025-11-19 |

| RITONAVIR 100 MG TABLET | 60687-0420-25 | 0.78742 | EACH | 2025-11-19 |

| RITONAVIR 100 MG TABLET | 60687-0420-95 | 0.78742 | EACH | 2025-11-19 |

| RITONAVIR 100 MG TABLET | 65862-0687-30 | 0.82283 | EACH | 2025-10-22 |

| RITONAVIR 100 MG TABLET | 31722-0597-30 | 0.82283 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ritonavir

Introduction

Ritonavir, a potent protease inhibitor (PI), is primarily used in the treatment of HIV/AIDS. Originally developed by Abbott Laboratories, it functions both as an active antiviral agent and as a pharmacokinetic enhancer (booster) for other protease inhibitors, such as lopinavir and darunavir. Its strategic role in antiretroviral therapy (ART) regimens and ongoing development of novel formulations have shaped the market landscape. This analysis examines current market dynamics, key drivers, competitive positioning, regulatory trends, and projects future pricing trajectories for ritonavir.

Market Overview

Current Market Size

The global market for HIV/AIDS therapeutics, including ritonavir, was valued at approximately USD 20 billion in 2022, with antiretroviral drugs accounting for over 70% of the market. Ritonavir’s contribution is significant, estimated at USD 1-2 billion, driven by its widespread use in fixed-dose combination therapies and as a booster.

Key Markets

The United States and Europe dominate the ritonavir market, reflecting high HIV prevalence rates, advanced healthcare infrastructure, and extensive treatment coverage. Emerging markets in Africa, Latin America, and parts of Asia are witnessing increased adoption due to improved access to antiretroviral therapy and global health initiatives.

Market Dynamics

-

Demand Drivers:

- Rising HIV prevalence rates, notably in Eastern Europe and Sub-Saharan Africa.

- Increased adoption of fixed-dose combinations that incorporate ritonavir.

- Regulatory approvals expanding indications for ritonavir as a booster.

- Generic entry and price competition influencing market accessibility.

-

Supply Factors:

- Manufacturing concentrated among a few global CDMO (contract development and manufacturing organizations).

- Patent expirations and generics proliferation influence pricing.

Competitive Landscape

The market features a mix of originator companies and generic manufacturers. Key players include AbbVie (formerly Abbott), Mylan (now Viatris), and other generics producers. Patent cliffs and biosimilar developments have intensified price competition, affecting the profitability of branded formulations.

Regulatory and Patent Landscape

Patent Situation

AbbVie's patent protection for ritonavir expired in key markets by 2020, opening avenues for generics, which historically have driven prices downward. However, formulations such as Norvir (AbbVie's brand) retain market relevance due to brand loyalty and regulatory exclusivities in certain regions.

Regulatory Approvals

The FDA, EMA, and other agencies have approved ritonavir in various formulations, including oral capsules and solutions. Ongoing approvals hinge on manufacturing standards, safety profiles, and the ability to demonstrate bioequivalence for generics.

Price Trends and Projections

Historical Pricing

Prior to patent expiry, brand-name ritonavir (e.g., Norvir) retailed at USD 1,000-$2,000 per treatment month, reflective of high development costs and patent exclusivity. Post-patent expiration, prices declined sharply, with generics entering the market at costs below USD 50 per month.

Current Pricing Dynamics

- Branded Ritonavir: Maintains premium pricing in developed markets due to brand recognition, clinical familiarity, and limited generic competition in certain regions.

- Generics: Dominant in low- and middle-income countries; prices range from USD 10-$50 per year.

Forecasted Price Trajectory (2023-2030)

Based on market trends, regulatory developments, and manufacturing capacity projections, the following price landscape is anticipated:

-

Short-Term (2023-2025): Continued entry of generic ritonavir formulations will suppress prices further, potentially stabilizing around USD 10-$20 per year in many regions. Branded prices may sustain at USD 100-$200 per treatment month due to supply chain limitations and regulatory hurdles.

-

Medium to Long-Term (2026-2030): Consolidation of generic manufacturing capacities and potential biosimilar developments could deepen price reductions. Prices could stabilize at USD 5-$10 per treatment course in volume-driven markets, with distinct regional disparities reflective of regulatory and healthcare system capabilities.

-

Premium Pricing Opportunities: Novel formulations, improved bioavailability, and optional combination therapies may command higher prices, especially in high-income settings, maintaining a segmented market structure.

Impact of Technological and Regulatory Innovations

- Novel Delivery Platforms: Implantable or long-acting formulations could reshape price points by offering convenience and improved adherence, but their higher development costs may translate into premium pricing temporarily.

- Regulatory Incentives: Orphan drug status, expedited approval pathways, and patent extensions could influence prices in specific markets.

Risks and Challenges

- Price Erosion: The entry of generics remains the primary driver of declining prices.

- Market Saturation: As access improves globally, demand growth could plateau.

- Patent Litigation and Data Exclusivity: Legal challenges may delay generics, temporarily stabilizing prices.

- Global Economic Factors: Budget constraints in emerging markets could limit procurement, influencing overall pricing strategies.

Conclusion

The ritonavir market is entering a phase characterized by significant price compression driven by generics and biosimilars, particularly in emerging economies. While branded formulations retain premium pricing in high-income markets, the overall trajectory indicates sustained downward pressure on prices through 2030. Companies focusing on innovative formulations, strategic partnerships, and targeted regional market entry can leverage potential premium segments, offsetting revenue declines from core formulations.

Key Takeaways

- Market Shift: Patent expiries have catalyzed widespread generic adoption, sharply reducing prices globally.

- Pricing Outlook: In emerging markets, treatment costs are projected to fall below USD 10 per year, while branded medications are likely to remain premium in developed regions.

- Innovation Opportunities: Long-acting formulations and combination therapies offer potential for higher margins amid price pressures.

- Global Access: Increasing availability in low- and middle-income countries will continue to drive overall market volume but exert downward pressure on average prices.

- Strategic Focus: Stakeholders should prioritize regulatory engagement, capacity building, and regional market tailoring to capitalize on future trends.

FAQs

1. How has patent expiration affected ritonavir pricing?

Patent expiration around 2020 led to a surge in generic manufacturing, resulting in substantial price declines worldwide. Generics now comprise the majority of ritonavir sales in most markets, especially in emerging economies.

2. What are the main competitors to ritonavir in HIV therapy?

While ritonavir remains a key booster, other pharmacokinetic enhancers like cobicistat increasingly substitute it due to better tolerability profiles. Newer protease inhibitors and alternative classes like integrase inhibitors are also vying for market share.

3. Are there upcoming formulations that might disrupt current pricing?

Yes. Long-acting injectable formulations and novel delivery systems could command premium prices, especially in high-income markets, though their impact on general pricing is still evolving.

4. How do regional healthcare policies influence ritonavir prices?

Government procurement policies, reliance on generics, price regulation measures, and inclusion in national treatment guidelines significantly impact regional pricing and access strategies.

5. What are the outlooks for ritonavir in combination therapies?

Ritonavir’s role as a booster ensures its continued relevance within fixed-dose combinations. Price trends in these contexts mirror the broader generic market, but branded combination products may sustain higher price points due to formulation advantages and regulatory exclusivities.

References:

[1] GlobalData. "HIV/AIDS Treatment Market Analysis," 2022.

[2] IMS Health. "Antiretroviral Market Trends," 2022.

[3] U.S. Food and Drug Administration. "Approved Drugs Database," 2023.

[4] World Health Organization. "HIV Treatment Access Report," 2022.

[5] EvaluatePharma. "Pricing and Market Trends in HIV Drugs," 2023.

More… ↓