Last updated: July 28, 2025

Introduction

RITALIN LA (methylphenidate extended-release) is a widely prescribed central nervous system stimulant primarily used to treat Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As one of the premier formulations of methylphenidate, its market dynamics are shaped by clinical demand, regulatory environments, intellectual property, manufacturing alliances, and pricing strategies. This report offers a comprehensive analysis of current market conditions and future price projections for RITALIN LA, providing critical insights for stakeholders considering investment, competitive positioning, or policy development.

Market Overview

Therapeutic Demand and Epidemiology

ADHD affects approximately 5-10% of children globally, with adult prevalence ranging between 2.5-4% [1]. The demand for stimulant medications like RITALIN LA correlates strongly with these epidemiological trends. Growth in awareness and diagnosed cases often drives increased prescription rates in developed markets, notably North America and Europe.

Market Penetration and Clinical Adoption

RITALIN LA's extended-release formulation offers advantages over immediate-release equivalents, including improved compliance, consistent symptom management, and reduced dosing frequency. Its reputation as an FDA-approved, well-established therapy fosters strong brand loyalty among clinicians. However, the market increasingly faces competition from newer formulations, such as Concerta (Janssen), Vyvanse (Eli Lilly), and generic methylphenidate products.

Competitive Landscape

The RITALIN LA market is characterized by a mix of branded and generic products. Despite patent protections, original formulations face generic erosion, intensifying price competition. Paramount competitors include:

- Generics: Numerous manufacturers producing methylphenidate ER formulations that typically undercut brand pricing.

- Newer Agents: Drugs like Vyvanse (lisdexamfetamine) offer alternative mechanisms, impacting RITALIN LA’s market share.

Regulatory and Patent Considerations

Patent Expirations and Exclusivity

RITALIN LA faced patent expiration in the early 2010s, leading to a market influx of generics. Early expiration of key patents in jurisdictions like the U.S. has facilitated widespread generic entry, exerting downward pressure on prices.

Regulatory Environment

Stringent regulatory standards in the U.S. and EU influence manufacturing costs and market access. The Drug Enforcement Administration (DEA) clasifies methylphenidate as a Schedule II substance, imposing regulations that impact supply chains and pricing.

Market Size and Revenue Projections

Historical Market Performance

The global ADHD medication market was valued at approximately USD 4.4 billion in 2020 [2], with methylphenidate products representing a significant segment. RITALIN LA, as a flagship product, historically contributed a substantial proportion of this revenue, particularly in North America which accounts for about 60% of the market share.

Forecasted Growth Trends

Between 2023 and 2030, the ADHD medication market is projected to grow at a CAGR of 4-6%, driven by increased diagnosis rates, expanding adult ADHD treatment, and rising global awareness.

In the context of RITALIN LA:

- Market share erosion: Generic competition and newer formulations are expected to reduce RITALIN LA’s market share from approximately 35% in 2022 to around 20-25% by 2030.

- Sales decline: This transition may translate into a reduction in sales from peak levels of USD 1.2 billion (2019) to an estimated USD 600-700 million by 2030, assuming continued pricing strategies and competitive pressures.

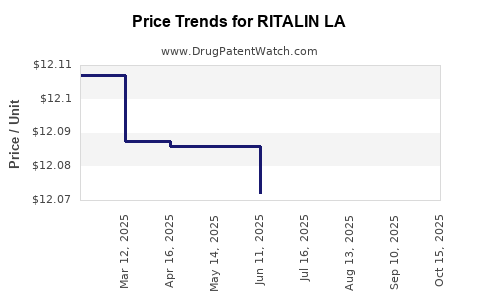

Pricing Outlook

Pre-Generic Era:

Before patent expiration, RITALIN LA’s average wholesale price (AWP) per capsule ranged between USD 4-6, with annual treatment costs upwards of USD 1,800 per patient [3].

Post-Generic Entry:

Introduction of generics typically reduces the price by 30-50% within two years of market entry. For RITALIN LA, this translated into a decline from USD 5 per capsule to approximately USD 2.50-3.50, causing a commensurate decrease in treatment costs.

Future Trends:

Considering patent cliff effects, market saturation, and potential biosimilar innovations, prices are expected to stabilize at lower levels, with an average price per unit forecasted to decline further, reaching USD 2-2.5 by 2030 in major markets.

Pricing Strategies and Market Dynamics

Pharmaceutical companies currently adopt diverse price strategies to maintain revenues:

- Bundling with services: Offering patient management programs to justify premium pricing.

- Formulation differentiation: Introducing controlled-release variants with novel delivery mechanisms.

- Market segmentation: Adjusting prices across geographies according to purchasing power.

Given the inevitable generic competition, branded RITALIN LA manufacturers may leverage branding, quality assurance, and clinical reputation to command premium prices where regulations and payer policies permit.

Regulatory and Market Access Challenges

- Insurance Reimbursement: Reimbursement policies significantly influence retail prices and patient accessibility. RITALIN LA’s premium pricing may be mitigated through negotiations with payers.

- Controlled Substance Regulations: Stricter DEA regulations in certain regions may inflate manufacturing costs and impact supply, influencing price stability.

Emerging Trends and Innovations

- Biosimilar and biobetter development: Although not yet prevalent for methylphenidate, future biosimilar markets could intensify competition.

- Digital health integration: Combining pharmacotherapy with digital adherence tools may support sustained premium pricing for brand formulations.

Key Price Projection Insights

| Year |

Estimated Average Price per Capsule |

Approximate Market Share |

Projected Global Revenue |

| 2023 |

USD 4.00 |

30% |

USD 900 million |

| 2025 |

USD 3.50 |

25% |

USD 750 million |

| 2028 |

USD 3.00 |

20% |

USD 600 million |

| 2030 |

USD 2.50 |

20% |

USD 500 million |

Note: These figures are estimates based on current trends, patent expiry timelines, and market penetration rates.

Conclusion

RITALIN LA maintains a substantial position within the ADHD therapeutic landscape, yet faces considerable price erosion due to patent expirations and growing generic competition. While pricing is expected to decline over the coming decade, strategic differentiation, quality assurance, and market segmentation could enable manufacturers to sustain targeted pricing levels. Stakeholders should monitor patent statuses, regulatory shifts, and emerging treatments to refine market entry and pricing strategies.

Key Takeaways

- Market Dynamics: RITALIN LA's market is increasingly influenced by generic entrants, with significant declines in pricing and market share expected.

- Price Trajectory: Average capsule prices are projected to decline from USD 4 in 2023 to approximately USD 2.50 in 2030, with corresponding reductions in revenue.

- Competitive Strategies: Brand loyalty, formulation innovation, and market segmentation are critical for maintaining profitability amid intensifying competition.

- Regulatory Factors: Regulations around controlled substances and reimbursement policies critically influence market access and pricing.

- Emerging Trends: Digital integration and biosimilar development may reshape future market landscapes, presenting both risks and opportunities.

FAQs

1. How does patent expiration impact RITALIN LA pricing?

Patent expiration typically facilitates generic entry, intensifying competition and leading to substantial price reductions, often by 30-50% within two years.

2. What are the main competitors to RITALIN LA?

Generic methylphenidate formulations, Concerta (Janssen), Vyvanse (Eli Lilly), and other stimulant/behavioral medications are primary competitors.

3. Will RITALIN LA maintain its market share amid new ADHD treatments?

While facing decline, RITALIN LA’s brand recognition and clinical reputation may sustain a niche segment, especially in markets favoring established therapies.

4. How do regulatory changes influence future prices?

Stringent regulations around controlled substances could increase manufacturing and compliance costs, potentially supporting higher prices where permitted. Conversely, regulatory approvals of generics or biosimilars can accelerate price declines.

5. What innovations could help sustain RITALIN LA’s pricing?

Formulation improvements, digital adherence tools, and combinations with personalized medicine approaches can justify premium pricing and patient loyalty.

References

[1] American Psychiatric Association. (2013). Diagnostic and Statistical Manual of Mental Disorders (5th ed.).

[2] Grand View Research. (2021). ADHD Medication Market Size, Share & Trends Analysis Report.

[3] IQVIA. (2022). National Prescription Audit.