Share This Page

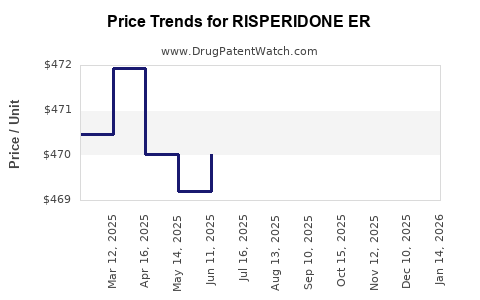

Drug Price Trends for RISPERIDONE ER

✉ Email this page to a colleague

Average Pharmacy Cost for RISPERIDONE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RISPERIDONE ER 50 MG VIAL | 00480-1453-08 | 948.75715 | EACH | 2025-12-17 |

| RISPERIDONE ER 50 MG VIAL | 00480-9735-01 | 948.75715 | EACH | 2025-12-17 |

| RISPERIDONE ER 25 MG VIAL | 00480-1232-08 | 490.57929 | EACH | 2025-12-17 |

| RISPERIDONE ER 25 MG VIAL | 00480-9733-01 | 490.57929 | EACH | 2025-12-17 |

| RISPERIDONE ER 25 MG VIAL | 00480-9733-01 | 493.91143 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RISPERIDONE ER

Introduction

Risperidone Extended Release (Risperidone ER) is a long-acting formulation of risperidone, an atypical antipsychotic primarily prescribed for schizophrenia, bipolar disorder, and irritability associated with autism. Its extended-release mechanism offers benefits like improved adherence, reduced dosing frequency, and stable plasma concentrations. The pharmaceutical landscape surrounding Risperidone ER is poised for consumption growth, driven by escalating mental health awareness, expanding indications, and evolving treatment paradigms. This article provides a comprehensive market analysis and price projection strategy for Risperidone ER, factoring in current trends, competitive dynamics, regulatory influences, and economic variables.

Market Overview

Global Market Size and Growth

The antipsychotic drugs market, valued at approximately USD 13.5 billion in 2022, is expected to witness a CAGR of around 3.7% over the next five years, reaching USD 17.5 billion by 2028 [1]. Risperidone, as one of the leading atypical antipsychotics, commands a significant share within this sector. The extended-release versions constitute a burgeoning niche, projected to accelerate at a higher CAGR of approximately 5%, driven by increased patient preference for long-acting formulations.

Key Market Drivers

-

Rising Prevalence of Mental Health Disorders: According to WHO, over 300 million people suffer from schizophrenia globally, with bipolar disorder affecting approximately 45 million individuals [2]. The growing burden necessitates effective, long-term treatment options like Risperidone ER.

-

Enhanced Patient Compliance: Extended-release formulations mitigate adherence challenges linked with daily oral medication, especially among non-compliant populations, reducing relapse rates.

-

Regulatory Approvals and Expanding Indications: Continued approvals for use in autism-related irritability and bipolar disorder diversify the target patient group, broadening market opportunities.

-

Advancements in Drug Delivery Technologies: Innovations in depot injection systems increase acceptance among clinicians and patients, fostering market expansion.

Competitive Landscape

Major players include Johnson & Johnson (risperidone microspheres), Teva Pharmaceuticals, Sandoz, and Sun Pharmaceutical. Johnson & Johnson’s Risperdal Consta remains a dominant product but faces competition from generic and biosimilar players seeking market share.

Regulatory and Reimbursement Environment

-

Regulatory Approvals: Approved by FDA, EMA, and other agencies, Risperidone ER’s market access hinges on regulatory compliance and post-marketing surveillance.

-

Pricing and Reimbursement Policies: Variations across geographies impact sales. Developed markets (US, Europe, Japan) exhibit higher reimbursement levels, supporting premium pricing, while emerging markets face cost-conscious procurement.

-

Patent and Exclusivity Landscape: Patent expirations for core formulations have introduced generics, pressuring prices but also expanding market volume.

Price Trends and Projections

Historical Price Patterns

Historically, branded Risperidone ER formulations have commanded premium prices, averaging USD 20-30 per 30-day supply in the US, driven by brand recognition and clinical confidence. Generic versions introduced post-patent expiry have reduced prices by approximately 40-60%.

Current Pricing Landscape

-

Developed Markets: Premium formulations cost USD 25-35. Generics are available at USD 10-15, affecting branded sales.

-

Emerging Markets: Prices range between USD 5-12 owing to pricing regulations and lower income levels.

Projected Price Trends (2023-2028)

Short to Mid-Term (2023-2025):

-

Premium formulations are likely to sustain their premium, with slight adjustments due to inflation and supply chain costs. Prices are projected to hold steady or marginally increase by around 2-3%, driven by inflationary pressures and ongoing R&D investments.

-

Generics and biosimilars may see price erosion of 10-20%, further undercutting branded options as patent protections weaken.

Long-Term (2026-2028):

-

Market saturation and increased use of biosimilars could intensify price competition, leading to reductions of 15-25% from current levels.

-

Cost containment policies in public healthcare systems may enforce price ceilings, particularly in Europe and Asia.

-

Innovations such as depot delivery modifications or combined therapy formulations could influence pricing structures positively if they demonstrate superior compliance and outcomes.

Market Segmentation and Forecast

By Indication

-

Schizophrenia: Remains the primary driver, constituting about 70% of sales. Stable growth expected with a CAGR of 3-4%.

-

Bipolar Disorder and Autism: Growing indications with higher growth potential (5-6%) due to increasing recognition and approvals.

By Geography

-

North America: Dominates market share (~45%), supported by high reimbursement rates and advanced healthcare infrastructure.

-

Europe: Significant but slower growth; pricing pressures may lead to moderate price declines over time.

-

Asia-Pacific: Fastest growth rates (6-8%) owing to expanding healthcare access, affordability, and increasing mental health awareness.

Strategic Price Positioning and Market Entry

For companies entering or expanding within the Risperidone ER market:

-

Leverage patent expirations to introduce lower-cost generics, capturing price-sensitive segments.

-

Focus on premium formulations with added benefits such as improved compliance to justify higher pricing tiers.

-

Tailor pricing strategies regionally, accounting for economic and regulatory nuances.

-

Engage in value-based pricing models emphasizing long-term savings through reduced relapse and hospitalization.

Key Challenges and Considerations

-

Generic Competition: Rapid patent expirations threaten branded sales and margins; proactive lifecycle management is vital.

-

Regulatory Hurdles: Variability in approval processes across markets necessitates localized approaches.

-

Pricing Regulations: Governments seek to control drug prices, especially in public health systems, impacting profitability.

-

Market Penetration: Educating clinicians and patients on the benefits of Risperidone ER over oral formulations influences uptake and price acceptance.

Conclusion

The Risperidone ER market demonstrates consistent growth fueled by rising mental health disorders and advancements in drug delivery. Price projections suggest ongoing stabilization with gradual declines driven by generic competition, especially post-patent expiry periods. Strategic pricing, differentiated products, and regional adaptation are essential for maximizing market share and profitability.

Key Takeaways

-

Market Growth: Anticipate a compounded growth rate of around 4-5% annually, particularly in emerging markets due to increased healthcare access.

-

Pricing Dynamics: Expect a premium for branded Risperidone ER in developed markets; prices are likely to decline 10-25% over the next five years due to generic competition and cost-control policies.

-

Indication Expansion: Growing patent approvals for bipolar disorder and autism open additional revenue streams.

-

Competitive Strategies: Entering markets with cost-effective generics or adding value through improved formulations can optimize revenue.

-

Regulatory Focus: Vigilant compliance and localization are crucial to sustaining market presence amidst evolving pricing and reimbursement policies.

FAQs

-

What factors influence the price of Risperidone ER across different regions?

Market prices are influenced by patent status, regulatory restrictions, reimbursement policies, healthcare infrastructure, competition from generics, and regional economic conditions. -

How will patent expiries affect the Risperidone ER market?

Patent expiries predict a significant drop in branded drug prices (up to 50%), increasing generic competition and expanding affordable options, but potentially reducing branded sales margins. -

Are biosimilars and generics likely to dominate the Risperidone ER market in coming years?

While biosimilars and generics will likely capture a larger market share as patents expire, premium formulations with distinctive features may retain niche segments. -

What is the potential impact of new formulations or delivery systems?

Innovative delivery mechanisms that improve compliance and reduce side effects can command higher prices and attract prescriber preference. -

How should pharmaceutical companies approach pricing for Risperidone ER in emerging markets?

Implement tiered pricing strategies aligned with regional economic conditions, focus on cost-effective manufacturing, and establish partnerships to improve access.

Sources

[1] MarketsandMarkets. “Antipsychotics Market by Product, Indication, and Region - Global Forecast to 2028.” 2022.

[2] World Health Organization. “Mental health: strengthening our response,” 2021.

More… ↓