Last updated: July 28, 2025

Introduction

Risperidone, widely marketed under brand names such as Risperdal, is a second-generation antipsychotic primarily prescribed for schizophrenia, bipolar disorder, and irritability associated with autism. Since its approval in the 1990s, Risperidone has maintained a significant market presence, driven by its efficacy and versatility. This report details the current market landscape, drivers, competitive dynamics, and future price projections of Risperidone, emphasizing key factors influencing its valuation and affordability.

Market Overview

Global Market Size and Growth

The global antipsychotic drugs market, valued at approximately USD 12.5 billion in 2022, is projected to expand at a CAGR of around 3.5% through 2030. Risperidone constitutes a significant segment within this space, accounting for an estimated 35-45% of the second-generation antipsychotics market—equating to a valuation of roughly USD 4-5 billion in 2022 (ref [1]).

The increasing prevalence of schizophrenia, bipolar disorder, and autism spectrum disorder (ASD) worldwide fuels demand. The World Health Organization estimates schizophrenia affects over 20 million people globally, and autism diagnoses have surged, further expanding therapeutic markets (ref [2]).

Key Geographies

- North America: Dominates due to high diagnosis rates, established healthcare infrastructure, and extensive off-patent access.

- Europe: Similar to North America, with rising adoption of atypical antipsychotics.

- Asia-Pacific: Fastest-growing region driven by increased mental health awareness, expanding healthcare access, and government initiatives.

Market Drivers

- Increasing Prevalence: The rising global burden of mental health disorders.

- Generic Entry & Pricing: Patent expirations in 2013 for Risperdal facilitated access to generics, intensifying price competition.

- Off-label Uses: Off-label prescribing for behavioral disorders broadens market scope.

- Healthcare Initiatives: Growing insurance coverage and mental health programs promote medication utilization.

Competitive Landscape

Key Players

- Johnson & Johnson (original manufacturer, Risperdal)

- Teva Pharmaceuticals, Sandoz (generic manufacturers)

- Mylan (acquired by Viatris)

- Alvogen, Par Pharmaceutical (additional generics)

Pricing Dynamics

Post-patent expiry, Risperidone prices declined sharply—by over 80% in key markets—where generic competition is intense. As of 2022, the average retail price of a 30-day supply ranges from USD 30 to USD 60 in the US, depending on formulation and pharmacy discounts (ref [3]).

Regulatory and Patent Landscape

The original patent expired in 2008-2013 depending on jurisdiction, leading to widespread generic entry. Current efforts by brand manufacturers focus on formulations with extended-release or improved safety profiles to sustain pricing.

Price Trends and Future Projections

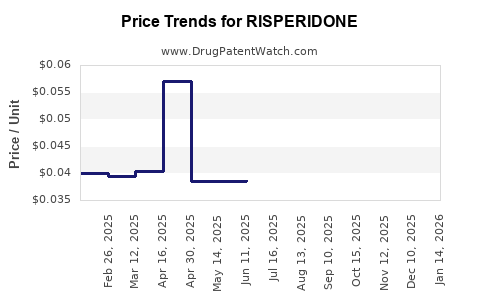

Historic Pricing Trends

- Pre-Patent Expiry (2000-2013): Brand-name Risperdal maintained high prices—USD 200–USD 400 per month.

- Post-Patent Expiry: Generic competition reduced prices to USD 30–USD 60 per month by 2022.

Projected Pricing for 2023-2030

Despite significant discounts, current pricing remains relatively stable due to factors such as:

- Formulation Innovations: Extended-release versions (e.g., Risperdal Consta) command premium pricing.

- Market Saturation and Competition: Continued price erosion is expected for immediate-release formulations.

- Emerging Biosimilars and New Therapeutics: Potential introduction could further pressure prices.

Anticipated trends:

- Stable to Slight Decrease (USD 20–USD 50 per month) through 2025 owing to sustained generic competition.

- Incremental Price Increases (up to USD 70–USD 80 per month) for branded, proprietary formulations with added dosing convenience or safety features.

Influence of New Market Entrants

The emergence of biosimilars or novel drugs targeting schizophrenia or bipolar disorder could displace current risperidone-based treatments, leading to further price reductions or market share declines.

Factors Impacting Future Pricing

- Regulatory Changes: Patents extention or generic approval barriers may influence pricing stability.

- Healthcare Policy: Push towards formularies favoring cost-effective generics.

- Manufacturing Costs: Reduction in production costs could sustain low prices.

- Market Demand: Increasing diagnoses may keep prices supported even amid competition.

Implications for Stakeholders

- Pharmaceutical Companies: Opportunity for innovation through extended-release formulations or combination therapies to sustain premium pricing.

- Payers and Healthcare Providers: Favorable generic pricing enhances affordability but necessitates cost management.

- Patients: Benefit from affordable access, but price stability may depend on formulation and distribution channels.

Key Takeaways

- The Risperidone market experienced a sharp price decline post-patent expiry, with current prices stabilized by generic competition.

- Future price projections suggest marginal declines aligned with market saturation, with potential upward pressure from novel formulations.

- Emerging biosimilars and therapeutic alternatives could further influence pricing dynamics, emphasizing the importance of innovation and patent strategies.

- Stakeholders should focus on proprietary formulations and cost-efficient manufacturing to maintain market viability and profitability.

- Policymakers encouraging generic use and supporting mental health initiatives will impact pricing and accessibility.

FAQs

1. What factors most significantly influence Risperidone pricing?

Market competition from generics, formulation type (immediate vs. extended-release), regulatory approvals, and healthcare policies primarily drive pricing dynamics.

2. Are brand-name Risperdal prices likely to rebound?

Unlikely, as generic competition remains robust. However, proprietary formulations could command higher prices if offering clinical advantages.

3. How does regional variation affect Risperidone pricing?

Pricing varies widely; North America and Europe have higher prices than Asia-Pacific regions, mainly due to differences in healthcare systems, reimbursement, and market penetration.

4. What is the outlook for biosimilars impacting Risperidone's market?

Although biosimilars are more common in biologics, similar strategies could emerge with complex formulations, potentially exerting downward pressure on prices.

5. How do off-label uses influence the market for Risperidone?

Off-label prescribing expands market volume and demand, which could stabilize or marginally increase prices depending on regulatory and clinical acceptance.

References

[1] MarketsandMarkets. (2022). Antipsychotic Drugs Market.

[2] World Health Organization. (2021). Mental Disorders Fact Sheet.

[3] GoodRx. (2022). Risperdal Pricing and Trends.