Share This Page

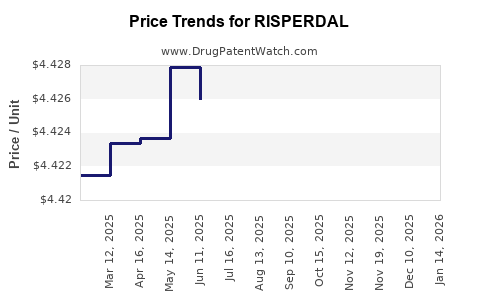

Drug Price Trends for RISPERDAL

✉ Email this page to a colleague

Average Pharmacy Cost for RISPERDAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RISPERDAL 0.5 MG TABLET | 50458-0302-06 | 4.40384 | EACH | 2025-12-17 |

| RISPERDAL 1 MG TABLET | 50458-0300-06 | 4.69365 | EACH | 2025-12-17 |

| RISPERDAL 1 MG/ML SOLUTION | 50458-0305-03 | 5.23493 | ML | 2025-12-17 |

| RISPERDAL 1 MG TABLET | 50458-0300-01 | 4.69365 | EACH | 2025-12-17 |

| RISPERDAL CONSTA 50 MG VIAL | 50458-0308-11 | 1240.39370 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RISPERDAL (Risperidone)

Introduction

Risperdal, the brand name for risperidone, is a pivotal antipsychotic medication extensively prescribed globally for schizophrenia, bipolar disorder, and irritability associated with autism [1]. Since its initial approval in 1993, Risperdal has became a cornerstone in psychiatric treatment due to its efficacy and relatively favorable side effect profile. This analysis explores the current market landscape, competitive positioning, regulatory influences, and future price trajectories for risperidone, emphasizing factors shaping its valuation and accessibility.

Market Landscape

Global Market Size

The global antipsychotic drugs market, valued at approximately USD 9.4 billion in 2022, is projected to grow at a CAGR of 4.2% through 2030 [2]. Risperdal accounts for a significant portion of this, sustained by its longstanding presence, generic availability, and continued clinical demand.

Key Geographic Markets

- United States: Dominates the market with high prevalence rates of schizophrenia (~1.2 million adults) and bipolar disorder, alongside widespread insurance coverage. Risperdal's initial patent expired in 2008, leading to extensive generic penetration.

- Europe: Strong acceptance owing to established healthcare systems; increasing adoption of newer atypical antipsychotics influences competition.

- Emerging Markets: Rapid growth driven by increasing mental health awareness, rising income levels, and expanding healthcare infrastructure. Countries like China and India exhibit rising demand for affordable generics.

Competitive Dynamics

Following patent expiration, risperidone's market share has shifted significantly to generics supplied by multiple pharmaceutical companies, exerting downward pressure on prices. Nevertheless, branded formulations maintain potency in niche sectors, notably in pediatric and off-label uses where clinician preference remains high.

Newer atypical antipsychotics—such as aripiprazole, brexpiprazole, and cariprazine—pose competitive threats due to improved side effect profiles, influencing prescribing patterns and pricing strategies. Moreover, the rapid entry of biosimilars and generics continually suppresses risperdal's price.

Regulatory and Patent Landscape

The expiration of Risperdal’s primary patent in 2008 facilitated widespread generic entry, catalyzing price declines. Patent litigations and secondary patents have occasionally extended exclusivity; however, most market protections have eroded, leading to increased price competition.

Regulatory approval processes in emerging markets remain lengthy and complex, impacting market penetration timelines but also opening opportunities for generic manufacturers. Additionally, ongoing patent litigations and potential for new formulations or delivery systems could influence future market exclusivity.

Current Pricing Overview

Brand vs. Generic Pricing

- Brand Risperdal: Historically commanded premium pricing; however, its market share diminishes owing to generic competition.

- Generics: Exhibit significantly lower prices, with discounts of up to 70-80% compared to brand costs.

Pricing in Different Markets

- United States: Average retail price for a 30-day supply of generic risperidone ranges from USD 10-30, compared to approximately USD 300 for the branded version before generic entry.

- Europe: Similar trends observed, with substantial reductions post-patent expiry.

- Emerging Markets: Prices remain variable; affordability remains a barrier, though generics are substantially cheaper relative to Western markets.

Future Price Projections

Factors Influencing Price Trends

- Continued Generic Competition: The influx of multiple generic manufacturers keeps prices under sustained downward pressure.

- Market Penetration of Biosimilars: Although biosimilars primarily impact biologic drugs, their increasing acceptance signifies a broader industry trend toward cost reduction.

- Introduction of New Formulations: Long-acting injectable (LAI) formulations of risperidone (e.g., Risperdal Consta) command premium prices but face competition from newer atypicals.

- Regulatory Incentives and Healthcare Policies: Governments emphasizing cost containment and formulary restrictions influence pricing and reimbursement.

- Supply Chain Dynamics and Raw Material Costs: These contribute to fluctuations in manufacturing costs, indirectly affecting drug prices.

Projected Price Trends (2023-2030)

Based on current trends, the following projections are estimated:

- Short Term (2023-2025): Continued stabilization at low price levels for generics, with prices ranging from USD 5-15 per 30-day supply in the US and similar markets.

- Mid Term (2026-2028): Marginal price increases for specialized formulations (e.g., LAIs) due to development costs; potential price erosion in primary generics.

- Long Term (2029-2030): Possible price stabilization or slight increase if new formulations or delivery systems gain market share; however, overall downward pressure is expected due to market saturation and competition.

Strategic Market Positioning

Pharmaceutical companies must adapt to ongoing generic pressure by differentiating products through new delivery platforms or indications. Investing in research for extended-release formulations or combination therapies may offer premium pricing opportunities.

Clinicians and healthcare payers prioritize affordability and safety, emphasizing the importance of cost-effective prescribing. Transparent pricing strategies and value-based pricing models are likely to be favored in the evolving landscape.

Conclusion

The risperidone market is characterized by mature, highly competitive dynamics, primarily driven by generic proliferation and evolving therapeutic options. While immediate prospects suggest continued price reductions, opportunities remain for premium formulations and targeted market segments. Stakeholders should anticipate a trend toward affordability, with incremental innovation serving as a differentiation strategy.

Key Takeaways

- The global risperdal market is mature, with significant generic competition prompting persistent price declines.

- Future pricing will be heavily influenced by the entry of generics, biosimilars, and new formulations, maintaining downward pressure.

- Emerging markets present growth opportunities due to increasing mental health awareness and demand for affordable medication.

- Pharmaceutical firms should prioritize innovation in delivery systems and explore new indications to sustain profitability.

- Policymakers and payers aim to balance affordability with access, influencing the pricing and formulary inclusion of risperidone.

FAQs

-

How has patent expiration impacted risperdal’s market pricing?

Patent expiry in 2008 led to a surge in generic risperidone entries, dramatically reducing prices, especially in Western markets. This increased affordability has expanded access but diminished profit margins for the original manufacturer. -

What are the major competitors to risperdal in the antipsychotic market?

Newer atypical antipsychotics like aripiprazole, brexpiprazole, and cariprazine increasingly compete by offering improved side effect profiles. Other generic risperidone variants also compete primarily on price. -

Are there upcoming formulations that could influence risperdal’s market price?

Yes, long-acting injectable formulations (e.g., Risperdal Consta) command higher prices but cater to adherence-focused segments. The development of new delivery systems could shift market dynamics further. -

What is the outlook for risperdal pricing in emerging markets?

Prices are expected to remain lower due to greater generic penetration and market competition, but affordability improvements will likely sustain demand growth. -

How do regulatory policies influence risperdal market prices?

Policies promoting generic substitution and cost-containment strategies tend to suppress prices, while regulatory barriers can delay generic entry, sometimes sustaining higher prices temporarily.

References

[1] U.S. Food and Drug Administration (FDA). Risperdal (risperidone) Prescribing Information. 2022.

[2] Grand View Research. Antipsychotic Drugs Market Size, Share & Trends Analysis Report. 2022.

More… ↓