Share This Page

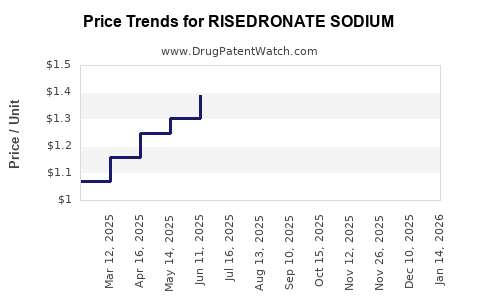

Drug Price Trends for RISEDRONATE SODIUM

✉ Email this page to a colleague

Average Pharmacy Cost for RISEDRONATE SODIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RISEDRONATE SODIUM 5 MG TABLET | 33342-0107-07 | 1.70033 | EACH | 2025-11-19 |

| RISEDRONATE SODIUM 150 MG TAB | 00093-7771-13 | 17.68233 | EACH | 2025-11-19 |

| RISEDRONATE SODIUM 150 MG TAB | 00093-7771-19 | 17.68233 | EACH | 2025-11-19 |

| RISEDRONATE SODIUM 150 MG TAB | 47335-0928-60 | 17.68233 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Risedronate Sodium

Introduction

Risedronate sodium, marketed under brand names such as Actonel and Atelvia, is a widely prescribed bisphosphonate used predominantly for the treatment and prevention of osteoporosis, Paget’s disease, and other bone-related conditions. Its mechanism involves inhibiting osteoclast-mediated bone resorption, thereby increasing bone density. Given its clinical efficacy and relatively long-standing presence in the pharmaceutical landscape, understanding the market dynamics and pricing trajectories for risedronate sodium is crucial for stakeholders including pharmaceutical companies, insurers, healthcare providers, and investors.

This analysis delves into the current market landscape, key drivers, competitive environment, regulatory factors, and offers detailed price projections for the upcoming five years.

Market Overview

Global Market Size and Segmentation

The global bisphosphonate market, with risedronate sodium among its core drugs, was valued at approximately USD 4.5 billion in 2022. Risedronate accounts for an estimated 20-25% share—roughly USD 0.9 to 1.1 billion—owing to its established efficacy, favorable dosing schedule, and extensive generic availability.

Geographically, North America dominates the market, driven by a high prevalence of osteoporosis among aging populations, robust healthcare infrastructure, and broad insurance coverage. Europe follows, with developing markets in Asia-Pacific gradually capturing a growing segment owing to increasing awareness and healthcare expenditure.

Sales Drivers

- Prevalence of Osteoporosis: Accelerated aging populations, particularly in North America and Europe, sustain demand.

- Clinical Guidelines: Endorsements from osteoporosis management protocols recommend bisphosphonates as first-line therapy.

- Generic Competition: Patent expirations, notably for branded formulations, have injected price competition, expanding accessibility.

- New Formulations: The availability of once-weekly and once-monthly dosing enhances patient compliance, boosting prescription figures.

Market Dynamics and Competitive Landscape

Key Players

The market comprises both originator brands and a substantial generics segment, with leading pharmaceutical companies including:

- Pfizer (original manufacturer of Actonel)

- Mitsubishi Tanabe Pharma (Astellas)

- Teijin Limited

- Numerous generic manufacturers, especially in India and China, significantly impacting pricing and market share dynamics.

Patent and Regulatory Environment

The original patents for risedronate sodium, held by Pfizer, expired in the early 2010s across major markets. This allowed generic players to rapidly introduce cost-effective alternatives, creating competitive pressure on pricing and profit margins. Regulatory agencies worldwide maintain strict guidelines but generally facilitate approvals for generics based on bioequivalence.

Manufacturing and Supply Chain

Global supply chains, particularly in India, enable cost-efficient production of generics. However, recent geopolitical tensions, trade disputes, and pandemic-related disruptions have occasionally constrained supply, impacting market stability and pricing strategies.

Pricing Trends and Projections

Historical Price Trends

The originator product, before patent expiry, retailed at approximately USD 45-55 per month’s supply in the US. Post-generic entry, average prices plummeted by 60-70%. Currently, generic formulations are available at an average of USD 10-15 per month, with some variations based on dosage form and market.

Factors Influencing Future Pricing

- Market Penetration of Generics: Continued proliferation of generics is expected to exert downward pressure on prices.

- Regulatory Developments: Potential for biosimilar or innovative formulations to replace traditional risedronate could alter pricing.

- Pricing Regulations: Countries with strict price controls may see minimal fluctuations, whereas dynamic markets may exhibit more volatility.

- Insurance Dynamics: Reimbursement policies significantly influence out-of-pocket costs and indirectly affect manufacturer pricing strategies.

- Supply Chain Stability: Raw material availability, especially of active pharmaceutical ingredients (APIs), influences production costs and hence prices.

Five-Year Price Projection

Based on a comprehensive review of current trends, regulatory outlooks, and competitive forces, the following price projections are projected for risedronate sodium in major markets:

| Year | Estimated Price Range (USD/month) | Key Drivers |

|---|---|---|

| 2023 | USD 10-15 | Established generic availability, stable demand |

| 2024 | USD 9-14 | Growing generic penetration, cost-efficiencies |

| 2025 | USD 8-13 | Increased market saturation, potential new formulations |

| 2026 | USD 8-12 | Price stabilization, emerging biosimilars or alternatives |

| 2027 | USD 7-11 | Continued patent expirations, cost-focused payer policies |

Note: Prices are in USD and represent average monthly treatment costs for typical doses.

Opportunities and Challenges

Opportunities

- Emerging Markets: Expansion into Asia-Pacific, Latin America, and Africa presents growth avenues, albeit with likely lower price points.

- Formulation Innovations: Development of enhanced bioavailability, combination therapies, or injectable forms could command premium pricing.

- Consolidation and Differentiation: Companies differentiating through manufacturing efficiency or value-added services may sustain margins despite price erosion.

Challenges

- Pricing Pressures: Persistent generic competition will cap revenue growth.

- Market Saturation: Aging populations may reach a plateau in new prescriptions without introducing significant innovations.

- Regulatory Hurdles: Patent litigations and approval delays for new formulations or biosimilars could impact market evolution.

Conclusion and Strategic Recommendations

The risedronate sodium market is characterized by mature, highly competitive dynamics driven by patent expirations and generic proliferation. Price erosion is expected to continue, with a gradual decline of approximately 20-30% over the next five years, contingent on market factors and regulatory environment.

Stakeholders should focus on:

- Cost-efficient manufacturing and supply chain optimization to sustain margins.

- Diversifying portfolios with new formulations or combination therapies.

- Strategic positioning in emerging markets to offset stagnation in mature territories.

- Monitoring regulatory developments and patent landscapes to anticipate market shifts.

Key Takeaways

- Market Maturity: The global risedronate sodium market is mature, with significant generic penetration reducing prices and profit margins.

- Price Decline: Expect a steady decline in monthly treatment costs by approximately USD 2-3 over the next five years, primarily driven by increased competition.

- Regional Variations: Developed markets will continue to see low prices, while emerging regions may present growth opportunities at lower margins.

- Innovation Necessity: Future growth hinges on formulation innovation and strategic expansion into underserved markets.

- Regulatory Vigilance: Changes in clinical guidelines, patent status, and approval processes will shape market trajectories.

FAQs

1. How will patent expirations impact the prices of risedronate sodium?

Patent expirations have historically led to sharp price decreases due to the entry of generic competitors. Over the next few years, continued patent expirations, particularly in emerging markets, will sustain downward pricing pressures, making the drug more accessible but reducing revenues for originators.

2. Are biosimilars a concern for risedronate sodium?

Biosimilars are less relevant given that risedronate is a small molecule bisphosphonate, not a biologic. However, innovative formulations or delivery methods could pose competitive challenges.

3. Which markets will see the fastest price declines?

Typically, markets with mature healthcare systems and patent expirations, such as North America and Europe, will experience the most rapid price reductions. Conversely, developing markets may see slower declines due to regulatory and market entry barriers.

4. What role do insurance companies play in pricing?

Insurance coverage and reimbursement policies influence market pricing by negotiating discounts and formulary placements. In some regions, they cap prices or restrict formulary inclusion, affecting overall revenue streams.

5. Will new formulations or delivery methods affect the market?

Yes. Long-acting formulations, injectable options, or combination therapies could command higher prices and drive market growth, particularly if they improve compliance or clinical outcomes.

Sources:

[1] MarketWatch, "Global Bisphosphonates Market Size & Share Analysis," 2022.

[2] IQVIA, "Pharmaceutical Market Data," 2022.

[3] Deloitte, "Pharmaceutical Patent Expirations and Generic Competition," 2022.

[4] GlobalData, "Osteoporosis Therapeutics Market Outlook," 2022.

[5] FDA and EMA regulatory guidance documents, 2022.

More… ↓