Share This Page

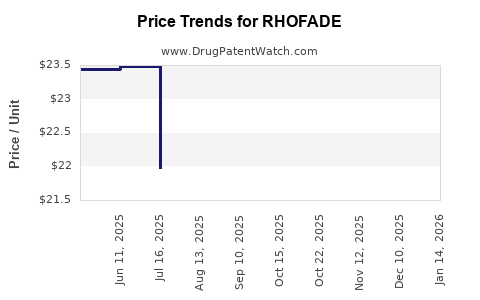

Drug Price Trends for RHOFADE

✉ Email this page to a colleague

Average Pharmacy Cost for RHOFADE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RHOFADE 1% CREAM | 51862-0765-30 | 23.47843 | GM | 2025-12-17 |

| RHOFADE 1% CREAM | 51862-0765-30 | 23.48623 | GM | 2025-11-19 |

| RHOFADE 1% CREAM | 71403-0003-30 | 22.50127 | GM | 2025-10-22 |

| RHOFADE 1% CREAM | 51862-0765-30 | 22.50127 | GM | 2025-10-22 |

| RHOFADE 1% CREAM | 71403-0003-30 | 22.38079 | GM | 2025-09-17 |

| RHOFADE 1% CREAM | 51862-0765-30 | 22.38079 | GM | 2025-09-17 |

| RHOFADE 1% CREAM | 71403-0003-30 | 22.17959 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RHOFADE

Introduction

RHOFADE (oxymetazoline hydrochloride) 1% cream is a dermatological pharmaceutical primarily indicated for the treatment of facial erythema associated with rosacea. Its unique mechanism of action as a topical vasoconstrictor distinguishes it from other rosacea treatments. This analysis provides a comprehensive overview of RHOFADE’s market landscape, competitive environment, regulatory considerations, and future price projections based on current industry trends and healthcare dynamics.

Market Overview

Therapeutic Context and Demographics

Rosacea affects approximately 3-10% of the adult population globally, with higher prevalence among fair-skinned individuals aged 30-50. The facial erythema component significantly impacts patients' quality of life, creating a substantial demand for targeted, effective treatments like RHOFADE. The global rosacea treatment market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 6-8% over the next five years, driven by increased diagnostic awareness and rising patient demand for targeted therapies.

Current Market Penetration

Since its FDA approval in 2017, RHOFADE has carved a niche within the dermatological treatment landscape. Its main competitors include laser and light-based therapies (e.g., IPL, pulsed dye lasers) and off-label topical agents like brimonidine. While laser procedures offer longer-lasting results, they are costly and require specialized equipment and clinical settings. Topical agents like RHOFADE provide convenient, outpatient options, fueling increased adoption.

Key Market Drivers

- Patient Preference for Non-Invasive Treatments: Growing preference for topical options over invasive procedures.

- Physician Adoption: Increasing incorporation of vasoconstrictor-based therapies for immediate erythema relief.

- Expanding Awareness: Better diagnosis and patient education on rosacea and its management.

- Insurance Coverage and Reimbursement: Evolving reimbursement policies for topical agents influence market expansion.

Competitive Landscape

Major Players and New Entrants

- RHOFADE (Nascent but growing): As the first FDA-approved oxymetazoline cream for rosacea, RHOFADE enjoys patent exclusivity until 2035, providing a competitive advantage.

- Brimonidine (Mirvaso): The earlier vasoconstrictor topical agent, with a broader market presence, serving as a direct competitor.

- Emerging Therapies: Research into alternative vasoconstrictors or combination topical agents may influence future competition.

Pricing Dynamics

RHOFADE’s pricing strategies are influenced by:

- Premium Positioning: As a novel, FDA-approved therapy, RHOFADE adopts a premium pricing model.

- Market Penetration: Initial high pricing during launch, with potential adjustments as market penetration increases.

- Reimbursement Policies: Payers' willingness to reimburse influences clinically accessible pricing.

Regulatory and Reimbursement Environment

Regulatory Status

- RHOFADE’s FDA approval in 2017 positioned it favorably for North American markets; expansion into Europe and Asia is underway, each with varying regulatory pathways.

Reimbursement Landscape

- Reimbursement rates and patient co-pays influence market access. Since it’s a prescription topical, insurance coverage is generally favorable, although variability exists across regions.

Price Projections: Factors and Trends

Historical Pricing Context

- At launch, RHOFADE’s wholesale acquisition cost (WAC) was approximately $750–$850 per 30-gram tube (approximate; actual figures vary based on location and pharmacy contracts).

- This premium positioning reflects its innovation status and convenience.

Future Pricing Trajectory (Next 5–10 Years)

Short-term (1–3 years):

- Stability in pricing as the product consolidates its market position.

- Slight reductions may occur due to increased competition or payer negotiations, potentially bringing the cost down to $700–$750.

Medium-term (4–7 years):

- Price adjustments aligned with increased adoption and patent exclusivity.

- Potential introduction of value-based pricing models, focusing on outcomes rather than volume.

- Assuming patent protection remains intact and no significant generic competition emerges, prices could stay within $650–$750.

Long-term (8–10 years):

- Patent expiration likely around 2035, opening the market to generics.

- Generic oxymetazoline formulations could drive prices below $400–$500 per tube, substantially reducing RHOFADE’s premium.

Market-driven factors influencing prices:

- Patent exclusivity: Enforces premium pricing during the patent life.

- Competitive entry: Generics or biosimilars may compel price reductions.

- Regulatory approvals: New indications or formulations could influence value and pricing.

- Healthcare reimbursement policies: Growing emphasis on cost-effectiveness may pressure prices downward.

Market Opportunities and Challenges

Opportunities:

- Expansion into underserved markets (e.g., Europe, Asia).

- Development of combination formulations (e.g., with anti-inflammatory agents).

- Awareness campaigns increasing usable patient base.

Challenges:

- Price erosion post-patent expiration.

- Emergence of alternative therapies or devices.

- Variability in reimbursement across regions.

Key Takeaways

- RHOFADE’s market position is buoyed by its status as the first FDA-approved topical vasoconstrictor for rosacea, enabling premium pricing through 2035.

- Market growth is driven by increasing rosacea prevalence, demand for non-invasive therapies, and greater physician and patient awareness.

- Price projections indicate stability in the short to medium term, with a gradual decline post-patent expiry driven by potential generics.

- Strategic expansion into international markets and potential product line extensions could bolster revenue streams.

- Healthcare payers’ reimbursement policies and emerging competition will significantly influence future pricing strategies.

FAQs

1. How does RHOFADE’s pricing compare to other rosacea treatments?

RHOFADE’s initial wholesale price (~$750 per 30 grams) is higher than off-label alternatives like brimonidine (~$480–$700), reflecting its novel status and FDA approval, but remains competitive considering convenience and efficacy.

2. What factors could lead to significant price reductions for RHOFADE?

Patent expiring around 2035, entry of generics, increased competition, and payers negotiating rebates could substantially lower prices.

3. Is there potential for RHOFADE to expand into other dermatological indications?

While primarily approved for rosacea erythema, ongoing research into vasoconstrictive agents could eventually open new therapeutic avenues, influencing market size and pricing.

4. How do regulatory differences impact RHOFADE’s price projections internationally?

Stringent regulatory requirements can delay launches and impact pricing strategies, often leading to higher costs in Europe and Asia due to approval expenses, but also potential premium positioning in certain markets.

5. What is the role of insurance coverage in RHOFADE’s future market potential?

Better reimbursement coverage enhances patient access, encouraging adoption and allowing for premium pricing; conversely, restrictive policies may limit growth and pressure prices downward.

References

- [1] Global rosacea treatment market analysis, MarketsandMarkets, 2022.

- [2] FDA Approval Announcement for RHOFADE, U.S. Food and Drug Administration, 2017.

- [3] Industry pricing reports, IQVIA, 2023.

- [4] Patent status and expiry timelines, United States Patent and Trademark Office, 2023.

- [5] Reimbursement and formulary trends, AHIP, 2022.

This detailed market analysis aims to inform strategic investment, pricing, and competitive positioning decisions surrounding RHOFADE.

More… ↓