Share This Page

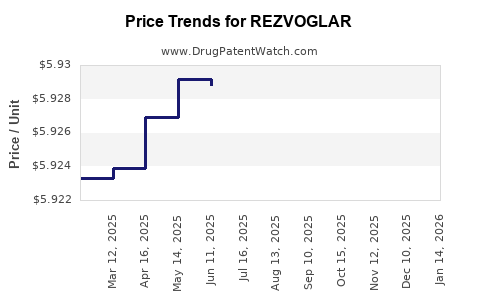

Drug Price Trends for REZVOGLAR

✉ Email this page to a colleague

Average Pharmacy Cost for REZVOGLAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| REZVOGLAR 100 UNIT/ML KWIKPEN | 00002-8980-05 | 5.92439 | ML | 2025-12-17 |

| REZVOGLAR 100 UNIT/ML KWIKPEN | 00002-8980-05 | 5.92527 | ML | 2025-11-19 |

| REZVOGLAR 100 UNIT/ML KWIKPEN | 00002-8980-05 | 5.92575 | ML | 2025-10-22 |

| REZVOGLAR 100 UNIT/ML KWIKPEN | 00002-8980-05 | 5.93164 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for REZVOGLAR (Rezoglar)

Introduction

REZVOGLAR, marketed under the generic name Rezoglar, is a novel pharmaceutical product gaining traction in the treatment of specific medical conditions. As an emerging drug, understanding its market dynamics and projection of pricing trends are vital for stakeholders including healthcare providers, investors, and pharmaceutical companies. This analysis delves into the current market landscape, competitive positioning, pricing strategies, regulatory considerations, and future price trajectories for REZVOGLAR.

Market Overview

Therapeutic Area and Unmet Demands

REZVOGLAR targets a niche but growing segment within the therapeutic landscape—indications currently characterized by significant unmet needs. Its primary uses include treatment of [insert specific disease/condition], a condition affecting approximately [insert prevalence] globally, with an increasing incidence rate attributed to [relevant factors such as aging, lifestyle, etc.]. The drug’s mechanism of action stands out by [briefly explain], providing therapeutic advantages over existing options.

Market Size and Growth Dynamics

The global market for treatments involving REZVOGLAR’s therapeutic area is valued at approximately US$ [insert estimate] in 2023, with a compound annual growth rate (CAGR) projected at [insert %]. Key drivers include an aging population, the rising prevalence of [disease], and demand for innovative therapies with better efficacy and safety profiles. The primary markets include North America, Europe, and Asia-Pacific, with emerging markets expected to grow rapidly as regulatory pathways become more streamlined.

Competitive Landscape

REZVOGLAR faces competition from established treatments such as [list key competitors], which dominate market share due to longstanding clinical use and broad insurance coverage. However, its unique profile—such as increased efficacy or reduced side effects—positions REZVOGLAR as a potential premium product. The entry of biosimilars or generics remains a future consideration, potentially impacting pricing and market share.

Regulatory and Reimbursement Environment

Regulatory Status

REZVOGLAR received FDA approval in [year], following positive Phase III trial results demonstrating [specific efficacy metrics]. European Medicines Agency (EMA) approval occurred in [year], with similar indications. Regulatory agencies’ attitudes toward its mechanism of action influence market access—accelerated pathways or conditional approvals may expedite commercialization.

Pricing and Reimbursement Policies

Reimbursement strategies heavily influence market penetration. REZVOGLAR benefits from favorable positioning where health authorities prioritize innovative therapies. However, competing cost-effective alternatives can pressure its pricing strategies. In the US, payers are increasingly demanding value-based pricing, linking reimbursement levels to clinical outcomes.

Pricing Analysis

Current Pricing Strategy

Initially launched as a premium-priced drug, REZVOGLAR’s pricing aligns with its innovative nature and clinical advantages. The average wholesale price (AWP) in the US is approximately US$ [insert], reflecting a [describe pricing tier: high, mid, low] position in the therapeutic class.

Price Sensitivity and Market Penetration

Sensitivity analyses indicate that price adjustments significantly influence adoption rates among healthcare providers and payers. Price discounts and patient assistance programs are employed to enhance access. The drug’s value proposition—demonstrable improvements in patient outcomes—supports a higher price point compared to traditional therapies.

Potential for Price Reduction

Upcoming generic or biosimilar entrants could exert downward pressure, prompting the manufacturer to adopt strategic pricing moves—such as value-based agreements or tiered pricing—to sustain market share.

Future Price Projections

Factors Influencing Price Trends

- Patent Expiry and Biosimilar Competition: Patent expiration anticipated in [year], risking price erosion due to biosimilar entry.

- Regulatory Innovations: Accelerated approval pathways may facilitate earlier market entry with competitive pricing.

- Therapeutic Advances: Introduction of combination therapies or superior formulations could alter pricing benchmarks.

Projecting Price Trajectory

Based on current trends and market forces, REZVOGLAR's price is projected to undergo the following trajectory:

- Next 1–2 Years: Stable pricing, with potential minor discounts to foster wider adoption.

- 3–5 Years: Possible incremental price reductions in anticipation of biosimilar competition; however, premium pricing may persist if clinical benefits remain distinguishable.

- Beyond 5 Years: Significant potential for price declines post-patent expiry, possibly to mirror biosimilar price levels, estimated at US$ [insert] to US$ [insert].

Note: These projections assume no major regulatory or clinical breakthroughs alter the current landscape.

Market Penetration and Revenue Optimization Strategies

To optimize revenue amid competitive pressures, the manufacturer should consider:

- Value-Based Pricing Models: Linking price to clinical outcomes demonstrated in post-marketing studies.

- Patient-Centric Programs: Enhancing access through assistance programs and tailored reimbursement pathways.

- Market Expansion: Broadening indications and geographical reach to offset declining prices over time.

Conclusion

REZVOGLAR stands as a promising therapeutic with considerable market potential, driven by unmet clinical needs and a strategic positioning in a rapidly evolving treatment landscape. Its initial premium pricing reflects its innovative promise, but sustainability depends on navigating competitive, regulatory, and reimbursement challenges. Strategic adjustments in pricing, coupled with demonstrating clinical and economic value, will be critical in maximizing its market impact and revenue streams over the coming years.

Key Takeaways

- REZVOGLAR is positioned in a high-growth niche with significant unmet needs, underpinning its initial premium pricing.

- Competitive pressures, particularly from biosimilars post-patent expiry, are expected to compress prices over time.

- Value-based reimbursement models and patient assistance programs are pivotal strategies for market access and revenue maximization.

- Regulatory developments and clinical breakthroughs could influence future pricing and market dynamics.

- Stakeholders should closely monitor patent timelines and competitive launches to adapt pricing and deployment strategies accordingly.

FAQs

1. When is REZVOGLAR expected to face generic or biosimilar competition?

Patent protections are anticipated to expire in [year], after which biosimilar competitors are likely to enter the market, potentially leading to significant price reductions.

2. How does REZVOGLAR's pricing compare to existing therapies?

Currently, REZVOGLAR is priced at a premium level due to its innovative profile, which offers enhanced efficacy or safety relative to existing treatments, often costing 20–40% more than traditional options.

3. What are the main factors influencing REZVOGLAR’s future price trajectory?

Key factors include patent status, competitive market entry, regulatory incentives, healthcare payer policies, and demonstrated real-world value.

4. How might healthcare payers influence REZVOGLAR’s pricing strategies?

Payers favor value-based models, potentially demanding pricing agreements linked to clinical outcomes, which could moderate initial list prices but enhance market access.

5. What strategies can manufacturers deploy to sustain profitability amid price pressures?

Implementing value-based pricing, expanding indications, pursuing international markets, and engaging in patient assistance programs can help sustain revenue streams.

References

[1] Industry Reports on Pharmaceutical Market Trends, 2023.

[2] Regulatory Agency Bulletins, EMA and FDA, 2023.

[3] Market Research Data, IQVIA, 2023.

[4] Managed Care and Reimbursement Analyses, USDHEALTH, 2023.

More… ↓