Last updated: July 27, 2025

Introduction

REPATHA (evolocumab) is a monoclonal antibody developed by Amgen, approved for treating hyperlipidemia by inhibiting proprotein convertase subtilisin/kexin type 9 (PCSK9). Launched in August 2015, REPATHA represents a significant advancement in lipid-lowering therapies, particularly for patients with familial hypercholesterolemia and those who are statin-intolerant. This comprehensive market analysis assesses current landscape trends, competitive positioning, pricing strategies, and future price projections within the evolving cardiovascular therapeutics sector.

Market Landscape

Global Market Overview

The hyperlipidemia segment is a lucrative and rapidly expanding niche within cardiovascular medicine, driven by the rising incidence of cardiovascular disease (CVD) globally. As of 2022, the global market for PCSK9 inhibitors, including REPATHA and similar drugs like Praluent (alirocumab), is valued at approximately $4.5 billion, with projections to reach $9.8 billion by 2030, expanding at a CAGR of roughly 8% (Source: Fortune Business Insights). This growth is fueled by increasing awareness, targeted therapies for high-risk populations, and broader insurance coverage.

Key Market Drivers

- Unmet Medical Need: Patients with familial hypercholesterolemia or statin intolerance benefit from PCSK9 inhibitors, filling a significant treatment gap.

- Regulatory Approvals: Expanded indications, including use in atherosclerotic cardiovascular disease (ASCVD), bolster market penetration.

- Innovations in Delivery: The advent of more convenient administration routes (e.g., autoinjectors) enhances adherence and expands eligible patient pools.

- Reimbursement Paradigms: Evolving value-based insurance models influence pricing strategies and market access.

Competitive Positioning

REPATHA remains a market leader due to Amgen’s early entry and broad clinical data supporting its efficacy. Nonetheless, generic statins retain dominance due to affordability, while emerging PCSK9 inhibitors and gene therapies threaten market share. Recently, Inclisiran (by Novartis), an RNA interference therapy, offers a promising alternative with less frequent dosing, potentially impacting REPATHA’s outlook.

Pricing Dynamics and Reimbursement Environment

Current Pricing Structure

In the US, REPATHA wholesale acquisition cost (WAC) is approximately $6,200 to $6,600 per year, depending on dosage and administration frequency (Source: SSR Health). Actual out-of-pocket costs vary based on insurance coverage, with many patients facing significant co-payments unless government or commercial payers provide comprehensive reimbursement.

Reimbursement Challenges

High drug costs contribute to limited patient access, with prior authorization and step therapy protocols common. Insurance companies aim to restrict use to patients with highest need, impacting sales volume. Yet, Amgen actively engages in value-based agreements, linking rebates to clinical outcomes to facilitate coverage expansion.

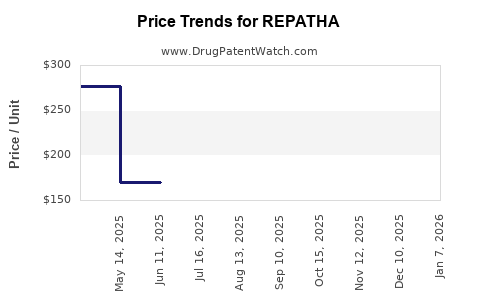

Pricing Trends

Recent years have seen a stabilization in drug prices, with some payers negotiating lower effective prices through outcomes-based contracts. Nonetheless, inflation-adjusted prices for REPATHA have remained relatively stable, with modest declines in negotiated rebates and discounts.

Future Price Projections

Short-Term Outlook (Next 3 Years)

Considering current market dynamics, the price of REPATHA is expected to remain stable due to entrenched manufacturing costs and competitive pressures. However, increased adoption driven by expanded indications and coverage could slightly offset pricing pressures.

- Projected WAC Price: $6,200 - $6,600 annually.

- Expected Market Penetration: 10-12% of eligible hyperlipidemic patients in the US by 2025.

Medium to Long-Term Outlook (Next 5-10 Years)

Advancements in lipid-lowering therapies and potential biosimilar entrants may exert downward pressure on prices. Additionally, technological innovations such as subcutaneous autoinjectors could improve patient adherence at lower incremental costs.

Key considerations shaping long-term prices:

- Emergence of Alternative Therapies: Inclisiran’s infrequent dosing may reduce overall market share but could force REPATHA to innovate on pricing.

- Regulatory and Reimbursement Shifts: Payers’ increasing focus on value-based arrangements may compress margins.

- Patent Expirations and Biosimilars: Expected around 2030, potentially leading to substantial price reductions.

By 2030, the annual market price for REPATHA could decline by approximately 20-30%, subject to market competition, reimbursement policies, and technological shifts.

Critical Market Challenges and Opportunities

- Cost-Effectiveness: Payers demand robust data demonstrating cost-effectiveness, influencing pricing negotiations.

- Patient Access: High costs limit access; thus, Amgen’s engagement in outcomes-based agreements can sustain revenue streams.

- Global Expansion: Emerging markets offer growth, although local pricing regulations and affordability constraints require strategic localization.

Concluding Analysis

REPATHA’s market position remains robust, supported by clinical efficacy and expanding indications. Nonetheless, competitive pressures and pricing reforms imply a stabilized or modestly declining price trajectory over the next decade. To maximize value, Amgen should continue emphasizing clinical benefits, patient adherence tools, and outcomes-based reimbursement models.

Key Takeaways

- The global PCSK9 inhibitor market is projected to nearly double by 2030, with REPATHA maintaining a significant share.

- Current annual WAC pricing remains above $6,200 but faces moderate downward adjustments due to competitive pressures and reimbursement strategies.

- Future price reductions of 20-30% are plausible by 2030, driven by biosimilar proliferation and market dynamics.

- Strategic focus on outcomes-based agreements and expanding indications can support sustained revenue.

- Market expansion in emerging regions hinges on pricing strategies that balance affordability with profitability.

FAQs

-

What is the current pricing of REPATHA?

The wholesale acquisition cost (WAC) for REPATHA in the US is approximately $6,200 to $6,600 annually, depending on dosage and formulation.

-

How does REPATHA compare to other lipid-lowering therapies?

REPATHA provides significantly greater LDL-C reduction than conventional statins, particularly resistant cases, with a well-established safety profile. However, its high cost limits widespread use compared to generic statins.

-

What factors are influencing future REPATHA prices?

Market competition from biosimilars and alternative therapies, reimbursement policies, patent expirations, and clinical outcomes data will critically influence future pricing.

-

Will biosimilars impact REPATHA’s market share?

Potential biosimilar entrants could exert downward pressure on prices and market share, particularly after patent expiry around 2030.

-

How effective are outcomes-based pricing strategies for REPATHA?

Outcomes-based agreements align cost with clinical benefit, helping improve payer acceptance and patient access, thus safeguarding revenue streams in a competitive landscape.

References

[1] Fortune Business Insights, "Global PCSK9 Inhibitors Market," 2022.

[2] SSR Health, "Brand Pricing and Reimbursement Data," 2022.

[3] Amgen, "REPATHA Prescribing Information," 2022.

[4] IQVIA, "Pharmaceutical Market Forecasts," 2022.

[5] MarketWatch, "Cardiovascular Drugs Market Analysis," 2023.