Share This Page

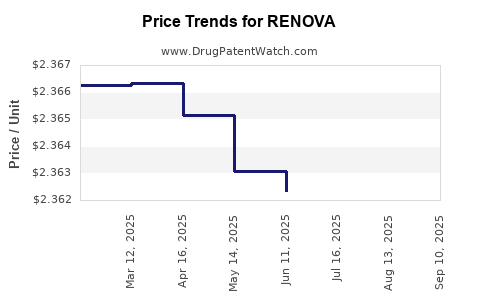

Drug Price Trends for RENOVA

✉ Email this page to a colleague

Average Pharmacy Cost for RENOVA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RENOVA 0.02% CREAM | 00187-5150-20 | 2.35557 | GM | 2025-09-17 |

| RENOVA 0.02% CREAM | 00187-5150-60 | 4.67480 | GM | 2025-09-17 |

| RENOVA 0.02% CREAM | 00187-5150-40 | 6.28815 | GM | 2025-09-17 |

| RENOVA 0.02% CREAM | 00187-5150-20 | 2.35707 | GM | 2025-08-20 |

| RENOVA 0.02% CREAM | 00187-5150-40 | 6.29113 | GM | 2025-08-20 |

| RENOVA 0.02% CREAM | 00187-5150-60 | 4.67480 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Renova (Tretinoin)

Introduction

Renova (generic tretinoin) is a topical retinoid primarily indicated for the management of fine wrinkles, mottled hyperpigmentation, and rough skin caused by photodamage. Since its approval by the U.S. Food and Drug Administration (FDA) in 1995, Renova has established a niche within the anti-aging and dermatology markets. As the aging population increases and skincare trends evolve, understanding its market trajectory and price dynamics becomes critical for pharmaceutical stakeholders.

Market Landscape Overview

Therapeutic Indications and Revenue Drivers

While initially launched for the treatment of photodamaged skin, tretinoin’s expanding applications—such as for acne, photoaging, and potential chemopreventive properties—have broadened its market scope. The primary revenue driver remains the cosmetic anti-aging segment, notably in developed markets where consumers prioritize aesthetic enhancements.

Competitive Environment

Renova faces competition from both prescription formulations and over-the-counter (OTC) retinoids. Major competitors include other prescription tretinoin brands, adapalene, tazarotene, and newer synthetic retinoids with improved tolerability profiles. The rise of OTC retinoids (e.g., tretinoin creams available without prescription) also pressures prescription sales, particularly in markets like the U.S.

Market Penetration and Consumer Trends

Demand for anti-aging products continues to grow driven by demographic shifts and increased skin awareness. However, regulatory scrutiny and safety concerns, such as skin irritation and teratogenicity, influence prescription formulations' usage patterns. The expanding acceptance of cosmetic dermatology procedures can act as both a competitor and complement to drug-based treatments.

Geographical Considerations

North America remains the largest market due to high consumer purchasing power and early market adoption. Europe follows, with Asia-Pacific rapidly emerging owing to increasing disposable income, urbanization, and growing skincare consciousness. Regulatory developments, such as OTC switches and OTC availability in certain markets, further influence geographic dynamics.

Market Size and Growth Projections

Historical Market Data

In 2021, the global tretinoin market was valued approximately at USD 400 million. It is expected to grow at a Compound Annual Growth Rate (CAGR) of 5-7% over the next five years, driven by aging demographics, increasing adoption of topical retinoids for skin repair, and innovations in formulation technology.

Forecast for 2027

Based on current trends and predictive models, the global tretinoin market valuation could reach USD 600–700 million by 2027. North America will likely dominate, accounting for approximately 55-60% of revenue, with continued growth in Asian markets due to rising consumer awareness and expanding healthcare infrastructure.

Impact of Regulatory Changes

Potential OTC switches and regulatory reforms in key markets could significantly influence market size and pricing strategies. For instance, the reclassification of tretinoin from prescription to OTC in certain jurisdictions could catalyze mass-market adoption, but it may also induce price competition.

Price Analysis and Projections

Current Pricing Landscape

In the United States, prescription Renova (0.05% tretinoin cream) typically retails for USD 200-300 per 45 grams (retailed via pharmacies). Prices vary based on pharmacy, insurance coverage, and formulation strength. Generic tretinoin products are priced considerably lower, often USD 20-50 per tube, affecting brand positioning.

Factors Influencing Pricing

- Patent Status and Market Exclusivity: Renova’s primary patents expired in the late 2000s, leading to a surge in generic availability.

- Regulatory Status: OTC switches could lead to significant price erosion but expanded access.

- Manufacturing Costs: Advances in formulation technology and sourcing impact pricing stability.

- Market Competition: The proliferation of generics in developed markets exerts downward pressure on prices.

Future Price Trajectory

Given increasing generic competition, prices for branded formulations like Renova are expected to decline by 10-15% annually over the next 3-5 years. In contrast, OTC versions or biosimilar entrants could further compress prices, potentially reducing the retail price for tretinoin products by upwards of 30-50% by 2027.

Potential Price Drivers

- Premium Positioning: Renova’s branding as a dermatologist-recommended product could sustain higher price points if marketed effectively.

- Formulation Innovations: Development of formulations with enhanced tolerability or unique delivery mechanisms (e.g., nanoparticles) could command premium pricing.

- Market Expansion: Entry into emerging markets may initially see lower prices but could stabilize as brand presence solidifies.

Regulatory and Market Dynamics Impacting Pricing

OTC Transition and Biosimilars

Transitioning tretinoin to OTC status could dramatically broaden access but will likely lead to significant price competition. Biosimilar introduction, while limited for topical drugs, might influence future pricing strategies.

Reimbursement Policies

Insurance coverage and reimbursement policies impact retail prices. High deductibles and copayments may restrict access, prompting shifts toward lower-cost generics and OTC alternatives.

Supply Chain and Patent Litigation

Patent litigations and supply chain disruptions can temporarily influence prices. Patent litigations in key jurisdictions such as the U.S. and Europe could delay generic entry, maintaining higher prices.

Strategic Market Opportunities and Risks

Opportunities

- Emerging Markets: Growing skincare markets and increasing disposable incomes provide expansion opportunities.

- Innovation: Formulating retinoid products with improved tolerability and efficacy aligns with consumer preferences.

- Diversification: Combining tretinoin with complementary agents (antioxidants, peptides) could create premium product lines.

Risks

- Regulatory Changes: Accelerated OTC switches could erode brand exclusivity and pricing power.

- Competitive Intensity: The influx of generics and OTC alternatives can suppress prices.

- Safety Concerns: Adverse effects may limit long-term usage and impact sales.

Conclusion

Renova occupies a significant but increasingly competitive segment within the dermatological and anti-aging markets. Its future valuation and pricing reliance hinge on regulatory pathways, market expansion, and innovation. The trend towards reduced prices driven by generics and OTC options will challenge brand premiums but also broaden access. Companies leveraging strategic marketing, innovative formulations, and geographic diversification can mitigate risks and capitalize on growth prospects.

Key Takeaways

- The global tretinoin market is projected to grow at a CAGR of 5-7%, reaching USD 600–700 million by 2027.

- North America will remain the primary revenue driver, with Asia-Pacific experiencing rapid growth.

- Price declines for branded formulations like Renova are expected with increasing generic competition, estimated at 10-15% annually.

- Regulatory shifts, including OTC switches, will influence market dynamics and pricing strategies.

- Innovation and geographic expansion present significant opportunities, but companies must navigate regulatory, safety, and competitive risks.

FAQs

1. Will Renova continue to maintain pricing dominance despite rising generic competition?

While brand loyalty and clinical reputation support premium pricing, increasing generic availability and OTC options are likely to exert downward pressure, making sustained premium pricing challenging over the long term.

2. How will regulatory changes impact Renova’s market share?

Reclassification of tretinoin from prescription to OTC in key markets could significantly expand access but also increase price competition, potentially reducing market share for branded formulations.

3. What are the key growth markets for tretinoin beyond North America?

Emerging markets in Asia-Pacific and Latin America present substantial growth opportunities due to increasing skincare awareness, rising disposable incomes, and expanding cosmetic dermatology services.

4. How might new formulations influence tretinoin’s pricing?

Innovative formulations that improve tolerability or efficacy can command higher prices, especially in premium market segments, offsetting revenue losses from generic competition.

5. What factors could accelerate or hinder Renova’s market growth?

Regulatory policies, technological advancements, consumer preferences, and safety profiles will critically influence Renova’s growth trajectory in both developed and emerging markets.

More… ↓