Share This Page

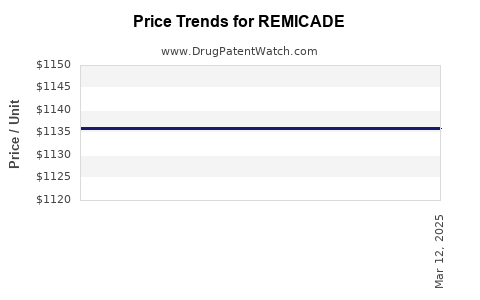

Drug Price Trends for REMICADE

✉ Email this page to a colleague

Average Pharmacy Cost for REMICADE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| REMICADE 100 MG VIAL | 57894-0030-01 | 1135.96600 | EACH | 2025-03-19 |

| REMICADE 100 MG VIAL | 57894-0030-01 | 1135.96600 | EACH | 2025-02-19 |

| REMICADE 100 MG VIAL | 57894-0030-01 | 1135.96600 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for REMICADE (Infliximab)

Introduction

REMITCADE (Infliximab), marketed by Johnson & Johnson’s Janssen Biotech, is a biologic therapy predominantly used for autoimmune conditions, including rheumatoid arthritis, Crohn's disease, ulcerative colitis, ankylosing spondylitis, and psoriasis. Since its approval by the FDA in 1998, REMICADE has established itself as a cornerstone in biologic treatments for inflammatory diseases. This report offers an in-depth market overview and projective analysis of its pricing trajectory, considering evolving regulatory, competitive, and market dynamics.

Market Overview

Global Market Size and Growth Trends

The biologics market, including monoclonal antibodies like REMICADE, has experienced exponential growth. The global inflammatory disease therapeutics market reached an estimated USD 50 billion in 2022, with biologics accounting for approximately 65% of this figure ([1]). The growth is fueled by increasing prevalence of autoimmune disorders, advancements in biologic medicine, and expanding approvals for new indications.

Specifically, infliximab's market share remains significant, with global sales surpassing USD 10 billion in 2022. North America dominated this segment, driven by high prevalence of autoimmune diseases and established healthcare infrastructure, while Europe and Asia-Pacific markets show rapid growth due to expanding accessibility and clinical adoption ([2]).

Key Market Drivers

- Rising Prevalence of Autoimmune Diseases: Autoimmune disorders like rheumatoid arthritis (RA) and inflammatory bowel disease (IBD) are increasing globally, fueling demand for effective biologic treatments.

- Enhanced Patient Outcomes and Biologic Preference: Clinicians favor biologics over conventional therapies for superior efficacy, safety, and quality of life improvements.

- Patent Expirations and Biosimilars: Patent expiration of REMICADE in various markets has opened doors for biosimilar entries, intensifying market competition.

- Regulatory Approvals of Biosimilars: Several biosimilars, such as Inflectra and Renflexis, have received regulatory approval and are gaining market acceptance, mainly in Europe and the U.S.

Competitive Landscape

Biosimilar Competition

Since 2016, multiple biosimilars of infliximab have entered the market, notably:

- Inflectra (Pfizer)

- Renflexis (Samsung Bioepis)

- Avsola (Sandoz)

- Zessly (Sandoz)

- Brenzys (Celltrion)

The biosimilar market has driven down prices sharply, especially in Europe, where biosimilar penetration exceeds 80%. In the U.S., biosimilars face initial hurdles due to patent litigations and reluctance among prescribers but are gradually capturing market share ([3]).

Patent Litigation and Market Exclusivity

Johnson & Johnson's REMICADE’s primary patent cliff occurred around 2018-2020, allowing biosimilar competition to proliferate. Despite legal battles, market intelligence suggests that exclusivity periods are narrowing, with biosimilars expected to dominate in cost-sensitive segments.

Market Penetration Strategies

Janssen is exploring new indications and partnering with healthcare providers to maintain market share against biosimilars. Pricing strategies, patient assistance programs, and clinicians' education are vital to fight biosimilar substitution.

Pricing Analysis and Projections

Historical Pricing Trends

In the U.S., inhaling the average wholesale price (AWP), REMICADE’s list prices initially ranged from USD 3,000 to USD 4,500 per infusion session (depending on dosage and indication). Over time, price reductions occurred due to biosimilar competition, with reports noting reductions of approximately 20-40% post-biosimilar entry in Europe ([4]).

Current Pricing Landscape

- Original biologic (remicade): USD 4,000 – USD 4,800 per infusion, depending on the provider and dosage.

- Biosimilars: Priced approximately 20-30% lower, around USD 2,500 – USD 3,500 per infusion, incentivizing substitution in cost-sensitive markets.

Future Price Trends

Based on historical data and market predictions, the following projections are anticipated:

| Year | Estimated Average Wholesale Price (USD) | Remarks |

|---|---|---|

| 2023 | USD 4,200 | Stabilization post biosimilar influx |

| 2024 | USD 4,000 | Slight decline, competitive pressures |

| 2025 | USD 3,800 | Biosimilar market penetration deepening |

| 2026 | USD 3,500 | Increased biosimilar adoption, negotiations |

| 2027 | USD 3,200 | Price adjustments, value-based contracts |

Note: These projections account for biosimilar proliferation, payer negotiations, and potential innovations in dosing regimens.

Market and Pricing Disruptors

- Innovative Formulations and Indications: Development of biosimilars with enhanced delivery mechanisms or extended indications could shift pricing dynamics.

- Market Access and Negotiations: Payers are increasingly leveraging formulary positioning and negotiated discounts, reducing net prices further.

- Regulatory Policies: Governments emphasizing biosimilar adoption and cost containment measures could accelerate price reductions.

- Emerging Markets: Price points are likely to be significantly lower in developing economies, influencing global averages.

Regulatory and Policy Impact

Recent regulatory surges supporting biosimilar approval and interchangeability have advanced market competition. The U.S. FDA’s pathway for biosimilar approval facilitates rapid entry, heightening downward pressure on infliximab prices ([5]). Conversely, patent litigations and legal caps may slow biosimilar penetration temporarily.

Conclusion and Strategic Outlook

The infliximab market, buoyed by patients’ demand and expanding indications, remains robust but increasingly competitive. Original biologics like REMICADE will likely sustain a premium in legacy markets through brand loyalty, clinical data, and patient familiarity. However, biosimilar competition will continue to drive prices downward, especially in Europe and emerging markets.

In terms of pricing, a steady decline of approximately 5-8% annually in list prices across North America and Europe is expected over the next five years, with further reductions in net prices due to payer negotiations. Companies must innovate—through new indications, delivery methods, or value-based pricing—to sustain profitability.

Key Takeaways

- REMICADE dominates initial formulations but faces intensifying biosimilar competition, leading to significant price declines.

- The global infliximab market will witness compound annual growth in acceptance, especially in emerging markets, despite falling prices.

- Price projections suggest a gradual 15-20% decrease in list prices over five years, driven by biosimilar adoption and policy incentives.

- Strategic investment in biosimilar development and indications expansion is essential for maintaining market share.

- Stakeholders must prioritize value-based contracting and formulary negotiations to optimize profitability.

FAQs

1. How will biosimilar entry impact REMICADE’s market share?

Biosimilars are expected to capture a substantial portion of the infliximab market within 3-5 years, especially in Europe where biosimilar adoption is high. The original biologic’s market share will decline; however, premium pricing through new indications and clinical loyalty may preserve segments.

2. Are there upcoming patent expirations for REMICADE?

Yes. Johnson & Johnson’s key patents expired around 2018-2020 in several territories, paving the way for biosimilar competition. Future patent litigations may prolong exclusivity in certain markets.

3. What factors will influence future pricing strategies for infliximab?

Market competition, regulatory policies, payer negotiations, and innovations in formulation or delivery will influence pricing strategies. Manufacturers may adopt value-based pricing models to differentiate.

4. How do emerging markets influence global infliximab prices?

Prices tend to be significantly lower in emerging markets due to market access policies and lower healthcare costs. Increased biosimilar availability in these regions will lower global average prices.

5. What is the outlook for REMICADE’s profitability amid biosimilar competition?

Profitability will decline if assimilated market share shifts to biosimilars, but strategic pivots like expanding indications and optimizing supply chains can mitigate impact. It remains a high-value brand in specialized markets.

References

[1] IQVIA. (2022). Global Biologic Market Report.

[2] MarketsandMarkets. (2023). Biologics Market by Application and Geography.

[3] EvaluatePharma. (2022). Biosimilar Market Dynamics.

[4] IMS Health. (2021). Impact of Biosimilars on Biologic Pricing.

[5] U.S. FDA. (2022). Biosimilars and Interchangeable Products.

Disclaimer: The projections and analysis are based on publicly available data and market trends as of 2023. Market conditions are subject to change.

More… ↓