Last updated: July 29, 2025

Introduction

REMERON, genericized as mirtazapine, is a widely prescribed antidepressant primarily used to treat major depressive disorder (MDD) and anxiety disorders. Since its original approval by the U.S. Food and Drug Administration (FDA) in 1996, REMERON has established itself as a cornerstone in psychiatric therapeutics, particularly due to its unique mechanism of action and favorable side-effect profile relative to earlier antidepressants. This analysis outlines its current market landscape, competitive positioning, patent and regulatory considerations, and current price trends, culminating in a forward-looking price projection.

Market Overview

Global and Regional Demand

The global antidepressant market stands at approximately USD 15 billion in 2022, with prescriptions for mirtazapine accounting for a significant segment within the broader selective serotonin reuptake inhibitors (SSRIs) and atypical antidepressants. North America remains the largest market, driven by high awareness, widespread diagnosis of depression, and favorable insurance coverage. Europe follows, with emerging markets in Asia-Pacific showing accelerated growth due to increased mental health awareness and expanding healthcare infrastructure.

In the U.S., nearly 18 million adults experienced at least one major depressive episode in 2020, with prescriptions for mirtazapine accounting for approximately 10-15% of antidepressant prescriptions, underscoring its relevance ([1]).

Therapeutic Adoption and Prescribing Trends

Mirtazapine is favored for its sedative properties, beneficial in depressed patients with insomnia, and its lower incidence of sexual dysfunction relative to SSRIs. Its off-label use extends into appetite stimulation in cancer cachexia and aiding sleep disorders, broadening its utility. Prescribing patterns indicate a steady increase, particularly among elderly populations and patients with comorbidities.

Competitive Landscape

Primary competitors include SSRIs like sertraline, escitalopram, and fluoxetine; serotonin-norepinephrine reuptake inhibitors (SNRIs) like venlafaxine; and other atypical antidepressants like trazodone. While SSRIs dominate in volume, mirtazapine’s niche advantages sustain its steady demand.

Regulatory and Patent Status

Patent and Exclusivity Landscape

The original patent for REMERON expired in the early 2010s, permitting generic manufacturers to enter the market. Since then, multiple generics have gained FDA approval, significantly decreasing brand-name sales prices. The absence of patent protection limits the scope for brand-specific pricing power; therefore, the current market hinges on generic affordability and physician prescribing preferences.

Regulatory Developments

The drug's safety profile has been reaffirmed by ongoing FDA evaluations, although initial warnings about weight gain and sedation persist as influencing factors in prescribing decisions. Ongoing support from clinical guidelines maintains its role in depression management.

Pricing Trends and Analysis

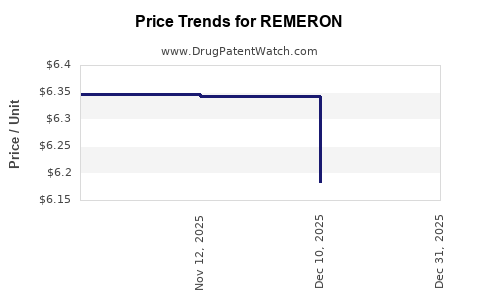

Historical Price Trajectory

Brand-name REMERON historically sold at a premium—approximating USD 200 for a 30-day supply of 15 mg tablets—before patent expiration. Post-generic entry, retail prices for brand-name REMERON have fallen to roughly USD 150 per month, with generics priced between USD 10 and USD 30.

Current Price Environment

Current retail prices for generics in the U.S. are approximately USD 15–25 per 30-day supply, undercutting the brand by over 80%. Pharmacy benefit managers (PBMs) often favor generics, further depressing brand-name sales.

In Europe and other regions, prices are comparable insofar as generic penetration exists, though national reimbursement policies significantly influence actual consumer costs.

Factors Impacting Future Pricing

-

Generic Competition: The proliferation of generics is expected to stabilize prices within a narrow band.

-

Insurance Reimbursements: Formulary choices and negotiated discounts significantly affect retail prices.

-

Potential New Formulations: Development of extended-release or combination formulations could temporarily alter pricing dynamics but face patent and regulatory hurdles.

-

Emerging Biosimilars and Alternatives: As newer mechanisms of depression treatment emerge, mirtazapine’s market share may subtly diminish.

Price Projection (2023–2028)

Given current generic pricing, the following projections are prudent:

-

Short-term (next 12 months): Slight downward pressure driven by intensified generic competition and cost-awareness. Expect prices to stabilize around USD 10–20 per month globally.

-

Medium-term (1–3 years): Stabilization due to mature generic market dynamics, with occasional slight fluctuations based on manufacturing costs and regulatory changes.

-

Long-term (3–5 years): Prices likely plateau unless significant new formulations or patents emerge, or if unintended supply chain disruptions occur.

In summary, retail prices for REMERON generics are expected to hover around USD 10–20 per 30-day supply, with negligible upward movement barring regulatory changes or market anomalies.

Market Growth and Revenue Outlook

Despite price stabilization, the growth in prescriptions driven by expanding mental health awareness and off-label uses ensures sustained revenues for manufacturers. Globally, the antidepressant market's compound annual growth rate (CAGR) is projected at 3-4% over the next five years, with mirtazapine occupying a stable segment owing to its specific therapeutic profile.

Key Factors Influencing Future Market and Pricing

- Patent expirations and generic entry

- Market penetration in emerging economies

- Changing prescribing guidelines favoring or de-emphasizing mirtazapine

- Development of novel antidepressants with superior efficacy or tolerability

- Healthcare policy reforms affecting drug reimbursement

Conclusion

REMERON (mirtazapine) remains a vital component in the antidepressant market, primarily due to its distinctive pharmacology and clinical niche. Its post-patent generic landscape ensures affordable pricing, with limited potential for significant price increases. Demand remains supported by clinical preference for its sedative and appetite-stimulant properties, with modest growth driven by global depression prevalence.

Business stakeholders should focus on:

- Monitoring generic market trends to optimize procurement strategies.

- Evaluating off-label uses for expanding clinical applications.

- Tracking regulatory changes that could influence manufacturing or formulation innovations.

Key Takeaways

- Market Size & Demand: The global antidepressant market is expanding, with mirtazapine capturing a significant share due to its unique therapeutic profile.

- Pricing Trends: Post-patent expiration, generic versions dominate, keeping prices low at USD 10–25 per month.

- Price Predictions: Stable pricing over the medium and long-term, barring regulatory or market disruptions.

- Competitive Dynamics: Intense generic competition limits brand premium potential, emphasizing cost-effective procurement.

- Strategic Outlook: Continued growth driven by rising mental health awareness and widening global access, with careful tracking of patent and regulatory developments.

FAQs

1. Has REMERON’s patent expired, and how does this affect its pricing?

Yes, the original patent expired in the early 2010s, enabling multiple generics to enter the market, which has driven down prices significantly.

2. What are the main advantages of mirtazapine over other antidepressants?

Its sedative and appetite-stimulating properties benefit patients with insomnia or weight loss, and it often exhibits better tolerability in certain populations, like the elderly.

3. Are there any upcoming patent protections or new formulations for REMERON?

Currently, no recent patent filings or advanced formulations are anticipated. Most future developments focus on generic manufacturing and distribution.

4. How does insurance coverage impact REMERON’s market price?

Insurance negotiations and formulary preferences often favor generics, further reducing out-of-pocket costs and influencing net pricing.

5. What is the future market outlook for REMERON?

Market demand is stable with modest growth prospects; prices are expected to remain low due to generic competition, with potential for minor fluctuations driven by regulatory or supply chain factors.

References

[1] Substance Abuse and Mental Health Services Administration (SAMHSA), 2020 National Survey on Drug Use and Health.