Share This Page

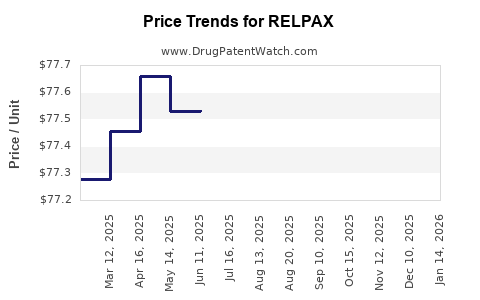

Drug Price Trends for RELPAX

✉ Email this page to a colleague

Average Pharmacy Cost for RELPAX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RELPAX 20 MG TABLET | 58151-0367-32 | 77.68695 | EACH | 2025-12-17 |

| RELPAX 20 MG TABLET | 00049-2330-79 | 77.68695 | EACH | 2025-12-17 |

| RELPAX 40 MG TABLET | 58151-0368-96 | 77.15146 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RELPAX (Eletriptan Hydrobromide)

Introduction

RELPAX (eletriptan hydrobromide) is a prescription medication developed by Allergan (now part of AbbVie) used primarily for the acute treatment of migraines with or without aura in adult patients. As a serotonin 1B/1D receptor agonist (“triptan”), RELPAX offers targeted relief for migraine sufferers, positioning itself within a competitive landscape of triptan drugs and alternative therapies. This analysis explores current market dynamics, competitive positioning, regulatory factors, pricing strategies, and future price projections for RELPAX, providing stakeholders with actionable intelligence to inform investment and commercialization decisions.

Market Landscape and Demand Drivers

The migraine treatment market is sizable, driven by the high prevalence of migraines globally. According to the World Health Organization (WHO), approximately 15% of the worldwide population suffers from migraines, translating to over a billion sufferers. In the United States alone, the CDC estimates that roughly 39 million adults experience migraines annually [1].

Several factors influence RELPAX's market share:

- Efficacy and Safety Profile: RELPAX is noted for rapid onset and sustained relief, with favorable tolerability compared to some older triptans.

- Market Incumbents and Competition: The triptan class includes sumatriptan, rizatriptan, eletriptan (RELPAX), and newer options like lasmiditan and ubrogepant, which target patients with contraindications to traditional triptans.

- Pricing and Reimbursement Landscape: Payer coverage, cost-sharing, and formulary placements significantly impact patient access and utilization.

- Prescriber Preferences: Clinician familiarity with RELPAX's efficacy and side-effect profile influences prescribing habits.

Global expenditure on migraine treatments is projected to grow at compounded annual growth rates (CAGRs) of approximately 4-6%, as new therapies expand options and awareness campaigns improve diagnosis rates [2].

Regulatory and Patent Status

RELPAX was approved by the FDA in 2009 and holds patent protections until at least 2024. Patent expiration creates potential for generic entrants, which historically lead to substantial price reductions and volume shifts. AbbVie's strategy for patent extension or exclusivity periods will influence pricing stability over the coming years.

The advent of highly effective "gepants" and serotonin 5-HT1F receptor agonists (e.g., lasmiditan) poses potential market share shifts, possibly curbing price inflation.

Pricing Dynamics and Competitive Positioning

Current Pricing Landscape

In the U.S., the average wholesale price (AWP) for a 10 mg RELPAX tablet hovers around $9–$10, with actual transaction prices adjusted downward via discounts, rebates, and pharmacy benefit manager negotiations. For comparison:

- Sumatriptan (generic): approximately $0.50–$2 per dose.

- Ubrogepant: around $15 per dose.

- Rizatriptan (generic): approximately $0.30–$1 per dose.

Reimbursement and Cost-Effectiveness

Reimbursement policies favor generic triptans, exerting downward pressure on RELPAX's net price. Nonetheless, RELPAX retains a premium for its differentiated efficacy, especially for patients unresponsive to generics.

Pricing Strategy and Market Differentiation

AbbVie's approach emphasizes establishing RELPAX as a first-line treatment for patients requiring rapid and reliable relief. The company leverages clinical data, patient assistance programs, and formulary negotiations to sustain premium pricing.

Future Price Projections (2023–2030)

Short-Term Outlook (2023–2025):

With patent protection intact and limited immediate generic competition, RELPAX is expected to maintain stable or slightly increasing pricing, supported by inflation, healthcare expenditure growth, and ongoing marketing efforts. Price increments are projected at approximately 2-3% annually, reflecting inflation and market conditions.

Mid to Long-Term Outlook (2026–2030):

Patent expiration anticipated around 2024-2025 could trigger generic entries, significantly eroding prices. Historical precedents for triptan generics demonstrate price drops up to 80% (from ~$10 to <$2 per tab). Hence, prices for branded RELPAX may decline by 60-75% within two years post-generic entry.

However, if AbbVie introduces new formulations, combination therapies, or patent extensions, branded prices could stabilize or even increase marginally via value-based pricing strategies.

Factors Influencing Price Trajectory:

- Market penetration of alternatives (lasmiditan, ubrogepant).

- Regulatory approvals of extended-release or novel triptans.

- Payer incentives and formulary tier placements.

- Consumer preferences moving toward non-triptan drugs or non-pharmacological modalities.

Market Entry Risks and Opportunities

The impending entry of generics represents a critical risk, potentially halving revenues for RELPAX. Conversely, opportunities include expanding indications (e.g., cluster headaches), developing combination formulations, and capturing underserved markets through targeted marketing.

Furthermore, the increasing acceptance of digital health solutions and personalized migraine management may enhance RELPAX market share if integrated effectively.

Conclusion and Strategic Implications

RELPAX occupies a stable position within the migraine pharmacotherapy market, supported by a favorable efficacy profile and brand recognition. However, its pricing sustainability hinges on patent protection and competitive dynamics.

To optimize profitability, AbbVie should consider strategies such as optimizing patient access programs, pursuing patent protections, and investing in pipeline innovations. The impending generic wave demands intensified focus on differentiation and value-added offerings to retain market share and mitigate revenue erosion.

Key Takeaways

- Market Dynamics: The global migraine treatment market is expanding, with increasing demand for effective therapies like RELPAX, particularly among patients unresponsive to or intolerant of generics.

- Pricing Trend: Short-term pricing remains stable, but significant declines are expected post-patent expiry, with potential reductions up to 75% within two years of generic entry.

- Competitive Landscape: Ancillary therapies and new drug classes threaten RELPAX’s market share, emphasizing the importance of ongoing innovation and differentiation.

- Regulatory and Patent Strategies: Patent expiry timelines are critical; proactive patent strategies and pipeline development are essential to sustain pricing power.

- Forecasting: By 2030, expect a marked decline in brand-name RELPAX prices unless new formulations or indications extend lifecycle and revenue.

FAQs

1. When is RELPAX's patent expected to expire, and how will this impact pricing?

Patents for RELPAX are anticipated to expire around 2024–2025. Post-expiry, generic eletriptan is likely to enter the market, causing branded prices to decline by 60–75%, significantly reducing revenue potential.

2. How does RELPAX compare in price to generic triptans?

Relpax's per-dose cost (~$9–$10 in the U.S.) is substantially higher than generics like sumatriptan (~$0.50–$2). This premium reflects its differentiated efficacy profile and targeted patient benefits.

3. What are the main competitive threats to RELPAX now and in the future?

Emerging threats include newer therapies such as lasmiditan, ubrogepant, and generic triptans, which offer similar or improved safety and efficacy profiles at lower costs.

4. What strategies can extend RELPAX's market exclusivity?

Developing new formulations, unique dosing regimens, or additional indications, alongside patent protections, can prolong market exclusivity and sustain higher prices.

5. How is the global migraine market expected to grow, and what does this mean for RELPAX?

The global migraine market is projected to grow at a CAGR of 4–6%, supporting ongoing demand. However, price erosion post-patent expiry emphasizes the need for strategic product lifecycle management.

References

[1] CDC. (2022). “Migraine Facts & Figures.” Centers for Disease Control and Prevention.

[2] Grand View Research. (2022). “Migraine Drugs Market Size, Share & Trends Analysis Report.”

More… ↓