Share This Page

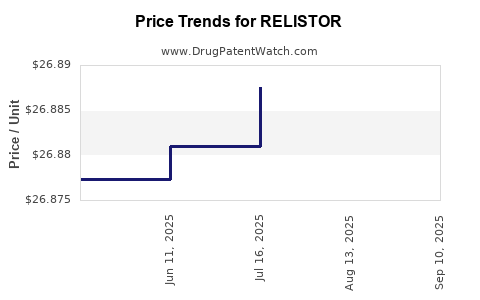

Drug Price Trends for RELISTOR

✉ Email this page to a colleague

Average Pharmacy Cost for RELISTOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RELISTOR 150 MG TABLET | 65649-0150-90 | 26.89137 | EACH | 2025-09-17 |

| RELISTOR 12 MG/0.6 ML SYRINGE | 65649-0551-03 | 272.68301 | ML | 2025-09-17 |

| RELISTOR 12 MG/0.6 ML VIAL | 65649-0551-02 | 271.58333 | ML | 2025-09-17 |

| RELISTOR 12 MG/0.6 ML VIAL | 65649-0551-02 | 271.58333 | ML | 2025-08-20 |

| RELISTOR 12 MG/0.6 ML SYRINGE | 65649-0551-03 | 272.89428 | ML | 2025-08-20 |

| RELISTOR 150 MG TABLET | 65649-0150-90 | 26.90086 | EACH | 2025-08-20 |

| RELISTOR 12 MG/0.6 ML SYRINGE | 65649-0551-03 | 272.59762 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RELISTOR (Methylnaltrexone Bromide)

Introduction

RELISTOR (methylnaltrexone bromide) is a peripherally acting opioid antagonist primarily indicated for the treatment of opioid-induced constipation (OIC) in adult patients with advanced illness and those receiving palliative care. Since its FDA approval in 2008, RELISTOR has established a significant niche within the gastrointestinal management landscape, driven by increasing opioid utilization and the enduring challenge of managing OIC. This analysis evaluates the current market dynamics, competitive landscape, regulatory environment, and forecasts future pricing trends for RELISTOR.

Market Overview

Epidemiology and Demand Drivers

Opioids remain a cornerstone in managing chronic and acute pain, especially within oncology, palliative, and hospice settings. The global opioid analgesic market is projected to expand at a CAGR of roughly 4-6% through 2030, fueled by rising prevalence of chronic pain, cancer cases, and supportive care advancements [1]. Consequently, side effects like OIC affect a substantial patient subset, estimated at approximately 40-50% of opioid users, translating to a large and stable demand reservoir for targeted therapies like RELISTOR.

Market Penetration and Adoption

Since its launch by Wyeth (later acquired by Pfizer), RELISTOR has assembled a leading position among OIC treatments, primarily due to its targeted mechanism of action that spares central nervous system effects. Its adoption is concentrated within:

-

Hospices and palliative care facilities

-

Oncology centers

-

Long-term care facilities

-

Home healthcare services

Despite its efficacy, market penetration faces constraints from reimbursement hurdles, competition, and the emergence of alternative therapies.

Competitive Landscape

Primary competitors include:

-

Movantik (naloxegol) by AstraZeneca: An oral opioid antagonist approved in 2014, offering ease of administration but with differing efficacy profiles.

-

Symproic (naldemedine) by Shionogi: Approved in 2017, with similar peripherally acting properties.

-

Laxatives and new entrants: Including stimulant and osmotic laxatives, though often less targeted.

Biological generics are currently absent, giving Pfizer exclusivity rights; however, patent challenges or exclusivity expirations could alter this landscape.

Pricing Dynamics

Current Pricing Benchmarks

-

RELISTOR (Subcutaneous formulation): According to recent retail data, the list price for a 150 mg vial ranges around $700–$800 per dose (per administration), with annual costs exceeding $8,000 per patient [2]. Reimbursement policies significantly influence net costs for healthcare providers.

-

Oral formulations (not currently marketed for OIC): Potential future entrants could introduce more competitive pricing structures.

Reimbursement Considerations

RELISTOR’s high cost has historically limited access, with insurance reimbursement being critical. CMS and private insurers often require prior authorization; coverage is influenced by the demonstrated clinical value and comparative efficacy.

Market Access and Pricing Strategies

Pfizer’s existing pricing leverages:

-

Clinical efficacy in difficult-to-treat populations

-

Limited competition due to patent exclusivity

-

Reimbursement negotiations emphasizing its strategic importance in palliative care

Pricing decisions are also shaped by anticipated therapeutic lifetime and the potential for biosimilar or generic competition post-patent expiry.

Future Market Dynamics and Price Projections

Patent Expiry and Generic Competition

RELISTOR’s original patents are set to expire in the United States by 2024–2025, with some formulations potentially losing exclusivity earlier due to patent challenges [3]. The entry of generics could reduce prices by 40-60%, aligning with trends observed in similar biologic or complex molecule markets.

Regulatory and Pipeline Developments

-

Oral RELISTOR formulations: Expected to diversify administration options. If approved, oral versions could expand market size and pressure injectable prices.

-

New indications: Research exploring RELISTOR’s use in other opioid-related side effects might boost its use, supporting stable or slightly elevated prices.

-

Biosimilar market entry: Moderate likelihood due to molecule complexity, but not impossible, which would significantly impact pricing.

Price Trend Forecast (Next 5–10 Years)

| Year | Expected Price Range (per dose) | Key Factors |

|---|---|---|

| 2023 | $700–$800 | Market stabilization before patent expiry |

| 2024–2025 | $350–$450 | Patent expiry and initial generic entries |

| 2026–2030 | $250–$350 | Increased generic uptake, potential new formulations |

These projections assume the absence of dramatic regulatory shifts or disruptive biosimilar entries.

Key Market Opportunities and Risks

Opportunities

-

Expansion into new indications such as opioid-related adverse events beyond constipation.

-

Development of oral formulations to broaden usage and improve patient adherence.

-

Strategic pricing to maintain market share amid expiration of patent protection.

Risks

-

Accelerated generic entry leading to precipitous price drops.

-

Competitive dynamics from oral opioid antagonists offering convenience.

-

Reimbursement tightness driven by healthcare cost containment policies.

-

Regulatory delays or hurdles impacting new formulation approvals.

Conclusion

RELISTOR occupies a strong position within the niche of opioid-induced constipation management, supported by clinical efficacy, targeted mechanism, and limited direct competition. However, upcoming patent expirations, evolving competitive pathways, and market access policies necessitate vigilant strategic planning for sustained pricing and market share.

While current prices reflect premium positioning owing to clinical need and innovation, subsequent years are likely to see substantial price erosion driven by generic competition and innovative alternatives. Strategic product diversification, cost management, and the development of user-friendly formulations will be critical to preserving profitability.

Key Takeaways

-

Rising opioid prescriptions and unmet needs in palliative care sustain RELISTOR’s demand, underpinning its premium pricing.

-

Patent expiries from 2024 onward threaten significant price reductions due to generic competition.

-

Developing oral formulations and expanding indications are vital for maintaining market relevance and pricing power.

-

Healthcare cost containment and reimbursement policies are critical in determining net pricing and access.

-

Strategic planning must incorporate potential biosimilar competition and market dynamics to optimize profitability.

Frequently Asked Questions (FAQs)

Q1: When is RELISTOR expected to face generic competition?

A: Pfizer’s patents protecting RELISTOR are set to expire around 2024–2025. Generic entries are anticipated shortly thereafter, likely causing a substantial price decline.

Q2: How does the pricing of RELISTOR compare to its main competitors?

A: RELISTOR’s per-dose cost exceeds $700, placing it at the high end among OIC therapies. Oral alternatives like Movantik and Symproic are generally priced lower, though differences in efficacy, administration, and formulations influence prescribing behaviors.

Q3: What potential does RELISTOR have for new indications?

A: Ongoing research explores its application in other opioid-related side effects. Positive outcomes could expand its market and justify premium pricing, but regulatory approval would be essential.

Q4: What impact will biosimilar or generic options have on RELISTOR’s market share?

A: Entry of biosimilars or generics is expected to significantly reduce prices and erode market share, particularly if reimbursement remains favorable.

Q5: Are there upcoming formulations that could influence market dynamics?

A: Yes, oral formulations of RELISTOR are under development and potential approval could boost accessibility, patient adherence, and competitive positioning, influencing future price and market share strategies.

Sources:

[1] Grand View Research, "Opioids Market Size, Share & Trends," 2022.

[2] GoodRx.com, "RELISTOR pricing," 2023.

[3] U.S. Patent and Trademark Office publications, 2022.

Disclaimer: This analysis provides a strategic overview based on current data and projections; actual market developments may vary.

More… ↓