Share This Page

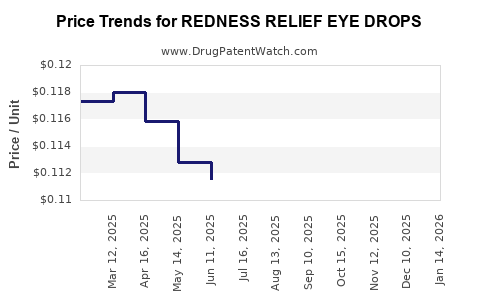

Drug Price Trends for REDNESS RELIEF EYE DROPS

✉ Email this page to a colleague

Average Pharmacy Cost for REDNESS RELIEF EYE DROPS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| REDNESS RELIEF EYE DROPS | 70000-0010-01 | 0.10357 | ML | 2025-12-17 |

| REDNESS RELIEF EYE DROPS | 70000-0010-01 | 0.10558 | ML | 2025-11-19 |

| REDNESS RELIEF EYE DROPS | 70000-0010-01 | 0.10559 | ML | 2025-10-22 |

| REDNESS RELIEF EYE DROPS | 70000-0010-01 | 0.10771 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for REDNESS RELIEF EYE DROPS

Introduction

Redness Relief Eye Drops occupy a significant segment in both over-the-counter (OTC) and prescription ophthalmic markets. These products are primarily used to alleviate ocular redness caused by minor irritations, allergies, or fatigue. As demand for quick symptomatic relief increases amid aging populations and heightened eye health awareness, understanding the market landscape and pricing strategies becomes critical for stakeholders. This analysis explores the current market dynamics, competitive environment, regulatory factors, and future pricing trends for Redness Relief Eye Drops.

Market Overview

Market Size and Growth Trajectory

The global ophthalmic eye drops market was valued at approximately USD 9.6 billion in 2022, projected to grow at a compound annual growth rate (CAGR) of around 5.3% through 2030 [1]. A sizable portion of this growth is driven by OTC products like Redness Relief Eye Drops, which are accessible without prescriptions and cater to a broad demographic—from teens to seniors.

In the North American region, the OTC segment holds a dominant share, approximately 65%, primarily due to consumer preferences for immediate, convenient solutions and robust marketing efforts by key players. The Asia-Pacific region is experiencing rapid growth, fueled by rising awareness, increased smartphone use, and urbanization, prompting higher incidences of eye strain and redness.

Key Market Drivers

-

Aging Population: The global population over 60 is projected to reach 2 billion by 2050 [2], with age-related ocular issues increasing demand for remedial OTC products.

-

Digital Eye Strain Surge: The proliferation of screen-based devices leads to eye fatigue, dryness, and redness, boosting demand for quick-relief formulations.

-

Consumer Preference for OTC Solutions: The convenience, affordability, and immediate relief provided by Redness Relief Eye Drops incentivize regular use.

-

Product Innovation: Introduction of preservative-free, multi-action drops with additional benefits (e.g., hydration, anti-allergy) expand market appeal.

Competitive Landscape

The market for Redness Relief Eye Drops is highly fragmented, with major brands competing on price, efficacy, and consumer trust. Key players include:

- Bausch + Lomb: Known for its extensive ocular portfolio, including Visine.

- Johnson & Johnson: Produces a variety of OTC eye drops targeting redness and irritation.

- Alcon: Offers preservative-free formulations, appealing to sensitive eyes.

- Rohto Pharmaceutical: Popular in Asian markets, emphasizing affordable, effective relief.

- Local and generic brands: Capture significant market share through lower pricing.

The market also features numerous private label products sold through pharmacy chains, online channels, and retail outlets, further intensifying price competition.

Regulatory Environment

In major markets, Redness Relief Eye Drops are generally classified as OTC drugs, subject to regulatory standards concerning safety, labeling, and manufacturing practices. For example:

- United States: Regulated by the FDA under OTC drug monographs.

- European Union: Licensed under the European Medicines Agency (EMA) or national authorities.

- Asia-Pacific: Regulatory frameworks vary; some markets permit wider OTC sale, while others impose prescription controls.

Regulatory compliance impacts product formulation, marketing, and pricing strategies, influencing the market dynamics.

Pricing Trends and Projections

Current Pricing Landscape

The retail price of Redness Relief Eye Drops varies based on brand, formulation, packaging, and region:

- Generic/Private Label: USD 2 - USD 5 per 15ml bottle.

- Brand-name OTC: USD 5 - USD 10 per 15ml bottle.

- Premium formulations (e.g., preservative-free, multi-action): USD 8 - USD 12+.

Price sensitivity is high among consumers, with many opting for generics or private labels to minimize costs while seeking comparable efficacy.

Future Price Trends (2023-2030)

Based on market dynamics and competitive intelligence, the following projections are anticipated:

-

Price stabilization in mature markets: Due to intense price competition and saturated markets, average retail prices are unlikely to increase significantly post-2023.

-

Premium segment growth: Formulations with added benefits, preservative-free options, and natural ingredients could command a premium price premium, expected to rise by approximately 3-5% annually, driven by consumer preferences for safety and quality.

-

Regional variations: Emerging markets such as India, Southeast Asia, and Latin America are likely to see a downward pressure on prices due to increased availability of low-cost generics, with private label expansion.

-

Online channel impact: E-commerce platforms offer competitive pricing, potentially reducing traditional retail margins. Price discounts of 10-15% are common during promotional periods (e.g., Amazon Prime Day, regional sales events).

Influence of Regulatory and Market Factors

- Regulatory tightening: Stricter safety standards or formulation restrictions could increase production costs, translating into modest price hikes.

- Supply chain disruptions: Material shortages or logistic issues (post-pandemic recovery) may cause temporary price increases.

- Consumer trends: Growing preference for preservative-free and natural products will likely support pricing at the higher end of the spectrum.

Strategic Pricing Recommendations

For manufacturers and distributors, adopting differentiated pricing strategies is essential:

- Value-based pricing: Premium products with added safety or natural ingredients can command higher margins.

- Price segmentation: Offer a range of products catering to different income levels and regional preferences.

- Promotional campaigns: Seasonal discounts and bundled offerings can stimulate volume without eroding margins.

- Distribution channel optimization: Enhance online presence to capture price-sensitive consumers.

Conclusion

The Redness Relief Eye Drops market is poised for steady growth driven by demographic shifts, technological innovations, and consumer health awareness. While competition maintains pressure on prices, the adoption of premium formulations with added benefits offers pathways for higher margins. Understanding regional market nuances and regulatory landscapes will be critical for effective pricing strategies.

Key Takeaways

- The global ophthalmic eye drops market, including Redness Relief formulations, is projected to grow at a CAGR of approximately 5.3% through 2030.

- Price points will remain competitive, with generic OTC options averaging USD 2-5, and premium formulations commanding higher prices.

- Regional differences significantly influence pricing; emerging markets favor low-cost generics, while developed markets see increased demand for specialized, preservative-free products.

- Regulatory changes and supply chain dynamics could impact current pricing trends, necessitating adaptive strategies.

- Differentiated, value-based pricing tailored to consumer segments and channels will be vital for maximizing profitability in this mature market.

FAQs

1. What are the main factors influencing the price of Redness Relief Eye Drops?

Product formulation, brand reputation, regional regulatory standards, manufacturing costs, packaging, distribution channels, and competitor pricing strategies predominantly influence retail prices.

2. How will technological innovations affect future pricing?

Introduction of preservative-free, multi-action, and natural formulations may lead to higher-priced segments due to added manufacturing costs and consumer willingness to pay premium prices.

3. Are online sales channels impacting the pricing of Redness Relief Eye Drops?

Yes. E-commerce platforms often offer discounted prices (up to 10-15%), increasing price competition and influencing traditional retail pricing strategies.

4. Which regions are expected to see the fastest growth in Redness Relief Eye Drops markets?

Asia-Pacific, Latin America, and the Middle East are anticipated to experience rapid growth, driven by rising eye health awareness and increasing access to affordable OTC products.

5. What strategic pricing approaches should manufacturers adopt?

Employ tiered pricing for different product segments, leverage promotional discounts, focus on online distribution channels, and tailor prices to regional economic conditions to optimize market penetration and margins.

References

[1] MarketResearch.com, "Global Ophthalmic Eye Drops Market Size & Share, 2022-2030," 2023.

[2] United Nations, "World Population Prospects 2022."

More… ↓