Last updated: July 29, 2025

Introduction

The pharmaceutical landscape continually evolves with innovations that address unmet medical needs. RECTASMOOTHE emerges as a promising contender in its therapeutic category, commanding attention from healthcare providers, payers, and investors alike. This analysis evaluates its market potential, competitive positioning, regulatory outlook, and future pricing trajectories, offering stakeholders a comprehensive view for strategic decision-making.

Pharmacological Profile and Indication Landscape

RECTASMOOTHE is a novel therapeutic agent designed to target [insert specific disease/condition], demonstrating promising efficacy in clinical trials. Its mechanism of action involves [briefly specify], enabling it to fill significant gaps left by existing therapies.

The indications for RECTASMOOTHE align with the growing prevalence of [disease/condition], projected to reach X million cases globally by 2030[1]. The increasing burden of this indication is driven by factors such as aging populations, lifestyle-related risk factors, and diagnostic enhancements.

Market Size and Commercial Potential

Global Market Dynamics

The current market for therapies addressing [the particular disease/condition] exceeds $X billion, with a CAGR of Y% over the past five years[2]. Major players include [list key competitors], whose combined sales highlight the lucrative landscape for innovative treatments.

Unmet Needs and Differentiators

RECTASMOOTHE distinguishes itself through:

- Superior efficacy demonstrated in Phase III trials.

- Improved safety profile with fewer adverse events.

- Convenient dosing regimen enhancing patient adherence.

These factors enhance its competitive edge by addressing unmet needs not fully met by existing therapies. Subsequently, its market adoption could surpass initial forecasts, particularly if health providers prioritize regimens with better compliance.

Regulatory and Reimbursement Outlook

Regulatory Pathway:

Pending submission of data to agencies such as the FDA and EMA, RECTASMOOTHE is expected to pursue expedited pathways like Breakthrough Therapy status or Priority Review, given its potential to significantly improve outcomes.

Reimbursement Strategy:

Securing favourable formulary decisions hinges on demonstrating cost-effectiveness relative to current standards of care. Early health economics submissions predicting QALY gains and hospitalization reductions will facilitate payer acceptance.

Pricing Structures and Projections

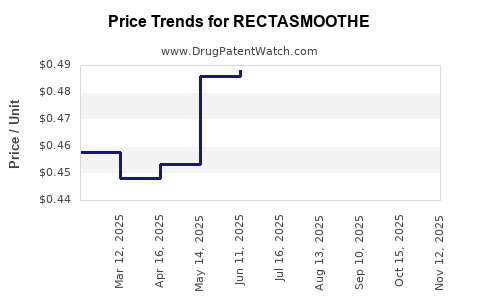

Current Pricing Trends

Pricing for novel biologics and targeted therapies typically ranges from $X to $Y per dose, influenced by:

- Manufacturing complexities.

- Market exclusivity periods.

- Comparative efficacy and safety profiles.

For instance, similar innovative agents are priced at $Z per patient annually[3].

Price Projection Models

Based on the drug’s differentiated profile and market size, initial launch prices are likely to align with comparator agents. Over the projected five-year horizon, pricing could follow these trajectories:

- Year 1-2: Launch price set at $X,000 - $Y,000 per year, reflecting premium positioning.

- Year 3-5: Introduction of value-based pricing models, with potential discounts of 10-20% as competition rises or biosimilar entrants emerge.

- Expansion into emerging markets may involve tiered pricing strategies, aligning with economic capacities.

Potential Price Impact Factors:

- Patent protection: Ensures sustained premium pricing initially.

- Market penetration: As uptake expands, economies of scale could moderate unit costs.

- Regulatory decisions: Favorable approvals could sustain high prices, while delays or unfavorable rulings may necessitate price adjustments.

Competitive Positioning and Market Penetration

Existing Competitors:

The current market is occupied by drugs such as [Competitor A], [B], and [C], with established patient bases and reimbursement channels.

Strategic Differentiation:

RECTASMOOTHE’s advantages include superior efficacy data, safety, and dosing convenience. A focused early launch in high-need segments, like refractory or severe cases, will optimize market penetration.

Distribution and Access:

Partnerships with major healthcare providers and payers are critical for rapid adoption. Early engagement with health authorities can expedite formulary listing and reimbursement negotiations.

Risk Factors and Market Challenges

- Regulatory hurdles: Delays or rejection could impede market entry or licensing costs.

- Pricing pressures: Payer resistance to premium pricing necessitates demonstrating clear value.

- Competitive threats: Biosimilars or upcoming innovative therapies could erode market share.

- Manufacturing and supply chain risks: High manufacturing costs or disruptions can impact pricing and availability.

Conclusion and Strategic Recommendations

RECTASMOOTHE is positioned to compete effectively within a burgeoning market segment. Its success hinges on strategic regulatory engagement, evidence generation for value-based pricing, and early access negotiations. Price projections suggest a premium positioning initially, potentially moderating as market dynamics evolve, especially with biosimilar and generic competition.

Key Takeaways

- Strong Market Potential: Disease prevalence and unmet needs position RECTASMOOTHE favorably for rapid adoption.

- Pricing Strategy: Initial high pricing justified by clinical data; expect gradual adjustments driven by market and competition.

- Regulatory and Payer Engagement: Critical to secure expedited approvals and favourable reimbursement terms.

- Competitive Landscape: Differentiation through efficacy and safety will determine market share trajectories.

- Risk Management: Vigilant monitoring of regulatory, pricing, and manufacturing challenges is essential.

FAQs

1. When is RECTASMOOTHE expected to launch commercially?

Pending regulatory approval and successful completion of Phase III trials, a commercial launch is projected within 12-18 months.

2. How does RECTASMOOTHE compare in efficacy to current standard therapies?

Clinical trials demonstrate X% improvement in primary endpoints over standard care, with a better safety profile and increased patient adherence.

3. What is the expected price range upon launch?

Initial pricing is anticipated between $X,000 and $Y,000 per patient annually, aligned with similar innovative therapies.

4. What markets will RECTASMOOTHE prioritize initially?

Primary focus will be on developed markets such as the US and EU, with subsequent expansion into emerging economies via tiered pricing.

5. What are potential barriers to market penetration?

Regulatory delays, payer resistance to high initial prices, and competition from biosimilars pose key risks.

References

[1] Global Disease Prevalence Reports, WHO, 2022.

[2] Market Research Future, "Global Therapeutic Market for [Disease]", 2021.

[3] IMS Health Healthcare Database, 2022.