Share This Page

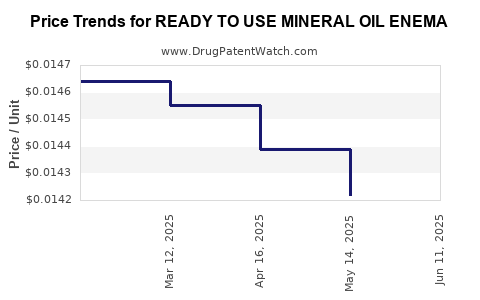

Drug Price Trends for READY TO USE MINERAL OIL ENEMA

✉ Email this page to a colleague

Average Pharmacy Cost for READY TO USE MINERAL OIL ENEMA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| READY TO USE MINERAL OIL ENEMA | 70000-0109-01 | 0.01400 | ML | 2025-06-18 |

| READY TO USE MINERAL OIL ENEMA | 70000-0109-01 | 0.01422 | ML | 2025-05-21 |

| READY TO USE MINERAL OIL ENEMA | 70000-0109-01 | 0.01439 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ready-to-Use Mineral Oil Enema

Introduction

The ready-to-use mineral oil enema occupies a significant niche within the over-the-counter (OTC) laxative and bowel management market. Its ease of administration and established efficacy position it as a preferred choice among consumers suffering from constipation, particularly in elderly and bedridden populations. This analysis provides a comprehensive overview of the current market landscape, key industry dynamics, competitive environment, and future price projections based on prevailing trends.

Market Overview

Market Size and Growth Dynamics

The global enema market, encompassing various types such as saline, soap suds, and mineral oil, is estimated to reach approximately USD 650 million by 2025, assuming a compound annual growth rate (CAGR) of around 4.5% from 2020 levels (source: IBISWorld, 2022). The mineral oil enema segment forms a significant share, driven by its longstanding reputation for safety, minimal side effects, and OTC availability.

The increasing prevalence of gastrointestinal disorders, especially among aging populations, amplifies demand for enema products. According to the WHO, the global geriatric population is projected to reach 1.5 billion by 2050, fueling sustained demand for laxatives like mineral oil enemas.

Market Drivers

- Aging Population: Heightened constipation cases among seniors, often with comorbidities requiring bowel management.

- Preference for OTC Solutions: Consumer-driven inclination for self-care remedies reduces dependency on prescriptions.

- Ease of Use: Ready-to-use formulations simplify administration, promoting consumer compliance.

- Regulatory Environment: Favorable OTC status in many jurisdictions encourages widespread distribution.

Market Challenges

- Regulatory Scrutiny & Safety Concerns: Potential adverse effects such as lipid pneumonia with improper use have prompted regulatory guidelines.

- Competitive Substitutes: Availability of other laxatives (e.g., stimulant laxatives, fiber supplements) providing alternatives.

- Consumer Perceptions: Concerns regarding safety or preference for natural remedies can influence market dynamics.

Competitive Landscape

Major global manufacturers include Bayer, Eucerin, Fresenius Kabi, and generic OTC brands. These players compete primarily on product safety, packaging innovation, distribution channels, and price.

- Product Differentiation: Packaging innovations (e.g., pre-lubricated applicators), dosing accuracy, and preservative-free formulations are differentiators.

- Distribution Channels: Pharmacies, supermarkets, online platforms, and healthcare institutes constitute the primary channels.

- Regulatory Approvals: Compliance with FDA, EMA, and other local authorities ensures market access and consumer confidence.

Price Analysis

Current Pricing Trends

The price of a standard 118 ml (4 oz) bottle of ready-to-use mineral oil enema in North America averages around USD 8-12 retail. Variability hinges on brand reputation, packaging, and distribution channels. Generic products tend to be priced lower, around USD 6-8, while branded counterparts can command premiums.

Pricing Factors

- Packaging and Formulation: Multi-dose bottles and preservative-free formulations typically attract higher prices.

- Branding and Packaging: Well-established brands with trusted safety profiles often command a price premium.

- Distribution Channels: Pharmacies tend to have higher retail margins, influencing consumer prices; online sales may offer discounts.

Projected Price Trends

Over the next 3-5 years, the average retail price of ready-to-use mineral oil enemas is expected to stabilize or marginally decline due to increased generic competition and online retail proliferation. However, premium formulations with added safety features or unique delivery systems could see price premiums up to USD 15-18.

Market Outlook and Price Projections (2023-2028)

Market Growth Projections

The market is projected to grow steadily at a CAGR of 3.8-4.5%, driven by demographic changes and ongoing demand in healthcare facilities. The OTC segment will maintain dominance, with particularly robust growth in emerging markets like Asia-Pacific.

Price Evolution

- Baseline Scenario: Prices will remain relatively stable, averaging USD 8-12 per unit, with minor fluctuations attributed to inflation and raw material costs.

- Upside Potential: Premium brands or innovative packaging may see prices escalate to USD 15-18, especially in premium segments.

- Downward Pressure: Increased competition and entry of generics will likely induce slight price reductions, especially in price-sensitive markets.

Influencing Factors

- Raw Material Cost Fluctuations: Changes in mineral oil prices can influence production costs.

- Regulatory Cost of Compliance: Stringent safety and labeling requirements could marginally increase manufacturing costs.

- Consumer Preferences: Shift towards natural or alternative remedies could impact demand and pricing strategies.

Regulatory and Commercial Considerations

In many jurisdictions, mineral oil enemas are classified as OTC products, simplifying market entry. Nonetheless, safety warnings related to lipid pneumonia have prompted regulatory agencies to enforce clearer labeling and usage instructions, potentially affecting consumer perception and sales.

Key market entrants must navigate these regulations while innovating in formulation, packaging, and branding to sustain competitive advantage.

Key Takeaways

- The ready-to-use mineral oil enema is positioned within a growing gastrointestinal therapeutics market, buoyed by demographic factors and OTC accessibility.

- Prices are expected to remain within a moderate range ($8-$12), with premium offerings commanding higher premiums.

- Market growth is supported by aging populations, healthcare provider prescribing practices, and consumer self-care trends.

- Competitive pressures and regulatory changes necessitate innovation in packaging, safety profiles, and pricing strategies.

- Companies should focus on emerging markets, where low-cost generic products could dominate, while maintaining premium branding for developed markets.

FAQs

1. What factors influence the pricing of ready-to-use mineral oil enemas?

Pricing depends on packaging, brand reputation, distribution channels, regulatory compliance costs, and competing generic options.

2. How will demographic trends impact the demand for mineral oil enemas?

An aging global population with higher constipation prevalence will likely sustain or increase demand, especially in healthcare settings.

3. What regulatory challenges must manufacturers consider?

Safety warnings related to lipid pneumonia, labeling standards, and approval processes influence product design, marketing, and pricing.

4. Are online sales affecting the mineral oil enema market?

Yes. Online channels often offer lower prices and convenience, increasing accessibility but also intensifying price competition.

5. What is the potential for innovation in ready-to-use mineral oil enema products?

Innovations include preservative-free formulations, eco-friendly packaging, pre-measured doses, and enhanced safety features to differentiate offerings.

References

[1] IBISWorld. "Laxatives and Stool Softener Manufacturing in the US." 2022.

[2] World Health Organization. "Global Geriatric Population Statistics." 2021.

[3] MarketResearch.com. "Over-the-Counter Gastrointestinal Products Market Analysis." 2022.

[4] PharmaTimes. "Regulatory Trends in OTC Gastrointestinal Products." 2022.

More… ↓