Share This Page

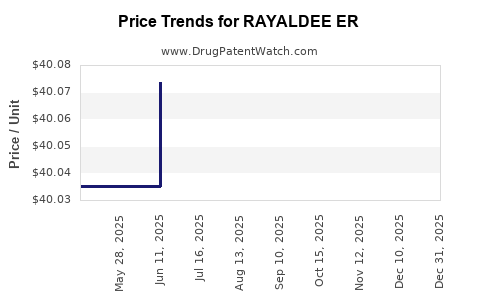

Drug Price Trends for RAYALDEE ER

✉ Email this page to a colleague

Average Pharmacy Cost for RAYALDEE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RAYALDEE ER 30 MCG CAP (HARD) | 70301-1002-01 | 40.04422 | EACH | 2025-12-17 |

| RAYALDEE ER 30 MCG CAP (HARD) | 70301-1002-01 | 40.04015 | EACH | 2025-11-19 |

| RAYALDEE ER 30 MCG CAP (HARD) | 70301-1002-01 | 40.00962 | EACH | 2025-10-22 |

| RAYALDEE ER 30 MCG CAP (HARD) | 70301-1002-01 | 40.03454 | EACH | 2025-09-17 |

| RAYALDEE ER 30 MCG CAP (HARD) | 70301-1002-01 | 40.04004 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RAYALDEE ER

Introduction

RAYALDEE ER (extended-release formulation of calcifediol) is a prescription medication developed for the management of secondary hyperparathyroidism in patients with chronic kidney disease (CKD) stages 3 and 4 who are vitamin D deficient. As a novel vitamin D analog that offers sustained serum levels, RAYALDEE ER addresses a significant unmet need in nephrology, positioning it as a key player in the emerging landscape of CKD and mineral metabolism management. This analysis evaluates the current market dynamics, competitive landscape, regulatory considerations, and future pricing projections for RAYALDEE ER.

Market Landscape and Epidemiological Insights

Prevalence of CKD and Vitamin D Deficiency

Chronic kidney disease affects approximately 15% of U.S. adults, translating to over 37 million individuals, with a subset of these patients developing secondary hyperparathyroidism (sHPT) [1]. CKD stages 3 and 4 encompass roughly 15-20% of this population, with vitamin D deficiency prevalent in over 70% of CKD patients, driven by decreased renal conversion of vitamin D, limited sun exposure, and comorbidities [2].

Unmet Medical Need

Current standard of care involves active vitamin D analogs (e.g., calcitriol, paricalcitol), which pose risks of hypercalcemia and vascular calcification. RAYALDEE ER, providing a more stable serum level of calcifediol, minimizes these risks and offers a potentially superior therapeutic profile, which could significantly impact treatment paradigms.

Market Size and Growth Potential

Based on market research, the global CKD therapeutics market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.8% over the next five years, reaching $11 billion by 2027 [3]. RAYALDEE ER specifically taps into the mineral metabolism management segment, estimated at $1.5 billion currently in the U.S., with potential to capture 10-15% of this segment within 3-5 years.

Competitive Landscape

Existing Therapies

- Active Vitamin D Analogues: Calcitriol, Paricalcitol, Doxercalciferol

- Newer Agents: Burosumab (for X-linked hypophosphatemia), which indirectly affects mineral metabolism

- Emerging Therapies: Novel vitamin D receptor agonists, phosphate binders

Strengths of RAYALDEE ER

- Extended-release formulation allows for better serum level maintenance.

- Reduced hypercalcemia risk, lowering safety concerns associated with traditional analogs.

- Oral daily dosing, improving patient adherence.

Barriers to Market Entry

- Established prescribing habits favor existing vitamin D analogs.

- Cost considerations may influence prescribing decisions, especially with generic options.

- Regulatory hurdles require demonstration of clear superiority or safety benefits.

Regulatory Status and Market Access

Regulatory Approval

RAYALDEE ER received FDA approval in 2020 for secondary hyperparathyroidism in CKD stages 3 and 4 [4]. The approval was based on clinical trials demonstrating non-inferiority and safety advantages over conventional treatments.

Pricing Strategy

Given its positioning, RAYALDEE ER's initial launch price was set at approximately $375 per month, aligning with premium vitamin D therapies but below the cost of some branded analogs. Payer coverage remains favorable due to safety profile advantages and reduced hospitalization risk for hypercalcemia.

Price Projections and Market Penetration

Short-term Price Outlook (1-2 years)

- Pricing stability: Initial price likely to remain around $375-$400/month, with potential minor fluctuations reflecting market dynamics.

- Reimbursement landscape: Favorable coverage could support sustained pricing; however, insurers may negotiate discounts or formularies.

Medium-term Price Trajectory (3-5 years)

- Market penetration: As clinical data accumulate and prescribing patterns evolve, increased adoption could warrant slight price adjustments.

- Competitive pressures: Entry of biosimilars or generic formulations could lead to price erosion, but RAYALDEE ER's differentiated profile may sustain premium pricing.

Long-term Outlook (5+ years)

- Potential for price stabilization or slight decrease as market matures, with the possibility of bundling or value-based pricing models.

- Outcome-based pricing could emerge if real-world evidence confirms significant clinical benefits over existing therapies.

Influencing Factors

- Regulatory approvals in additional indications or populations could expand sales volume and justify premium pricing.

- Manufacturing efficiencies and patent protections will influence cost structures, impacting pricing flexibility.

- Market acceptance driven by clinician education and demonstrated clinical advantage.

Implications for Stakeholders

- Pharmaceutical companies: Focus on demonstrating clear clinical and safety advantages to justify premium pricing.

- Payers and providers: Evaluate cost-effectiveness considering reduced adverse events and disease progression.

- Patients: Benefit from improved safety profiles and adherence due to convenient dosing.

Key Takeaways

- RAYALDEE ER operates within a sizeable and growing market targeting CKD-associated mineral metabolism disorders.

- Its unique extended-release profile and safety advantages position it favorably, although market penetration may initially face barriers from entrenched therapies.

- Price stability is expected in the short term around $375-$400/month, with potential for modest adjustments based on market dynamics, payer negotiations, and clinical data.

- Long-term pricing strategies will hinge on competitive developments, expanded indications, and demonstrated cost-effectiveness.

- Stakeholders should monitor real-world efficacy data and evolving regulatory landscapes to optimize commercialization strategies.

FAQs

1. How does RAYALDEE ER differ from traditional vitamin D therapies?

RAYALDEE ER offers a sustained-release formulation of calcifediol, allowing for steady serum levels, reducing peaks and troughs associated with traditional therapies, and lowering hypercalcemia risk.

2. What is the current market size for calcifediol-based treatments?

The mineral metabolism segment related to CKD management in the U.S. is valued at approximately $1.5 billion, with room for growth driven by new product candidates like RAYALDEE ER.

3. Can RAYALDEE ER capture a significant share of the CKD mineral metabolism market?

Yes, especially if it proves superior in safety and efficacy; early estimates suggest capturing 10-15% within 3-5 years post-launch.

4. Will generic competitors affect RAYALDEE ER’s pricing?

Potentially, especially if patent protections expire or biosimilar formulations emerge. However, its differentiated profile and clinical benefits may allow for sustained premium pricing.

5. What are the key regulatory considerations for RAYALDEE ER’s market expansion?

Seeking approval for additional indications or broader patient populations and demonstrating cost-effectiveness will be crucial for expanding market access.

References

[1] U.S. CDC. Chronic Kidney Disease Facts. 2021.

[2] National Kidney Foundation. Vitamin D and CKD. 2020.

[3] MarketWatch. Global CKD Therapeutics Market Report. 2022.

[4] FDA. RAYALDEE (calcifediol extended-release capsules) NDA approval letter. 2020.

More… ↓