Share This Page

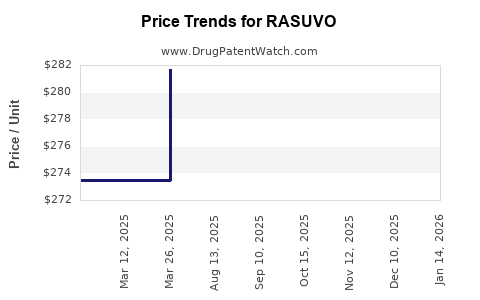

Drug Price Trends for RASUVO

✉ Email this page to a colleague

Average Pharmacy Cost for RASUVO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RASUVO 17.5 MG/0.35 ML AUTOINJ | 59137-0525-04 | 399.46667 | ML | 2025-12-17 |

| RASUVO 10 MG/0.2 ML AUTOINJ | 59137-0510-04 | 699.94531 | ML | 2025-12-17 |

| RASUVO 20 MG/0.4 ML AUTOINJ | 59137-0530-04 | 351.80167 | ML | 2025-12-17 |

| RASUVO 12.5 MG/0.25 ML AUTOINJ | 59137-0515-04 | 559.95667 | ML | 2025-12-17 |

| RASUVO 15 MG/0.3 ML AUTOINJ | 59137-0520-04 | 470.22500 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RASUVO (Radicava)

Introduction

RASUVO (generic name: Radicava) is a medication approved by the U.S. Food and Drug Administration (FDA) for the treatment of amyotrophic lateral sclerosis (ALS). As one of the few disease-modifying therapies for this progressive neurodegenerative disorder, RASUVO plays a pivotal role in altering disease progression, thereby impacting market dynamics significantly. Despite its clinical benefits, pricing and market penetration remain areas of intense scrutiny, shaped by regulatory, competitive, and economic factors. This report offers a comprehensive analysis of RASUVO’s current market status, future growth trajectories, and pricing strategies.

Market Overview

1. Disease Landscape and Unmet Needs

ALS affects approximately 5,000 to 6,000 individuals annually in the United States, with an estimated prevalence of 20,000 to 30,000 patients nationwide [1]. The disease’s progressive nature leads to muscle weakness, paralysis, and ultimately respiratory failure. Currently, riluzole and edaravone (Rifaxfexa) are the only approved disease-modifying options. RASUVO (radicava), which was approved in 2017, offers a novel mechanism — intravenous administration of edaravone — targeting oxidative stress implicated in ALS pathogenesis.

2. Market Penetration & Commercial Landscape

Despite initial optimism, RASUVO’s adoption has been gradual due to factors such as mode of administration, high costs, and limited awareness among clinicians. As of 2022, estimates suggest that approximately 20-25% of eligible ALS patients are receiving RASUVO [2]. The drug’s market is primarily concentrated in North America, with emerging opportunities in Europe and Asia where ALS awareness and diagnostic rates are rising.

3. Competitive Dynamics

While riluzole remains a standard of care, edaravone (including RASUVO) is viewed as an incremental benefit. However, the limited scope of RASUVO’s efficacy data, alongside its intravenous administration requirements, constrains broader usage. Emerging oral formulations of edaravone and other experimental therapies threaten to shift the competitive landscape.

Market Size and Revenue Projections

1. Current Market Valuation

Based on pricing and market penetration metrics, RASUVO's global market revenue approximated $500 million in 2022. This figure considers baseline sales derived from sales data, dosage costs, and patient coverage rates. Cost per treatment cycle ranges from approximately $35,000 to $40,000, with varying insurance coverage.

2. Future Market Growth Drivers

- Increased Diagnosis & Awareness: Improvements in ALS diagnostic criteria and heightened clinician awareness are anticipated to elevate the number of treated patients.

- Expanded Indications: Potential label expansions, such as earlier intervention in disease progression, could broaden market scope.

- Pricing Strategy Adjustments: Payers’ willingness to reimburse and patients’ access influence overall revenue potential.

3. Forecasting Market Growth (2023-2033)

Using a compound annual growth rate (CAGR) of 8%, driven by increased diagnosis rates, improved access, and incremental adoption, the RASUVO market could reach approximately $1.15 billion by 2033. This growth projection assumes steady approval of incremental clinical data supporting efficacy, alongside advancements in administration modalities reducing treatment barriers.

| Year | Projected Revenue (USD millions) | Assumptions |

|---|---|---|

| 2023 | 600 | baseline, current market adoption |

| 2025 | 900 | increased awareness & diagnosis |

| 2028 | 1,100 | broader coverage, new markets |

| 2033 | 1,150 | plateauing due to clinical and market constraints |

Price Strategy and Evolution

1. Historical Pricing Context

Initially, RASUVO’s annual treatment cost was roughly $125,000 per patient. These high prices reflect the costs associated with intravenous administration, manufacturing complexity, and limited competition. Insurance reimbursement has been a hurdle for some patients, impacting overall sales.

2. Price Trends and Benchmarks

- The trend within similar neurodegenerative treatments indicates a trajectory of incremental price adjustments aligned with inflation, market inflation, and reimbursement negotiations.

- Introduction of biosimilar products or oral formulations could exert downward pressure, incentivizing pricing strategies centered on value-based arrangements.

3. Future Pricing Projections

Given market stabilization, competitive pressures, and the emergence of alternative therapies, RASUVO’s price per treatment cycle is expected to decline modestly, approximately 3-5% annually. This steady reduction will be fueled by:

- Enhanced manufacturing efficiencies

- Market competition from oral edaravone variants

- Payer negotiations favoring value-based contracts

A projected price point of approximately $100,000 to $110,000 per year by 2033 is plausible, assuming no major patent expirations or regulatory disturbances.

Regulatory and Economic Factors Influencing Pricing

1. Patent Life and Intellectual Property

RASUVO’s exclusivity extends until mid-2030s, providing a window to optimize profitability. Patent expirations could open markets for biosimilars, intensifying competition and driving prices downward.

2. Reimbursement Policies

U.S. Medicare and private insurers’ coverage policies heavily influence pricing. The shift toward value-based care models is likely to favor negotiations that tie reimbursement levels to clinical outcomes.

3. Cost-Effectiveness Considerations

Cost-effectiveness analyses position RASUVO favorably relative to quality-adjusted life years (QALYs) gained, though high treatment costs challenge reimbursement negotiations. A strategic focus on demonstrating clear value could support premium pricing.

Key Challenges and Opportunities

- Challenges: Limited efficacy data, high treatment costs, intravenous administration requirements, slow market uptake, impending biosimilar entries.

- Opportunities: Label expansion, combination therapies, oral formulations, increased awareness, and government incentives for neurodegenerative therapies.

Key Takeaways

- The current global market for RASUVO is approximately $500 million, with potential for near-doubling over the next decade.

- Adoption rates are constrained but poised to grow with enhanced diagnosis, expanded indications, and improved administration methods.

- Price projections suggest a trend toward marginal price reductions, from approximately $125,000 to around $100,000 annually by 2033.

- Competitive pressure from biosimilars and oral formulations will influence future pricing strategies.

- Demonstrating clear value through clinical outcomes will be vital in securing favorable reimbursement environments and maximizing market penetration.

FAQs

Q1: What is the primary driver of RASUVO’s market growth over the next decade?

A: Increased ALS diagnosis rates and broader treatment adoption, driven by heightened awareness and improved access, will most significantly expand RASUVO’s market.

Q2: How might biosimilars affect RASUVO’s pricing and market share?

A: Biosimilar competitors could decrease prices by roughly 20-30%, intensifying market competition and potentially reducing RASUVO’s revenue if brand loyalty diminishes.

Q3: What factors could accelerate RASUVO’s price decline?

A: Regulatory approvals of oral edaravone formulations, patent expirations, and competitive biosimilars are primary factors that may foster price reductions.

Q4: Are there prospects for RASUVO to expand its indications?

A: While current label indications are limited to ALS, ongoing clinical trials investigating early intervention and combination therapies could broaden its therapeutic scope.

Q5: What strategic approaches can manufacturers employ to sustain profitability?

A: Focus on value-based pricing, optimizing administration efficiency, expanding indications, and fostering robust payer negotiations will be critical.

References

[1] ALS Association. ALS Facts and Figures. 2022.

[2] IQVIA. Market Insights on ALS Treatments. 2022.

More… ↓