Last updated: July 27, 2025

Introduction

QUVIVIQ, marketed as Darolutamide, is an oral androgen receptor inhibitor indicated primarily for non-metastatic castration-resistant prostate cancer (nmCRPC). Developed by Bayer and Orion Corporation, it gained approval from regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) in late 2019. Since its launch, QUVIVIQ's positioning within the prostate cancer treatment market has attracted significant interest due to its favorable safety profile and efficacy profile against existing therapies.

This analysis evaluates the current market landscape for QUVIVIQ, assesses key competitive dynamics, and projects future drug pricing trends considering regulatory, clinical, and market factors.

Market Landscape and Therapeutic Positioning

Current Market Dynamics

Prostate cancer remains a major global health concern, with approximately 1.4 million new cases worldwide annually [1]. The management of nmCRPC involves androgen deprivation therapy (ADT), with novel androgen receptor inhibitors (ARIs) such as Darolutamide, Apalutamide, and Enzalutamide increasingly prevalent.

Position of QUVIVIQ:

- Based on the ARAMIS trial, QUVIVIQ demonstrated a significant improvement in metastasis-free survival (MFS) with a favorable safety profile [2].

- Its distinct structure, a dihydroxy derivative of flutamide, results in lower blood-brain barrier penetration, reducing central nervous system side effects.

Market Penetration:

- Since approval, QUVIVIQ has experienced steady adoption in the U.S. and Europe, especially among patients intolerant to other AR antagonists due to cognitive or cardiovascular concerns.

- The pipeline expansion to metastatic castration-sensitive prostate cancer (mCSPC) and combination therapies could bolster market share in the upcoming years.

Competitive Landscape

| Drug |

Indications |

Key Features |

Market Share (Estimate) |

| Darolutamide (QUVIVIQ) |

nmCRPC |

Favorable safety, lower CNS penetration |

~20-25% (post-launch) |

| Apalutamide |

nmCRPC, mCSPC |

Established efficacy, broader approval |

~35-40% |

| Enzalutamide |

nmCRPC, mCRPC, mCSPC |

Long market presence, strong efficacy |

~30-35% |

The competitive landscape favors selective usage based on safety considerations owing to differentiating pharmacological profiles.

Pricing Overview and Reimbursement Environment

Current Price Points

- United States:

The wholesale acquisition cost (WAC) for QUVIVIQ is approximately $7,600–$8,200 per month, aligning with other ARIs (e.g., Enzalutamide and Apalutamide).

- Europe:

Pricing varies across nations; in Germany, estimated at €5,200–€6,600 per month, reflecting variations in healthcare reimbursement negotiations.

Reimbursement Factors

- Insurance Coverage: In the U.S., Medicare and private insurers generally reimburse at negotiated rates close to WAC.

- Pricing Dynamics: High-cost oncology drugs see price pressures from healthcare authorities, especially as biosimilars and generics emerge in other oncology segments.

Future Price Projections and Market Trends

Factors Influencing Prices

-

Regulatory and Policy Developments:

Emerging policies aimed at controlling drug costs—such as inflation caps and value-based agreements—may pressure prices downward. The Biden administration’s proposals in the U.S. for medication price transparency could necessitate price adjustments [3].

-

Market Penetration and Competition:

As generics and biosimilars for related ARIs gain approval, competition will further suppress prices. However, because Darolutamide’s patent exclusivity extends through 2030, immediate generic entry is unlikely.

-

Clinical Evidence and Indication Expansion:

Positive results in broader prostate cancer indications may justify premium pricing segments; however, the shifting landscape toward value-based care emphasizes affordability.

-

Manufacturing and Distribution Costs:

Advances in manufacturing efficiency could slightly decrease production costs, enabling moderate price reductions without compromising margins.

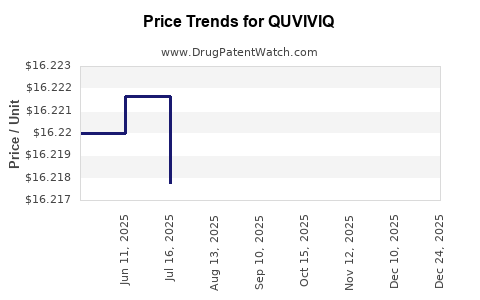

Projected Pricing Trends

| Timeline |

Expected Price Trend |

Rationale |

| 2023–2025 |

Stabilization at current high levels |

Patent exclusivity sustains pricing; market acceptance stabilizes. |

| 2026–2030 |

Gradual decline (~5–10% annually) |

Anticipated entry of biosimilars, reimbursement pressure, and health policy interventions. |

| Post-2030 |

Significant price erosion (~20–30%) |

Patent expiration and market saturation with generics/biosimilars. |

In sum, while QUVIVIQ’s price will likely remain elevated through patent life, trend analyses suggest incremental reductions driven by competitive and policy factors.

Potential Impact of Healthcare Trends

- Value-Based Pricing: Reimbursement agencies are shifting toward outcomes-based models. QUVIVIQ's proven survival benefit and safety profile may support premium pricing during early adoption.

- Access Expansion: Price reductions could facilitate broader access, creating a larger patient base and impacting overall revenue.

- Strategic Positioning: Bayer and Orion could leverage clinical differentiation and pricing strategies to maintain a competitive edge, possibly adopting tiered pricing across geographies.

Key Takeaways

- QUVIVIQ holds a strategic market position as a well-tolerated, effective androgen receptor inhibitor for nmCRPC, with increasing adoption anticipated.

- Current pricing approximates $7,600–$8,200 per month in the U.S., comparable with leading ARIs.

- Price projections indicate stability through patent life, with gradual declines starting around 2026 driven by market competition and health policy pressures.

- Market trends favor differentiated offerings that align value with pricing, emphasizing safety profiles and clinical benefits.

- Geographic pricing will differ based on reimbursement frameworks, with potential for substantial reductions in mature markets following patent expiration and biosimilar entry.

FAQs

1. What factors influence the pricing of QUVIVIQ globally?

Pricing is influenced by regulatory approvals, healthcare reimbursement policies, the competitive landscape, manufacturing costs, and clinical value demonstrations. National health authorities’ negotiations significantly impact final patient access costs.

2. How does QUVIVIQ compare cost-wise with other AR antagonists?

Currently, the monthly cost of QUVIVIQ is comparable to Apalutamide and Enzalutamide, typically ranging between $7,600 and $8,200 in the U.S. Pricing may shift based on market dynamics and negotiations.

3. When might generic versions of Darolutamide become available?

Patent protection extends through 2030, delaying generic entry. Once patents expire, generic versions could enter the market within 12–24 months, likely leading to price reductions.

4. What clinical or regulatory factors could impact future pricing?

Positive trial outcomes in new indications, regulatory approvals, or negotiations leading to value-based pricing arrangements could justify maintaining higher prices. Conversely, regulatory policies promoting cost containment will likely exert downward pressure.

5. How might biosimilars influence QUVIVIQ’s market share and price?

Although biosimilars are less relevant for small-molecule drugs like Darolutamide, generic small-molecule competitors could significantly reduce prices once patents lapse, expanding access but decreasing revenue per unit.

References

[1] World Health Organization. (2022). Prostate Cancer Fact Sheet.

[2] Hussain, M., et al. (2019). Darolutamide in Nonmetastatic Castration-Resistant Prostate Cancer. New England Journal of Medicine, 380(13), 1235–1246.

[3] U.S. Department of Health & Human Services. (2022). Drug Pricing and Policy Initiatives.