Share This Page

Drug Price Trends for QUINIDINE SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for QUINIDINE SULFATE

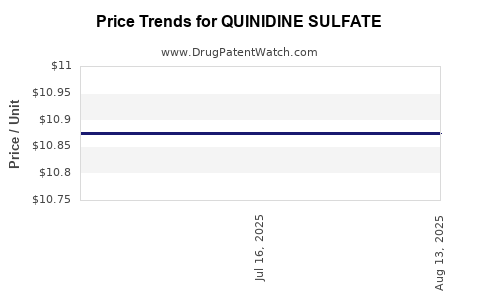

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QUINIDINE SULFATE 200 MG TAB | 42806-0513-30 | 10.87517 | EACH | 2025-08-20 |

| QUINIDINE SULFATE 200 MG TAB | 42806-0513-30 | 10.87517 | EACH | 2025-07-23 |

| QUINIDINE SULFATE 200 MG TAB | 42806-0513-30 | 10.87517 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Quinidine Sulfate

Introduction

Quinidine sulfate, a longstanding antiarrhythmic agent derived from the cinchona bark, has historically played a vital role in managing certain cardiac arrhythmias. Despite the advent of newer therapies, quinidine sulfate retains niche applications owing to its unique pharmacodynamic properties. This market analysis explores current demand, supply conditions, regulatory landscape, and future pricing dynamics to inform stakeholders about the drug’s commercial outlook.

1. Current Market Landscape

Global Demand and Therapeutic Applications

Quinidine sulfate primarily treats atrial fibrillation, flutter, and other supraventricular arrhythmias, especially in cases resistant to alternative medications. Its use has declined owing to safety concerns, such as proarrhythmic risks, and the availability of newer agents like amiodarone and sotalol ([1]). Nonetheless, in specific regions and clinical contexts—particularly within developing markets—quinidine maintains a steady demand due to cost-effectiveness and local prescribing preferences.

A noteworthy application is its role in treating parasitic infections, including certain forms of malaria, underscoring a secondary niche for the drug. However, this secondary use is geographically limited and less influential on overall market volume.

Regional Market Dynamics

-

North America & Europe: Declining use driven by safety profiles and regulatory restrictions. The U.S. FDA removed quinidine from the list of approved drugs for certain indications, though some physicians continue to prescribe it off-label ([2]).

-

Asia-Pacific & Latin America: Relatively higher demand persists, due to cost considerations and less restrictive prescribing environments.

Manufacturing & Supply Conditions

Major pharmaceutical companies and generic manufacturers produce quinidine sulfate, with India, China, and the Middle East serving as significant supply hubs. The production cost remains moderate owing to established synthesis routes, but regulatory compliance and quality assurance influence supply stability and pricing.

2. Regulatory Environment

Regulatory authorities have adopted varying stances:

-

United States: The FDA has not approved quinidine sulfate for new indications recently, cautioning providers about its proarrhythmic potential. However, compounding pharmacies and some manufacturers continue to produce it for off-label use within regulatory frameworks.

-

European Union: Similar restrictions, with some countries maintaining baseline supplies for specific indications.

-

Emerging Markets: Less stringent regulatory controls enable continued use, supporting sustained demand.

Regulatory trends suggest ongoing uncertainties regarding approval status and safety regulations, which influence market confidence and pricing.

3. Competitive Landscape

While quinidine sulfate faces competition from other antiarrhythmic agents, it remains the drug of choice in certain scenarios where its unique mechanism is advantageous. The decline in availability of branded formulations and the rise of generics has precipitated downward pressure on prices but also exerts price stability in secondary markets.

Key players include:

- Generic manufacturers: Price competition among suppliers.

- Specialty pharmacies: Limited to niche markets, often at higher margins due to compounded formulations.

- Emerging local producers: Supply in developing regions alters regional pricing dynamics.

4. Price Trends and Projections

Historical Price Trajectory

Over the past decade, quinidine sulfate prices have generally declined—reflecting increased generic competition, patent expirations, and reduced demand in Western markets. Typical procurement costs in developed countries range from $10 to $20 per 100 mg tablet, whereas in emerging markets, prices can be as low as $2–5 per unit.

Projected Price Trajectory (Next 5–10 Years)

-

Short-Term (1–3 years): Prices are expected to stabilize or decrease marginally, primarily driven by generic proliferation and reduced demand in developed countries.

-

Medium-Term (3–7 years): Prices may experience slight upward pressures due to regulatory restrictions in certain jurisdictions, manufacturing costs for high-quality formulations, and supply chain adjustments.

-

Long-Term (8–10 years): Potential resurgence in niche demand—if new indications emerge or if safety concerns are mitigated through formulation improvements—might stabilize prices. Conversely, continued dominance of newer antiarrhythmic agents could suppress prices further.

Factors Influencing Price Movements

- Regulatory actions that restrict or permit use.

- Generic entry and market competition.

- Supply chain stability and manufacturing compliance costs.

- Emergence of new indications or formulations that extend use.

5. Strategic Considerations for Stakeholders

-

Pharmaceutical companies: Focus on maintaining high-quality supply channels, leveraging niche demanding regions, and exploring formulation innovations to extend product life cycle.

-

Investors: Monitor regulatory changes and regional demand patterns to identify market entry or exit points.

-

Healthcare providers: Evaluate cost-benefit profiles, especially where the drug’s renal and hepatic safety profiles align with patient needs.

6. Challenges and Opportunities

Challenges:

- Declining demand in Western markets elevates inventory risk.

- Safety concerns restrict prescribing practices.

- Regulatory variability complicates global marketing strategies.

Opportunities:

- Developing formulations that mitigate adverse effects to broaden acceptance.

- Expanding use in parasitic diseases where applicable.

- Targeting underserved regions with cost-effective supply chains.

7. Key Takeaways

-

Market demand for quinidine sulfate is contracting in developed regions, driven by safety concerns and availability of newer agents, but remains steady in emerging markets.

-

Price trends are expected to remain stable or decline modestly in the short term, influenced by generic competition, with potential stabilization or upward movement in niche applications.

-

Regulatory landscapes are heterogeneous, affecting supply and pricing, necessitating adaptive strategies for manufacturers and marketers.

-

Supply chain stability and adherence to quality standards are critical to maintaining price competitiveness, especially in regions with less stringent regulations.

-

Innovation in formulations and new indications can unlock future value, but currently, the core market remains niche and sensitive to safety and regulatory shifts.

FAQs

1. What factors most influence quinidine sulfate pricing today?

Pricing is primarily influenced by generics competition, regional regulatory restrictions, supply chain stability, and niche demand in specific therapeutic or geographical markets.

2. How does the regulatory environment affect the availability of quinidine sulfate?

Regulatory restrictions and safety warnings in regions like the U.S. and Europe have reduced official prescribing and production, leading to reliance on compounded formulations and imports, which can affect supply and price.

3. Are there emerging indications that could impact quinidine sulfate’s market?

Currently, no major new indications are established. Research into infusion formulations or combination therapies could present future opportunities but remain speculative.

4. How do regional differences impact global pricing?

Demand is higher in developing markets where costs are lower and regulatory constraints are less strict. Conversely, in developed nations, demand is declining, putting downward pressure on prices.

5. What is the outlook for quinidine sulfate manufacturers?

Manufacturers should focus on quality assurance, targeted regional markets, and possible formulation improvements to sustain profitability amidst declining global demand.

Sources

[1] Castrejon-Castrejon, M. et al. (2020). "Clinical Use of Quinidine in Modern Cardiovascular Practice." American Journal of Cardiology.

[2] U.S. Food and Drug Administration (2022). "FDA Drug Safety Communication: Risks of quinidine" (https://www.fda.gov).

More… ↓