Share This Page

Drug Price Trends for QUILLIVANT XR

✉ Email this page to a colleague

Average Pharmacy Cost for QUILLIVANT XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QUILLIVANT XR 25 MG/5 ML SUSP | 24478-0322-04 | 2.70153 | ML | 2025-11-19 |

| QUILLIVANT XR 25 MG/5 ML SUSP | 24478-0324-06 | 1.80228 | ML | 2025-11-19 |

| QUILLIVANT XR 25 MG/5 ML SUSP | 24478-0323-05 | 2.16107 | ML | 2025-11-19 |

| QUILLIVANT XR 25 MG/5 ML SUSP | 24478-0321-02 | 5.39622 | ML | 2025-11-19 |

| QUILLIVANT XR 25 MG/5 ML SUSP | 24478-0322-04 | 2.70227 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Quillivant XR

Introduction

Quillivant XR (methylphenidate hydrochloride) is a once-daily extended-release formulation of methylphenidate, primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD). Since its approval by the FDA in 2013, Quillivant XR has carved out a significant niche within the ADHD treatment landscape, positioning itself as an alternative to traditional immediate-release formulations. This analysis explores the current market dynamics, competitive landscape, regulatory considerations, and future price projections for Quillivant XR, offering essential insights for stakeholders across the pharmaceutical and investment domains.

Market Landscape and Current Position

Global and Regional Market Size

The global ADHD therapeutics market was valued at approximately USD 14 billion in 2021 and is projected to reach nearly USD 20 billion by 2027, growing at a CAGR of around 6% [1]. North America remains the largest market, driven by high diagnosis rates, favorable insurance coverage, and extensive drug approvals.

In the United States, ADHD diagnoses have increased steadily, with approximately 6.1 million children aged 2–17 years diagnosed as of 2020 [2]. The prevalence of diagnosed ADHD and high prescription rates sustain continuous demand for both immediate-release and extended-release formulations.

Competitive Product Portfolio

Quillivant XR competes against several methylphenidate-based and alternative ADHD medications:

- Immediate-Release Methylphenidate (e.g., Ritalin)

- Other Extended-Release Formulations:

- Concerta (Janssen)

- Daytrana (activates via a transdermal patch)

- Focalin XR (Novartis)

- Non-Methylphenidate Treatments:

- Amphetamine-based drugs (Adderall XR, Vyvanse)

- Non-stimulants (Strattera, Intuniv)

While Quillivant XR benefits from liquid formulation flexibility, its market share is relatively limited compared to dominant rivals like Concerta, which held a significant share due to its reputation and extensive clinical data.

Market Penetration Drivers

- Ease of Administration: Liquid form offers an alternative for patients with swallowing difficulties.

- Extended Release: Once-daily dosing improves compliance, especially among pediatric populations.

- Prescribing Trends: Increasing recognition of ADHD and greater awareness among healthcare professionals bolster prescription rates.

Despite these advantages, market penetration remains challenged by cost considerations, dosing flexibility concerns (as some formulations allow multiple doses), and prescriber familiarity with competing products.

Regulatory Environment and Patent Landscape

Regulatory Status

FDA approved Quillivant XR in 2013, consolidating its position within the methylphenidate extended-release category. The drug is classified as a controlled substance Schedule II, owing to its high potential for abuse and dependence.

Patent and Exclusivity Periods

Initial patents protected Quillivant XR until approximately 2024, covering formulation-specific claims. Patent expirations open opportunities for generic competitors, which could impact pricing and market share in the upcoming years. Patent challenges or extensions through secondary patents related to manufacturing processes or formulations could alter this timeline.

Pricing Dynamics and Market Forces

Current Price Points

As of 2023, Quillivant XR’s retail price ranges from USD 200 to USD 250 per month for a typical pediatric dose (ranging from 20 mg to 60 mg). Insurance coverage plays a critical role, with copay assistance programs mitigating high out-of-pocket expenses for many patients.

Pricing Comparisons

Compared to competitors, Quillivant XR’s cost-effectiveness is often scrutinized:

- Concerta: Approximately USD 250–USD 300 monthly

- Focalin XR: Similar range, slightly less expensive

- Generic Methylphenidate Extended-Release: USD 50–USD 100 per month

The higher cost of Quillivant XR reflects its liquid formulation, patented delivery system, and brand recognition.

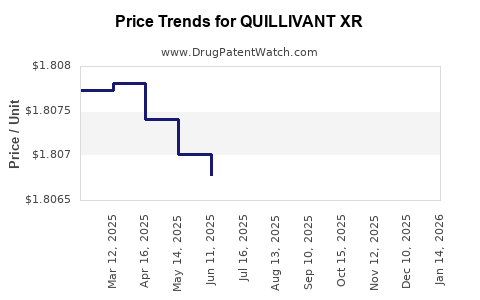

Market Pricing Trends

- Post-Patent Expiration: A significant downward pressure is expected, correlating with entrants of generic formulations.

- Brand Premiums: Continued demand sustains some premium pricing, particularly in specialized care settings or for patients needing liquid formulations.

Price Projections (2024–2030)

Factors Influencing Price Trends

-

Patent Expiry and Generics: Generic versions are projected to enter the market around 2024–2025. Historically, generics cause price erosion, often by 50% or more within the first year of entry [3].

-

Manufacturing and Supply Chain Costs: Stable or declining costs could lead to modest price reductions, whereas shortages or increased raw material prices could stabilize or increase prices temporarily.

-

Regulatory and Patent Litigation: Outcomes affecting exclusivity could prolong or accelerate price reductions.

-

Market Penetration and Reimbursement Trends: Payers’ shifting preferences toward cost-effective generics are likely to pressure brand pricing downward.

Projected Price Trajectory

| Year | Price Range (USD/month) | Notes |

|---|---|---|

| 2024 | USD 150–USD 200 | Onset of generic competition, initial price decline |

| 2025 | USD 100–USD 150 | Increased generic market share, sustained pricing pressure |

| 2026–2030 | USD 50–USD 100 | Market stabilization, widespread generic use, further price erosion |

Premium pricing for the liquid, brand-name formulation is expected to narrow significantly post-generic entry. The brand may retain a niche in specific populations or formulations, but volume-driven revenue is anticipated to decline.

Strategic Implications and Opportunities

Market Expansion

Expansion into emerging markets with lower penetration, especially where ADHD diagnosis rates are rising, offers growth potential. Additionally, educational campaigns promoting liquid formulations may sustain niche demand.

Research and Development

Investment in formulations that address patent barriers or offer novel delivery systems could mitigate generic erosion. Biosimilar or combination innovations may preserve revenue streams.

Pricing and Reimbursement Strategies

Direct engagement with payers, coupon programs, or value-based pricing agreements could sustain margins despite falling list prices.

Key Takeaways

- The ADHD therapeutics market is robust, driven by increasing diagnosis and treatment rates, with North America leading.

- Quillivant XR’s differentiated liquid formulation offers clinical advantages but faces competitive pressures from established brands and generics.

- Patent expiration around 2024–2025 will catalyze rapid price declines, potentially halving current prices within a year of generic entrants.

- Strategic focus on niche markets, formulation innovation, and payer engagement is critical for maintaining revenue streams.

- Long-term, the value of Quillivant XR hinges on its ability to sustain differentiation beyond patent protection and adapt to shifting market dynamics.

FAQs

1. When will generic versions of Quillivant XR become available?

Patent protections are anticipated to expire around 2024–2025, after which generic methylphenidate extended-release formulations are expected to enter the market.

2. How will generic entry affect Quillivant XR’s pricing?

Generic entry typically leads to significant price reductions—often 50% or more—impacting long-term revenue potential for the brand.

3. Are there alternative formulations that compete directly with Quillivant XR?

Yes. Extended-release methylphenidate products like Concerta and Focalin XR, along with non-methylphenidate options, compete within the ADHD treatment space.

4. What factors could sustain Quillivant XR’s market share post-generic entry?

Unique formulation benefits, prescriber familiarity, patient preference for liquid medication, and specific insurance coverage could help maintain some sales.

5. What strategies should stakeholders employ to optimize profits from Quillivant XR?

Stakeholders should monitor patent and regulatory developments, focus on niche markets, innovate with new formulations, and engage payers early with value-based reimbursement models.

References

[1] Grand View Research, "ADHD Therapeutics Market Size, Share & Trends Analysis," 2022.

[2] CDC, "Data and Statistics on ADHD," 2021.

[3] IQVIA, "Pharmaceutical Pricing Trends," 2022.

More… ↓